Da Nang wins big thanks to stock investment

Da Nang Housing Development Investment Joint Stock Company (Code: NDN) has just announced a consolidated financial report for the third quarter of 2025 with strong growth results. Revenue reached nearly 106 billion VND, an increase of more than 2 times over the same period, while profit after tax reached nearly 71 billion VND, 36 times higher than the same period last year.

The NDN said that the profit skyrocketed thanks to the positive recovery of the stock market, leading to a sharp increase in financial profits. As of September 30, the trading stock portfolio of NDN has a market value of VND651 billion, 32% higher than the original price, corresponding to an interim interest of VND159 billion. Most of the investments recorded interest.

In the quarter, the company took a portion of Vinhomes (VHM) shares profits, causing the book value to decrease from VND131 billion to VND93 billion. However, the market value of this investment still reached 177 billion VND, double the capital price thanks to VHM shares continuously increasing. In the GMD (Gemadept) code, the NDN also narrowed the investment ratio from 61 billion to 26 billion VND, recording a preliminary loss of nearly 2 billion VND.

Notably, the investment in Idico (IDC) that appeared in the second quarter with a principal price of VND 44 billion has been withdrawn from the portfolio, while NDN added VCG shares (Vinaconex) with a principal price equivalent to VND 44 billion.

Da Nang also poured money to buy HPG, GMD, DGC, BSR, PNJ, HDG, TCB stocks... With positive market developments, the company has reduced its provision in stocks, from VND49 billion at the beginning of the year to VND9 billion at the end of the third quarter.

Accumulated for the first 9 months, Da Nang House's net revenue only reached 20 billion VND, down 58% over the same period due to slowing real estate business activities. However, financial revenue increased by 39% to VND137 billion, of which stock investment interest accounted for more than VND128 billion. In addition, the company also repaid more than 53 billion VND in stock price reduction reserves and investments, helping to balance financial costs.

Thanks to that, the 9-month after-tax profit reached more than 145 billion VND, 3.5 times higher than the same period and far exceeding the annual plan (44.3 billion VND) approved by the general meeting of shareholders.

As of the end of the third quarter, NDN's total assets reached VND1,309 billion, up slightly by 2% compared to the beginning of the year. Cash, cash equivalent and bank deposits increased by 6% to VND 295 billion. The debt payable has been reduced sharply by half, to VND94 billion, of which the other short-term payment is only nearly VND18 billion because the maintenance fee of more than VND43 billion of the Monarchy B project is no longer recorded.

Tu Liem House loses real estate revenue, interest increases sharply thanks to stocks

Similarly, Tu Liem Urban Development Joint Stock Company (Code: NTL) has just announced its business results for the third quarter of 2025 with a bright spot from financial activities. Although there is no revenue from the real estate business segment, the enterprise still reported a profit of nearly 13 billion VND, 3.5 times higher than the same period last year.

According to the report, in the third quarter, Tu Liem Urban Area recorded nearly 58 billion VND in financial revenue, nearly 4 times higher than the same period, mainly from deposit interest and stock investment activities. Meanwhile, net revenue only reached nearly 4 billion VND.

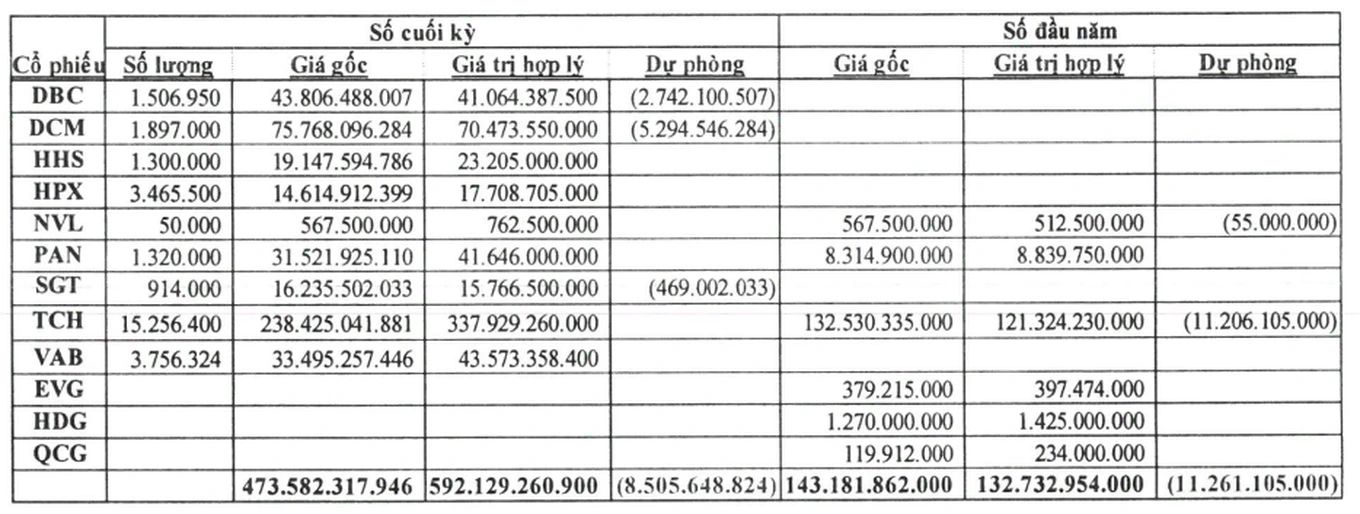

As of September 30, the total value of the enterprise's stock investment reached nearly VND 474 billion, more than 3 times higher than the same period and accounting for about 24% of total assets. The largest investment is in TCH shares of Hoang Huy Financial Services Investment Joint Stock Company with a value of more than VND 238 billion. Thanks to the increase in TCH shares in the market, Tu Liem Urban Area temporarily profited about 100 billion VND from this investment.

NTL's stock investment portfolio also includes codes such as DBC, DCM, HHS, HPX, PAN, SGT and VAB. The company criticized the establishment of a reserve of about 8.5 billion VND - a very small amount compared to the total investment value - showing that most of the investments are making a profit.