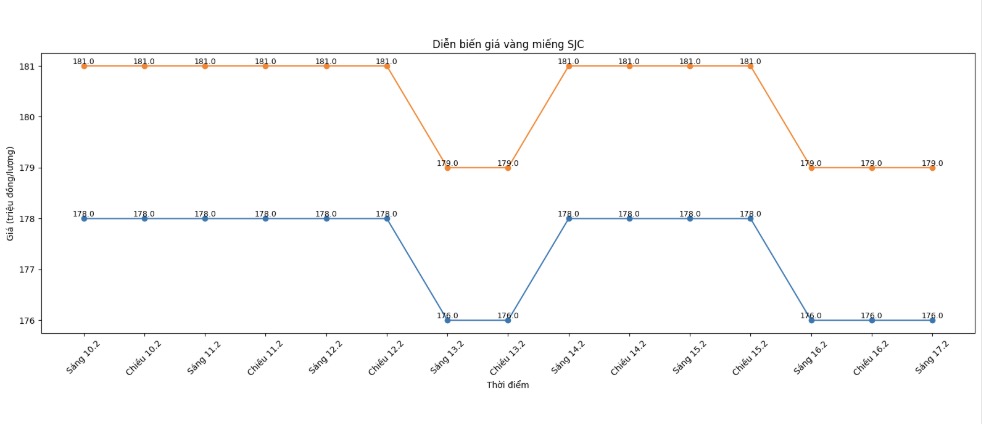

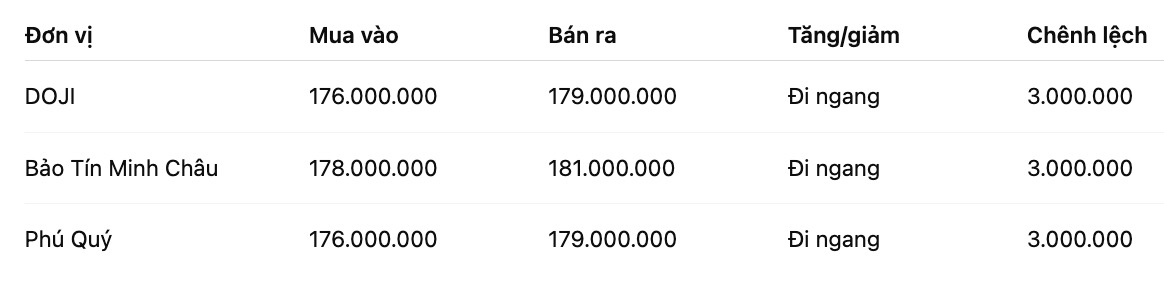

SJC gold bar price

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

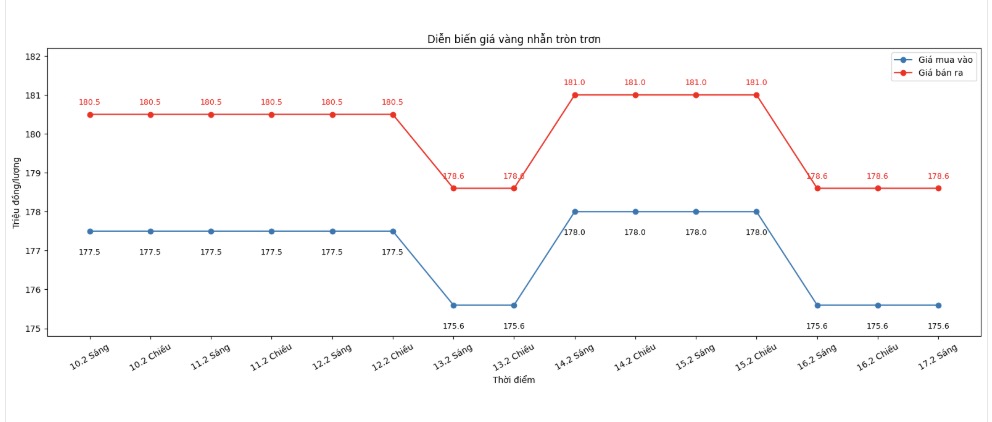

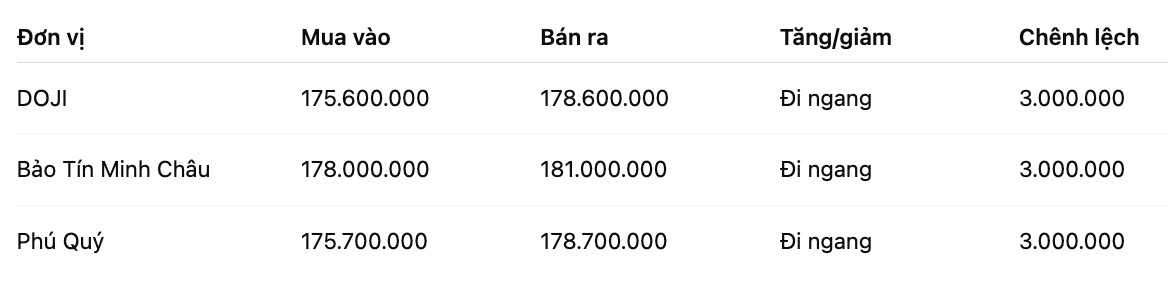

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

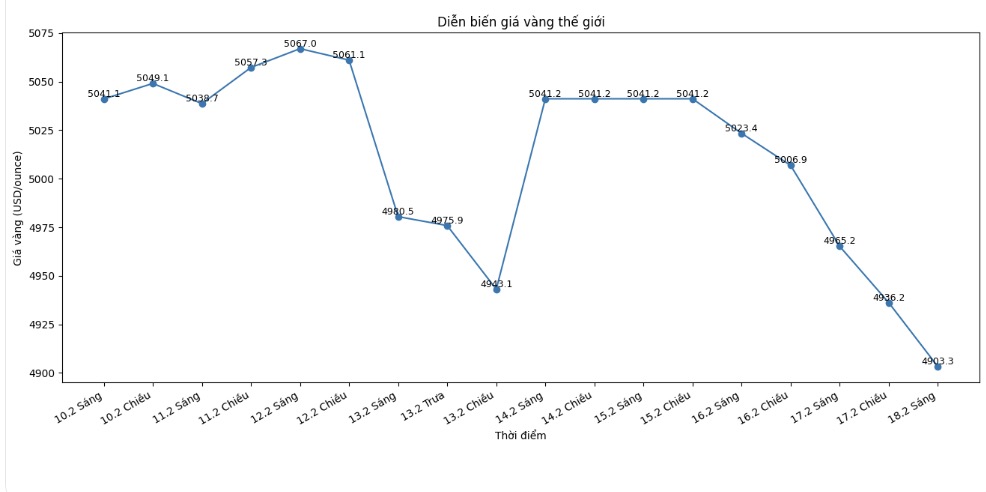

World gold price

At 9:35 am, world gold prices were listed around 4,903.3 USD/ounce, down 61.9 USD compared to the previous day.

Gold price forecast

After a series of hot increases, the world gold market entered a correction phase with cautious trading status. Analysts believe that precious metals have not attracted strong enough buying force when the Chinese market is closed for a whole week on the occasion of the Lunar New Year - a capital factor that often contributes to improving liquidity. In the context of a lack of cash flow from one of the major consumption centers, selling pressure appeared slightly but was prolonged.

The trading atmosphere at the beginning of the week became even more quiet as the US market took a holiday on Presidents' Day. The closure of the Toronto Stock Exchange (Canada) on Family Day caused activity on international exchanges to cool down significantly. According to observers, this is a typical time for the "standstill" mentality, when investors limit opening new positions and wait for clearer signals from macroeconomic data.

A similar development is also recorded in the silver market. Weakening liquidity and defensive sentiment make this metal lack breakthrough momentum, continuing to bear pressure in the context of cash flow prioritizing more stable assets.

Although the short-term market is in a "finding balance point" phase, many experts still maintain a positive view on the long-term outlook for gold.

Dominic Schnider - Head of APAC Commodity and Foreign Exchange of UBS Wealth Management said that the fundamental factors have not changed significantly. According to him, the need to hedge against risks is still present as geopolitical instability, large budget deficits and the trend of real interest rates falling continue to be supporting variables for precious metals.

From a more cautious perspective, James Steel - Head of Precious Metals Analysis at HSBC believes that "fluctuations" will be a prominent characteristic of the market in the near future. He noted that the traditional relationship between gold and real interest rates has weakened in recent years, making market reactions to signals from the Fed or the USD more unpredictable.

According to this expert, the Fed's monetary policy and the greenback's trajectory will continue to play a dominant role in investor sentiment.

In general, the precious metal market is in a sensitive phase, when the pulling force from fundamentals intertwines with profit-taking pressure after a sharp increase. In that context, investors should maintain a reasonable allocation strategy, prioritize risk management and avoid emotional trading psychology.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...