Geopolitical risks in the Middle East continue to be a factor dominating the gold market.

US President Donald Trump said he would only spend "about 10–15 days" on negotiations on a nuclear deal with Iran, as US forces are increasing their presence in the region on the largest scale since the Iraq war in 2003. In the previous two sessions, gold prices had increased by more than 2%.

In addition, the US interest rate roadmap is still uncertain, which is also a key driving force for gold, an asset that often benefits when borrowing costs decrease. According to Dow Jones, US Federal Reserve (Fed) Governor Stephen Miran has lowered his voice calling for deeper interest rate cuts this year, after recent data showed that the US economy is stronger than his initial forecast.

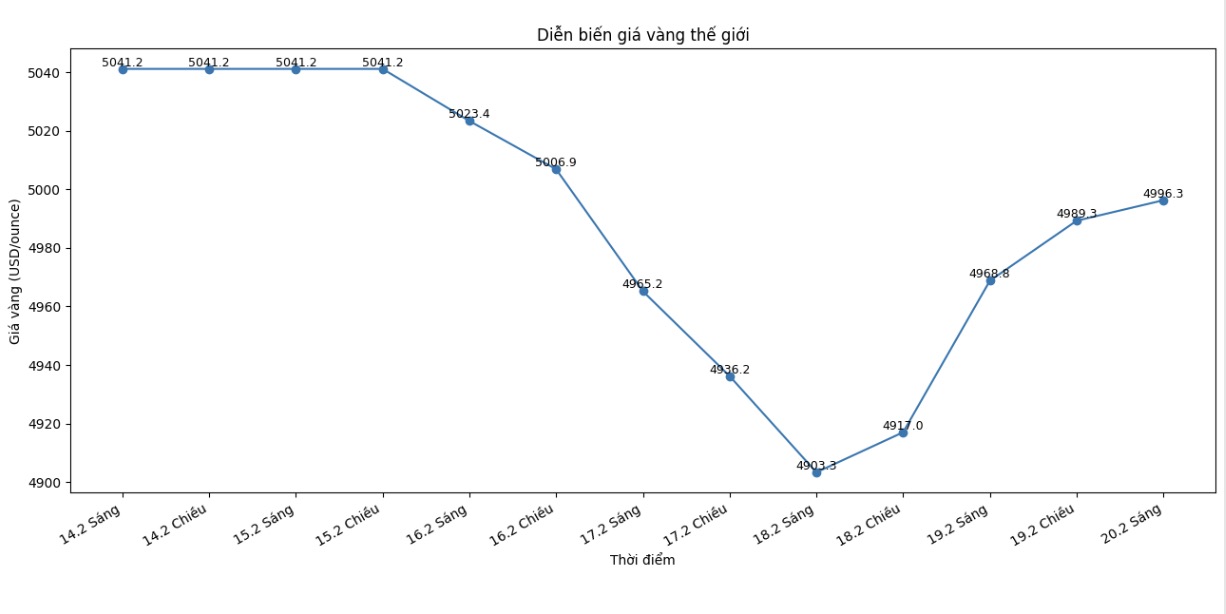

The gold market has fluctuated unusually strongly since the historic sell-off at the change of months, when prices fell from a record high of over 5,595 USD/ounce to nearly 4,400 USD/ounce in just two days. The wave of speculative buying accelerated in January pushed the long-term upward momentum to the point of overheating. However, the fundamental factors that supported the previous upward trend are generally still there, including the trend of moving away from government bonds and currencies.

The safe-haven value of gold also returned to the focus as tensions surrounding Iran increased. A large-scale attack on the Islamic Republic of Iran - where leaders are concerned about regime stability after widespread instability could drag the US into its third war in the Middle East since 1991. Meanwhile, oil prices stabilized around a six-month high on Friday.

In other developments, Newmont Corp. - the world's largest gold producer - announced on Thursday that production this year is expected to decrease by about 10%, partly due to upgrade plans at some mines managed by the company.

As of 7:57 am in Singapore, spot gold prices fell slightly by 0.1% to 4,990.09 USD/ounce. Silver fell 0.7% to 77.99 USD/ounce. Platinum and palladium remained almost unchanged. Bloomberg Dollar Spot Index - a measure of the strength of the USD - went sideways in Friday's session but increased by 0.8% for the whole week.