The National Assembly's Economic and Financial Committee, in its inspection report dated May 4, 2025, clearly warned of outstanding risks for the current financial and banking system, especially the situation of bad debt that has not been fully reflected, along with the pressure from maturing real estate bonds accounting for a large proportion this year.

In the content of the review on the socio-economic situation in 2025, the Economic and Financial Committee assessed: "Financial, monetary markets and the banking system need to be closely monitored to promptly control arising risks."

Notably, the inspection agency requested the Government to: Report more fully on bad debt within the board, unresolved sales debt to VAMC and potential debts turned into bad debts to have a comprehensive assessment of bad debt pressure and appropriate solutions.

The emphasis on the need for more complete reporting clearly reflects concerns that current bad debt figures may not comprehensively reflect the financial situation in the banking system.

As reported by Lao Dong Newspaper, by the end of 2024, group 5 debts at many banks had skyrocketed. Some banks recorded an increase of more than 100%, creating great pressure to set up reserves.

Along with the warning about bad debt, the report also highlights another worrying risk such as the pressure to mature large real estate bonds, accounting for 64% of the total maturity value in 2025.

This rate shows that the bond market continues to depend heavily on the real estate sector, which is facing many difficulties in liquidity, legality and investor confidence.

The Economic and Financial Committee stated that the real estate market faces many difficulties and needs synchronous solutions for sustainable and healthy development.

Setting two major warnings about bad debt and real estate bonds next to each other, along with a call for appropriate solutions, shows the need for the Government to urgently have response policies, to ensure the safety of the financial - monetary system, avoiding widespread impact.

According to the reporter's records, the 2024 semi-annual financial report of the Vietnam Asset Management Company (VAMC) - the unit that plays a role in shouldering the majority of bad debts from banks - also shows remarkable signs.

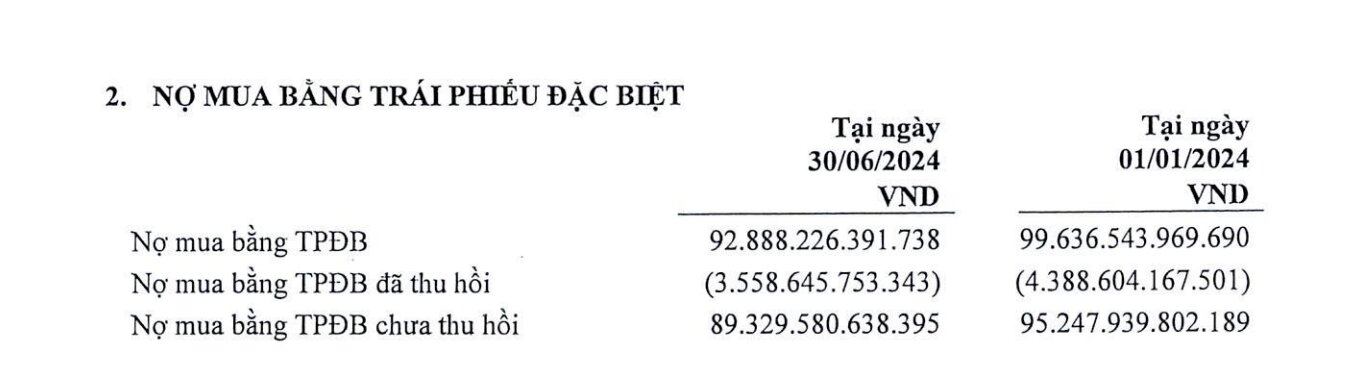

Total outstanding loans purchased using special bonds (TPDB) - the main tool that VAMC uses to collect bad debts from credit institutions - as of June 30, 2024 is still over VND 89,329 billion, down slightly compared to the beginning of the year but still at a high level. Meanwhile, the revenue from debt trading activities increased to VND223 billion, mostly from debts that are no longer guaranteed by the General Confederation of Labor.

The pure cash flow from VAMC's business activities in the first half of 2024 was negative by more than VND 1,306 billion, causing cash and cash equivalent to decrease sharply. This raises questions about the ability to self-financing for further debt settlement activities, especially in the context of the volume of bad debts that have not been thoroughly handled being "tached" here.

The National Assembly's Economic and Finance Committee proposed a more clear report on the debt sold to VAMC but has not handled it, is also a reminder of the delay between debt transfer and actually "clean" the balance sheet of the bank. If there is no synchronous solution, the risk of potential bad debts turns into actual bad debts will put great pressure on the system.