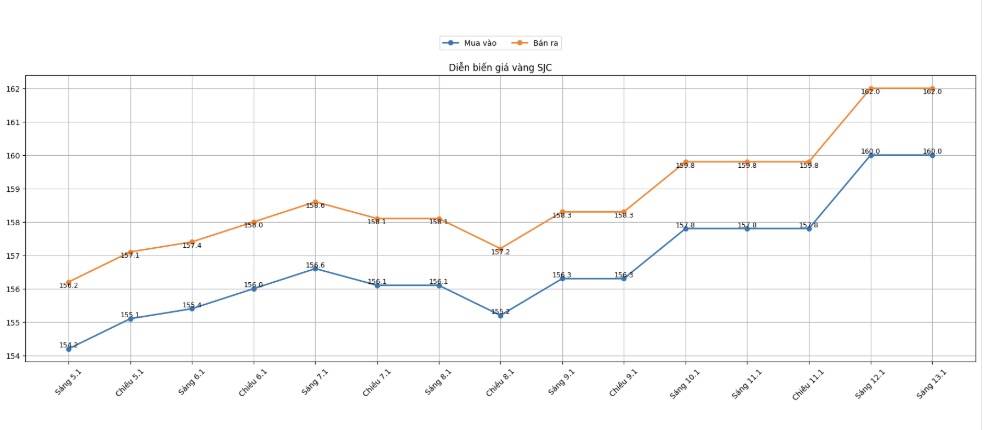

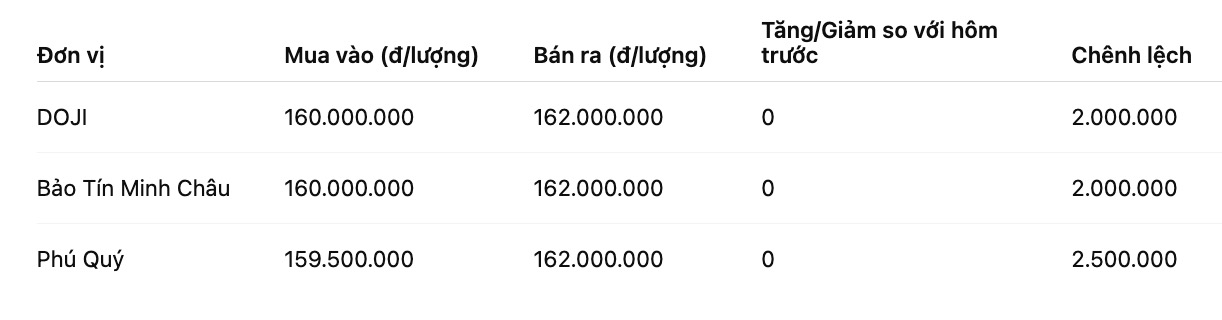

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 159.5-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

