USD Index

On November 10, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.13%, standing at 99.60 points.

In the first week of November (from November 3-9), the USD weakened slightly in the international market after US President Donald Trump first admitted that US consumers are having to pay additional fees for goods due to his tariff policy, although he still affirmed that this is a measure to " bring overall benefits to the country".

At the end of the session on November 7, the USD Index (DXY) - a measure of the strength of the greenback against six major currencies - stopped at 99.47 points, down 0.2 points compared to the end of last week.

Mr. Trump's speech weakens the psychology of US consumers, along with the US government's partial shutdown, causing official economic data to be delayed, increasing concerns about the prospects for US economic growth. The monthly employment report was also postponed, causing investors to lack orientation information, weakening market sentiment and dragging the USD down.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 10, the State Bank announced that the central exchange rate of the Vietnamese Dong is currently at 25,103 VND. This is an increase of 10 VND compared to the end of last week, ending a streak of 5 consecutive declines.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: 23,848 VND - 26,358 VND.

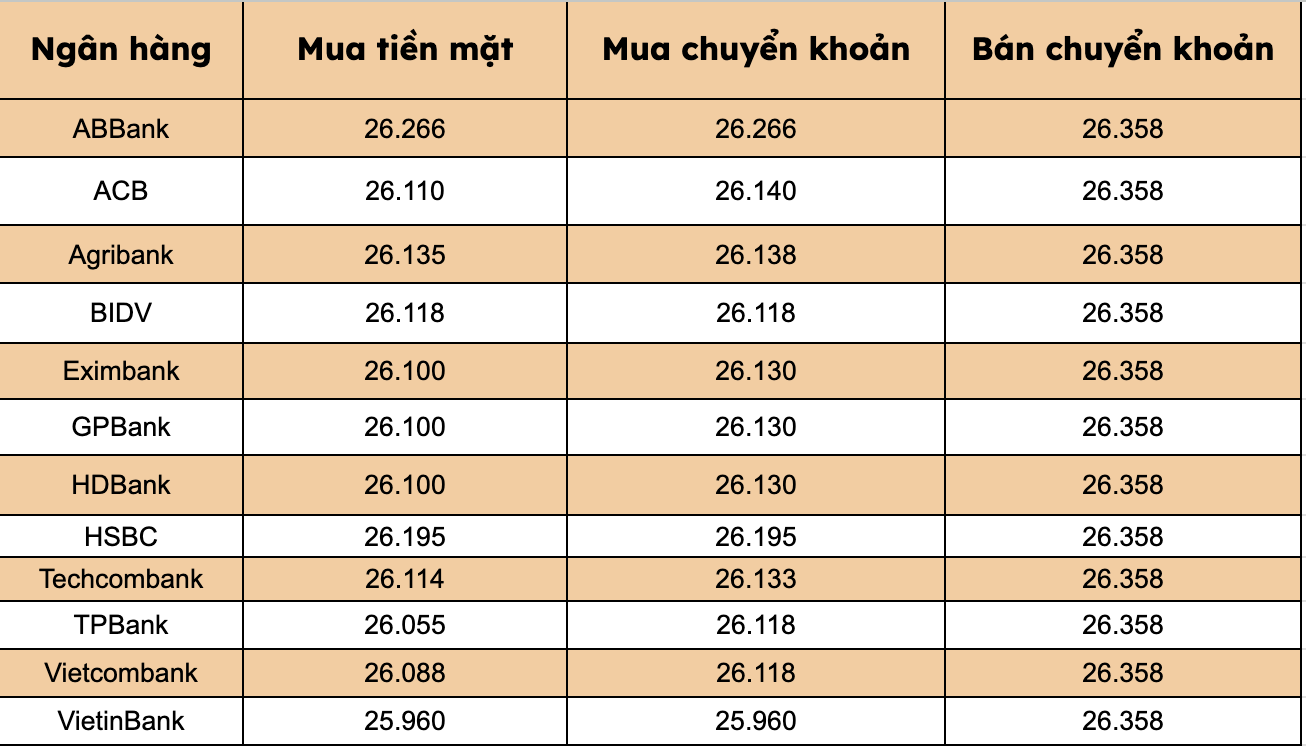

At commercial banks, USD prices increased at most brands.

Banks listed USD selling prices at VND 26,358/USD.

Bank with the highest cash and bank transfer price: ABBank (26,266 VND/USD).

The difference between buying and selling prices at banks ranges from 92-394 VND/USD.