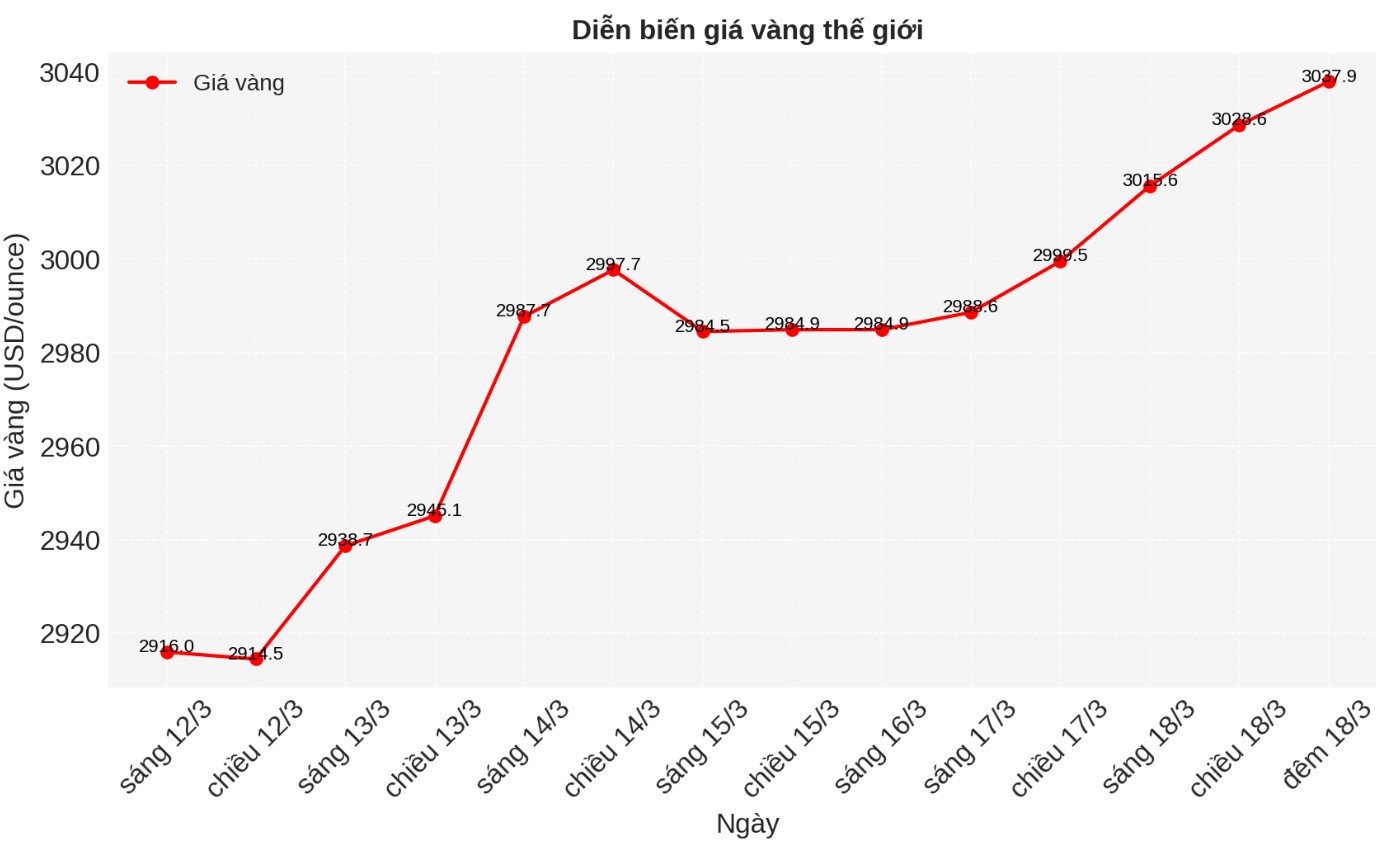

Last night, the world gold market witnessed a historic milestone when the gold price surpassed the threshold of 3,037 USD/ounce for the first time at 23,34 on March 18, Vietnam time. This event marks an all-time high for precious metals, reflecting concerns and trends in finding safe investment channels among global investors.

The escalation of gold prices is driven by many factors. Increased geopolitical tensions, especially in the Middle East, have led investors to seek gold as a safe haven asset. The weakening of the US dollar also increases the attractiveness of gold to investors holding other currencies.

