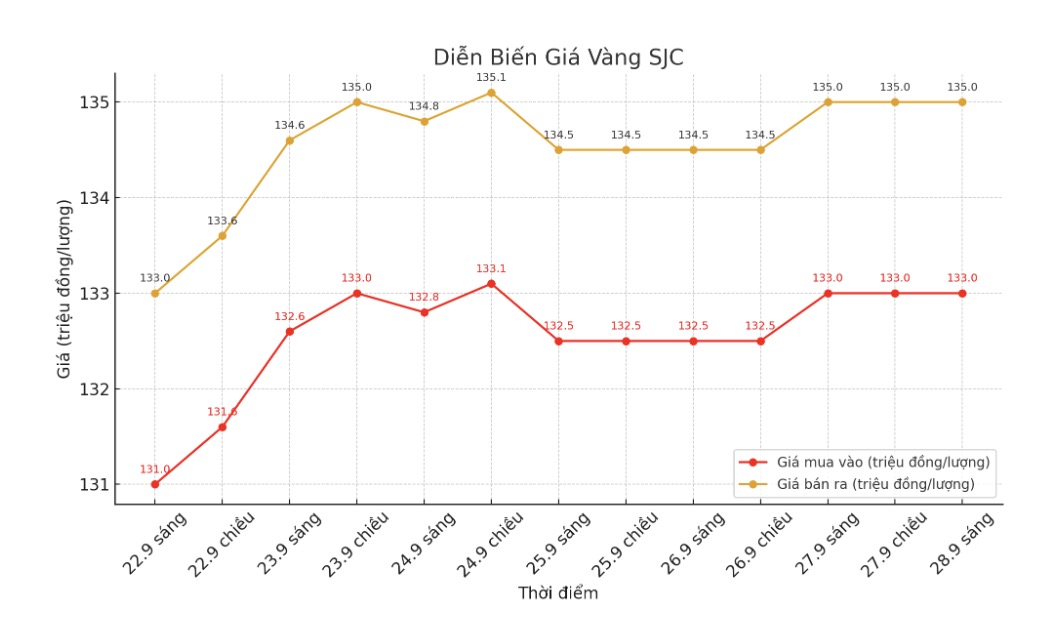

At the end of the week, Saigon Jewelry Company SJC listed gold bars at VND133-135 million/tael; compared to a week ago (September 21 session), it increased by VND2 million/tael in each direction, but the difference still remained at VND2 million/tael.

Bao Tin Minh Chau was also at 133-135 million VND/tael with the same increase. With the scenario of buying a week ago (September 21) and selling today (September 28), SJC gold bar buyers are almost only breaking even because the increase has been eliminated by the difference in range.

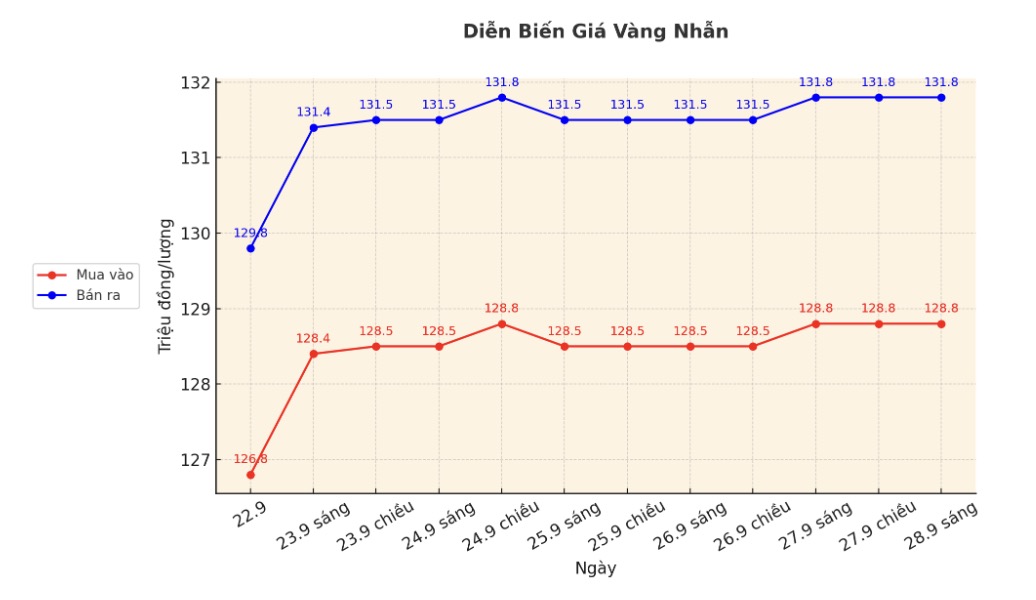

9999 gold rings show clearer risks. Bao Tin Minh Chau listed 129.1-132.1 million VND/tael; Phu Quy 128.8-131.8 million VND/tael. The difference between buying and selling is around 3 million VND/tael.

Although the increase was about 1.9-2 million VND/tael compared to a week ago, the difference between buying and selling was up to 3 million VND/tael, causing buyers on September 21 and 28 to lose about 1 million VND/tael.

The high difference makes all short-term transactions an unfavorable race: as soon as the buy order is matched, the investor has "sold out" the equivalent of 23 million VND/tael. To escape losses, prices must continue to increase beyond this difference, which does not always happen in a week.

When the market fluctuates strongly, businesses often widen the margin to prevent liquidity and price risks, making it easier for buyers to get stuck.

In addition, the product structure is different: gold rings are flexible in terms of denomination but often have a higher margin than gold bars, which is not favorable for short-term surfing.

Observing the developments last week also showed that the buying and selling time is a key factor. For gold bars, buyers on September 21 and sell on September 28 only have to match their capital; just need to choose the wrong beat (buy at the high price area during the day, sell at the adjusted price area during the day) to increase the loss. With gold rings, although the face value has increased, the difference of 3 million VND/tael has "locked" short-term profits, requiring a longer uptrend to compensate.

In the context of market fluctuations, investors need to prioritize checking the buying - selling difference before putting down money, because the 2-3 million VND/tael limit means " grassroots" right after matching the order. Avoid the fear of missing out in the hot price zone; Pre-establish a loss cut and profit-taking target based on actual fluctuations instead of expectations.

Comparing between brands and choosing products with lower dividends to reduce hidden costs. With long-term accumulation, the price should be average over time; surfing is only suitable when the margin narrows and liquidity improves.

See more news related to gold prices HERE...