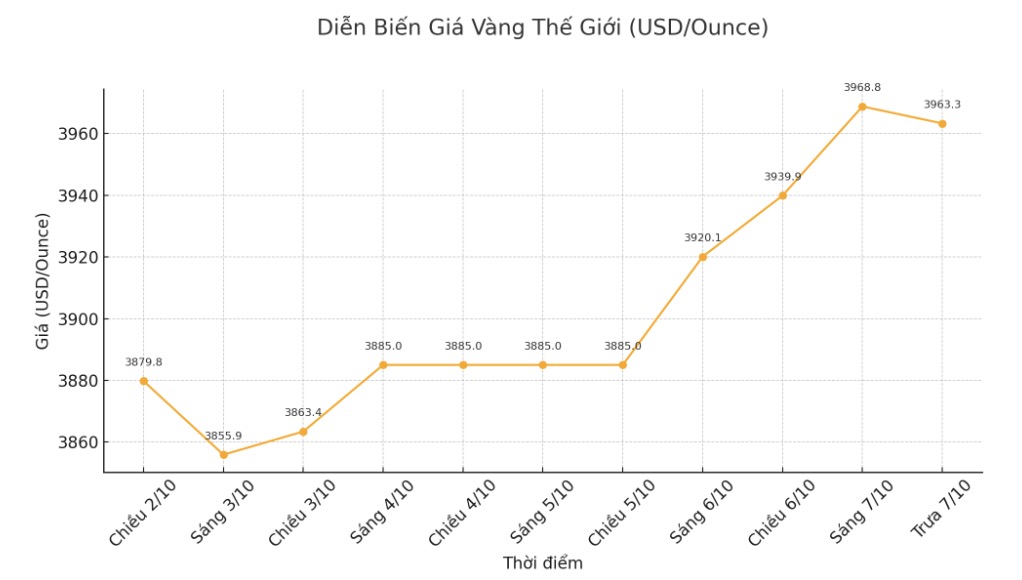

World gold prices traded at a high level in the trading session on October 7, driven by strong investment demand amid widespread geopolitical and economic instability, along with expectations that the US Federal Reserve (FED) will continue to lower interest rates.

At 7:45 GMT (ie 2:45 p.m. Vietnam time), spot gold prices remained at $3,956.02/ounce, after hitting an all-time record of $3,977.19/ounce. December gold futures in the US are stable around $3,972.20 an ounce.

Mr. Ole Hansen - Commodity Strategy Director of Saxo Bank - commented: " Strong demand from ETFs is still a key factor, driven by the fear of missing out (FOMO) mentality and declining confidence in traditional Shelters".

He said that buying from central banks and low capital costs are also supporting the precious metal's increase.

The White House leowed President Donald Trump's previous statement on sacking government employees due to prolonged closures on October 6, but still warned of the risk of job loss if the deadlock continues into the 7th day.

The government's shutdown has delayed the release of many important economic data, forcing investors to rely on non-governmental data to predict when the Fed will cut interest rates.

The market is now betting that the Fed will cut another 25 basis points at its meeting this month and another 25 points in December. Gold - a non-yielding asset often benefits in a low interest rate environment and period of economic instability.

Since the beginning of the year, gold has increased by 51%, thanks to large purchases from central banks, cash flow into ETFs, a weak USD and the need for risk-off of individual investors amid global trade and political tensions.

Mr. Michael Langford - Investment Director of scorpion Minerals - predicted: "I think gold could reach 4,300 USD/ounce in the next 6 months, as the USD continues to weaken and the macro and geopolitical context is favorable for gold prices to increase".

On the same day, Goldman Sachs raised its December 2026 gold price forecast to $4,900/ounce, from $4,300 previously. We believe that the risk for this new forecast is still leaning towards an upward trend, as the private sector's portfolio diversification to the gold market - which is already small in scale - could cause ETF holdings to exceed our interest rate estimates, Goldman said.

Data from the People's Bank of China shows that the country continued to buy gold for the 11th consecutive month in September. Meanwhile, political fluctuations in Japan and France have caused the currency and bond markets to fluctuate for two consecutive days.

In other precious metals, silver prices fell 0.9% to $48.11/ounce; platinum fell 1% to $1,609.04/ounce; while palladium moved sideways at $1,317.5/ounce.

See more news related to gold prices HERE...