In addition, concerns about the global economic recession and loose monetary policies from central banks have also contributed to increased demand for this precious metal.

The above factors may continue to push world gold prices higher in the short term. Some experts even predict that gold could soon reach $3,100/ounce if this increase is maintained.

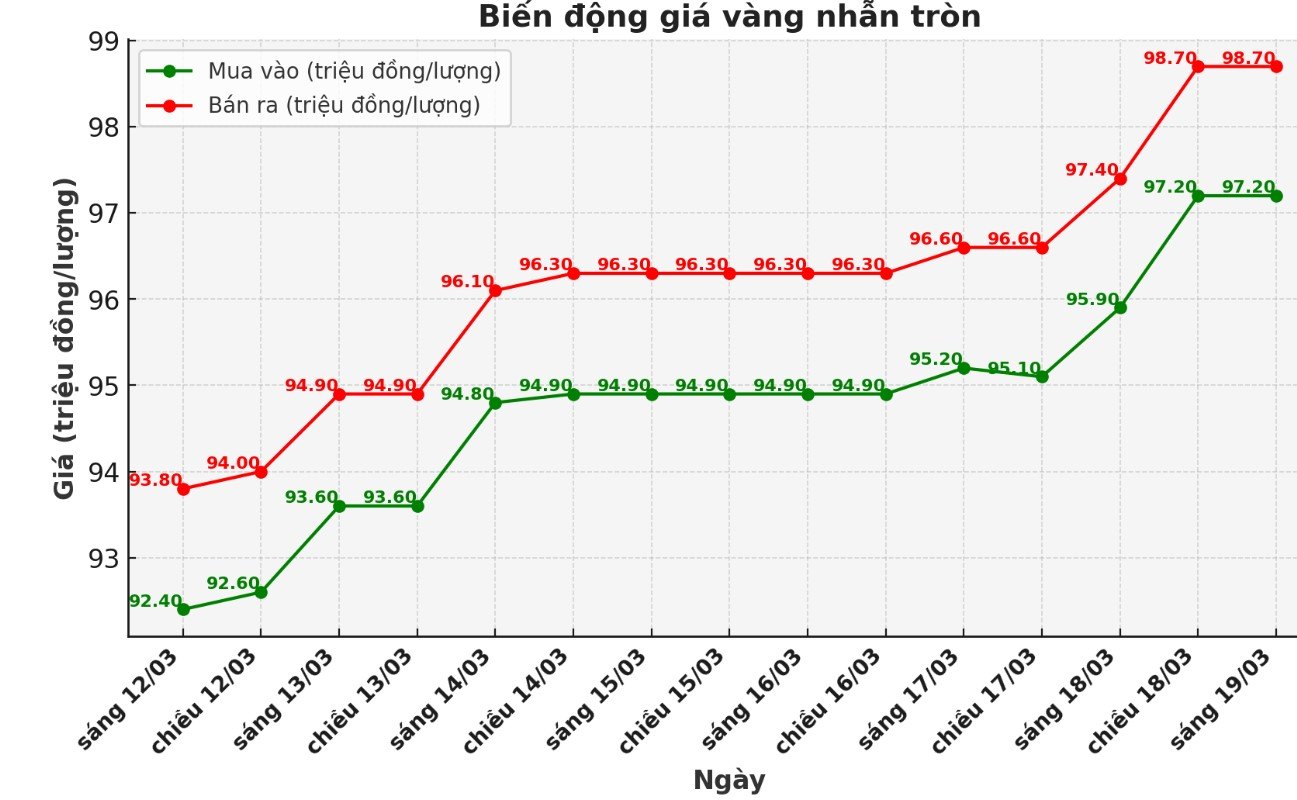

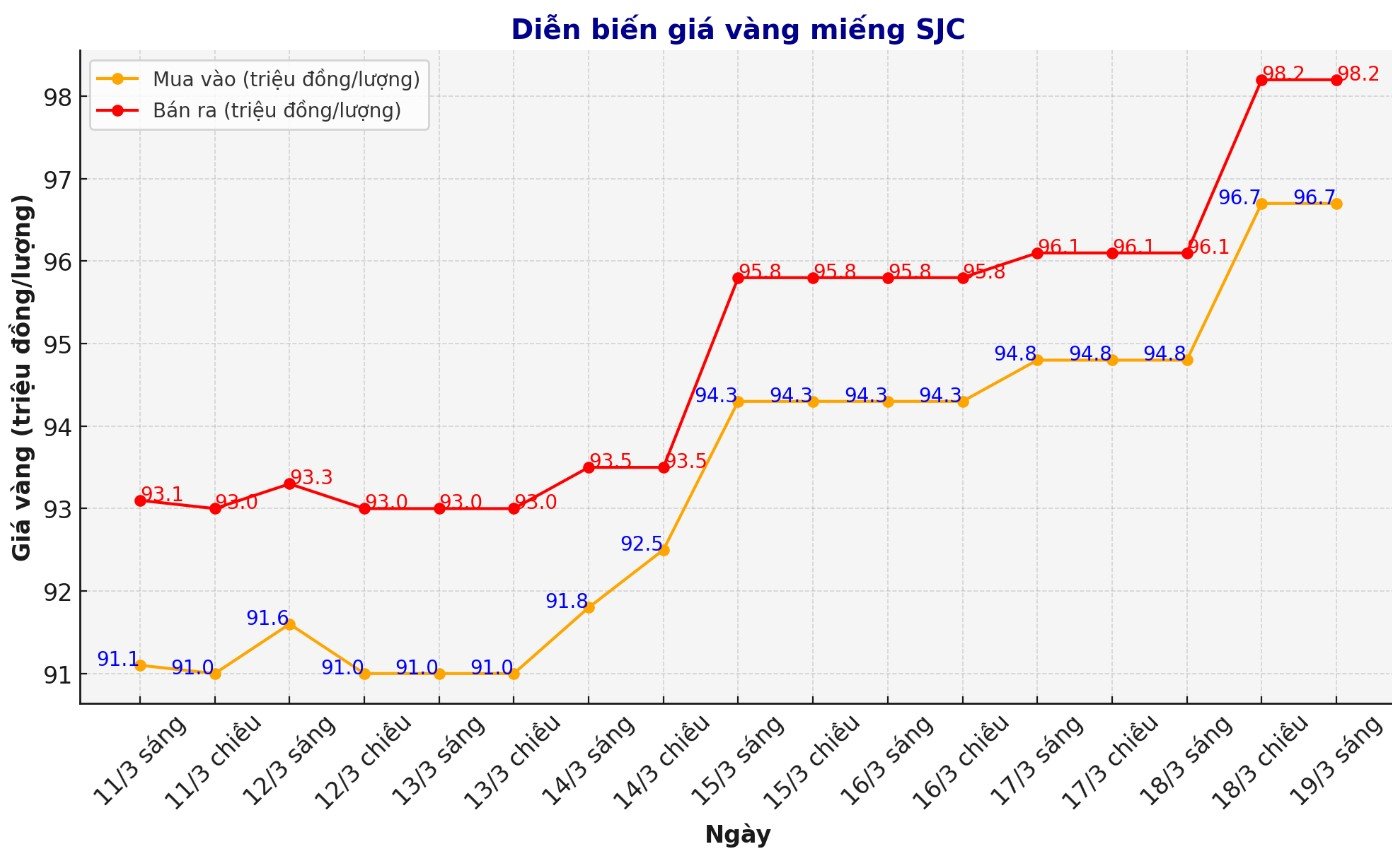

With world gold surpassing the 3,000 USD/ounce mark, the domestic gold market is likely to have a strong reaction when opening the trading session this morning (March 19). According to the law, domestic gold prices often adjust according to world trends, especially gold rings - the segment that reacts the fastest to market developments.

In recent sessions, the gap between domestic gold prices and world gold has narrowed, creating conditions for the domestic adjustment range to be larger than before. In particular, with world gold continuously reaching new peaks, individual investors can rush to buy, pushing gold ring prices up even more strongly.

Gold businesses also often have two strategies: quickly increase gold prices as soon as they open trading to reflect the increase of world gold; at the same time, keep the buy-sell price difference high to limit risks when the market fluctuates strongly.

Experts say that if world gold continues to maintain the upward trend, the price of SJC gold bars may soon approach or exceed the 100 million VND/tael mark in the coming sessions.

Although gold prices are in a strong uptrend, investors need to be especially cautious about surfing gold during this period.

The gap between the buying and selling prices of domestic gold is very high. In recent sessions, this difference has remained around 1.5 million VND/tael, creating great risks for those who want to invest in the short term.

When gold prices increase sharply, profit-taking pressure often appears, causing prices to reverse unexpectedly. If participating in the market at this time, investors need to have a clear plan, avoid chasing the crowd psychology and should consider a long-term strategy instead of short-term surfing to avoid the risk of losses.