James Stanley - senior market strategist at Forex. com, is one of the experts predicting gold prices will increase next week.

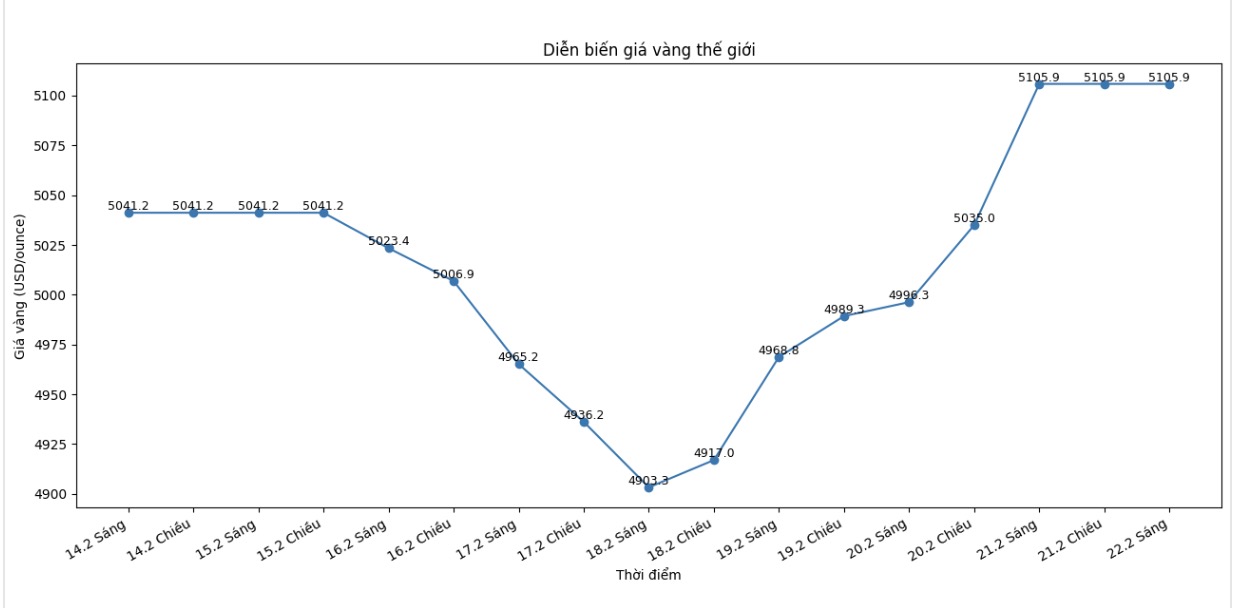

Buyers continue to show strength. On short-term charts, an upward triangle pattern has formed - a structure that often signals the possibility of a breakthrough. The threshold of 5,100 USD/ounce is an important milestone on the spot market. This used to be a support zone, then turned into resistance, and is now the "line" that buyers need to cross" - this expert said.

Increasing trend" - Rich Checkan, Chairman and COO of Asset Strategies International, said. "The gold market has not shown any fundamental differences to justify the recent correction. Clearly, this is just a short-term correction. This is healthy, and the upward trend is likely to return soon.

Agreeing with this view, Darin Newsom - senior market analyst at Barchart. com predicts gold prices will increase next week. According to observations from previous periods, the market usually becomes more cautious around the end of major international events, when investors re-evaluate geopolitical risks.

In the current context, uncertain factors related to relations between superpowers continue to exist, causing cash flow to tend to seek safe haven assets such as gold.

He believes that risk hedging sentiment may increase in the short term. “The diễn biến of the last session of the week shows that precious metals are reacting positively, reflecting defensive needs.

At the same time, the weakening oil prices show that investors are still considering many different scenarios. In general, the unstable environment tends to create support for gold. The next sessions may be very noteworthy.

Uptrend" - Adrian Day, Chairman of Adrian Day Asset Management, commented. "It is likely that gold has bottomed out after the sell-off at the end of January and is recovering clearly, although still fluctuating.

Before the weekend holiday and the possibility of the US taking action with Iran, not many people want to sell. If there is no escalation, gold may adjust slightly on Monday. However, the short-term recovery trend is still quite clear.

Notably, analysts at CPM Group issued a buy recommendation on Friday, with an initial target of 5,400 USD/ounce in the period from February 23 to March 6 and a cut-loss level at 4,850 USD/ounce.

Gold price fluctuations are forecast to continue in the context of global economic and political instability" - CPM Group wrote - "Prices are still likely to experience sudden drops, but CPM believes the main trend is to lean towards increase next week as well as the following weeks and months.

This recommendation sets the initial target at $5,225/ounce, but does not rule out the possibility of the price soaring to $5,400/ounce or higher. Gold may rush up to $5,500/ounce if political and economic risks escalate. The physical market tightens, capital inflows into ETFs are maintained, and technical models support this scenario.