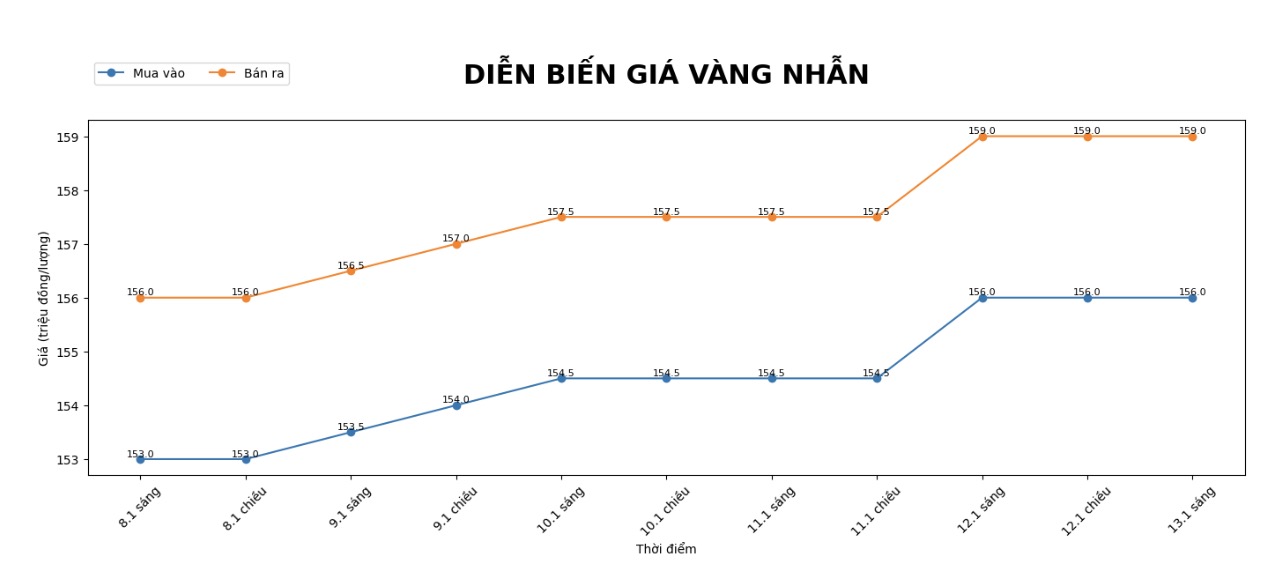

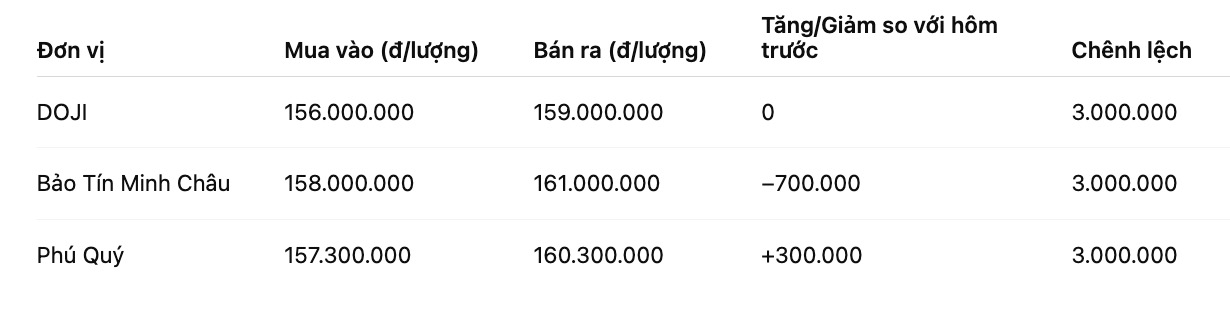

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at the threshold of 156-159 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 157.3-160.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

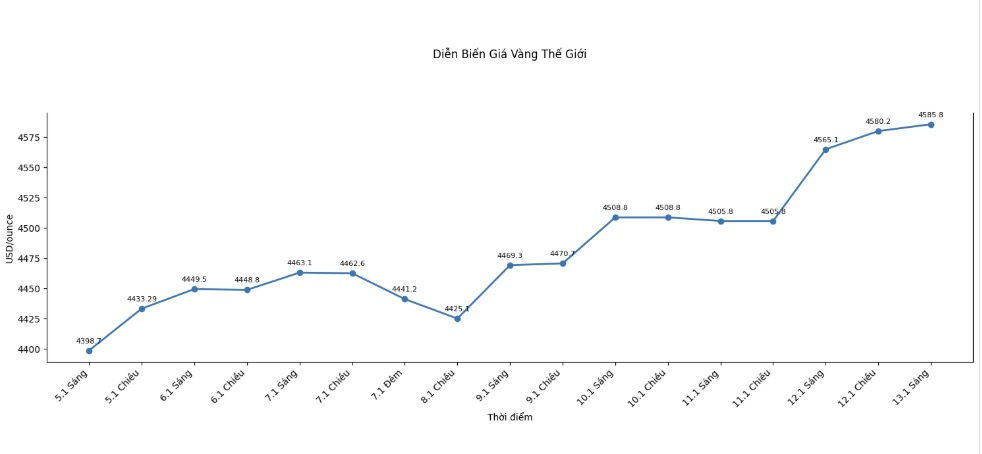

World gold price

At 9:15 am, world gold prices were listed around the threshold of 4,585.8 USD/ounce, up 20.7 USD compared to the previous day.

Gold price forecast

In the context of the global financial market continuously being affected by political instability and disruptions in US monetary policy, world gold prices continue to maintain a strong upward momentum and are at record highs. According to international analysts, the upward trend of this precious metal shows no signs of ending.

Investors are paying special attention to the risks surrounding the US Federal Reserve (Fed). The US Department of Justice's opening of an investigation into Fed Chairman Jerome Powell, along with speculation about the possibility of senior personnel changes, has increased concerns about the stability of monetary policy.

This makes cash flow in the global financial market tend to withdraw from risky assets to turn to gold as a safe haven.

Mr. Zain Vawda - analyst at MarketPulse of OANDA - commented: “When policy risks and macroeconomic instability increase, investors often prioritize holding tangible assets such as gold to preserve value. The weakening of the USD today makes gold even more attractive.”

Not only affected by currency factors, gold prices are also supported by escalating geopolitical tensions in many regions. US military moves in the Middle East, prolonged instability in Iran and Venezuela are increasing defensive sentiment in the global financial market.

According to Standard Chartered, in the current uncertain environment, gold continues to be ranked in the group of assets with the highest level of safety.

Technically, the fact that gold prices have surpassed previous historical peaks is seen as a confirmation sign of a new upward cycle. Many analysis models show that the $5,000/ounce zone is gradually becoming the next target of the market.

Goldman Sachs forecasts that gold prices may approach 4,900 USD/ounce by the end of 2026, while JP Morgan Private Bank is more optimistic, saying that the average price in Q4.2026 may rise to about 5,055 USD/ounce, and even higher short-term peaks may appear if safe deposits continue to pour strongly into gold.

However, experts also noted that after rising sharply above the 4,600 USD/ounce zone, gold prices may experience technical corrections in the short term.

However, with the complex geopolitical context and the prospect of the Fed shifting to a monetary easing stance, the long-term trend of gold is still assessed to lean towards the upside, in which the 5,000 USD/ounce mark is increasingly considered the "new standard" of the market.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...