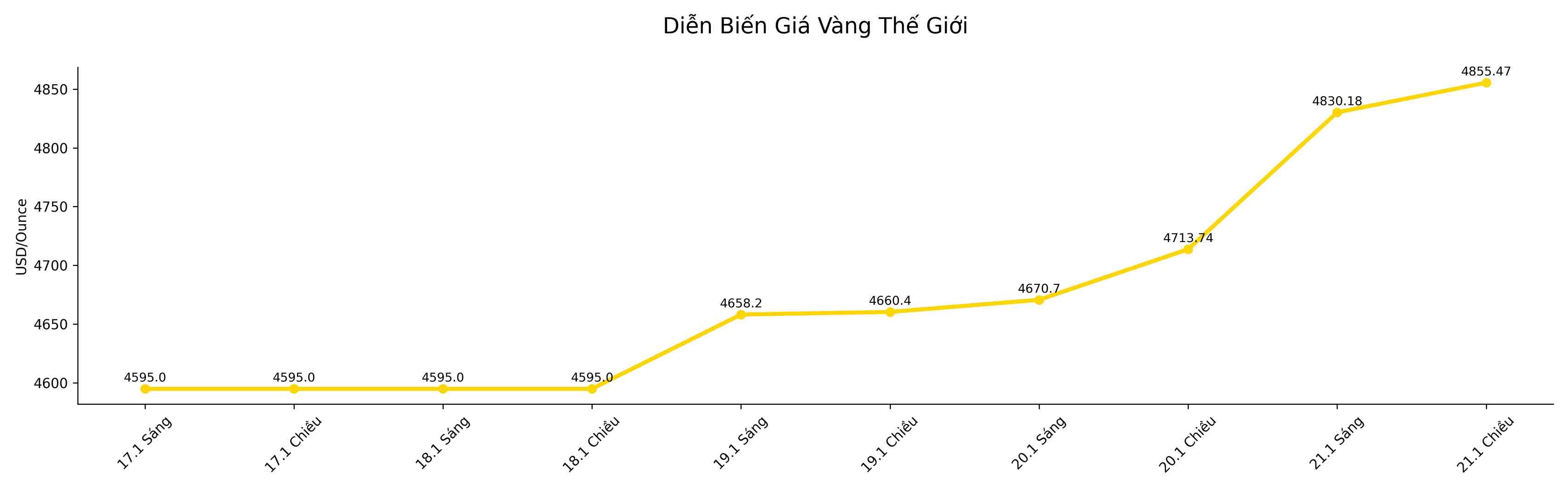

Spot gold prices rose 2.6% to 4,855.47 USD/ounce in this afternoon's trading session, after hitting a new peak of 4,887.82 USD earlier in the session. US gold futures for February delivery also rose 2.6%, reaching 4,888.20 USD/ounce.

This is the consequence of the decline in confidence in the US after Mr. Trump's moves last weekend to impose taxes on European countries and increase pressure to win Greenland. Gold price movements reflect concerns about global geopolitical tensions," said Kyle Rodda, senior market analyst at Capital.com.

On Tuesday, Mr. Trump declared "no way back" in his goal of controlling Greenland, not ruling out the possibility of using force, and criticized NATO allies. He then said: "We will find a direction that satisfies NATO and we will also be satisfied.

Meanwhile, French President Emmanuel Macron affirmed that Europe will "not yield to threats or coercion", in response to Mr. Trump's tough tax declaration in Davos.

According to Mr. Nicholas Frappell, Global Organization Market Director of ABC Refinery, "exceeding the $4,800 mark reinforces the view that investors would not want to sell gold before the price hits $5,000. This is a combination of traditional factors supporting gold, including increased public debt, weak USD and geopolitical instability.

The USD index (DXY) remained low for nearly a month after warnings from the White House related to Greenland triggered a sell-off wave on US assets – from the USD, Wall Street stocks to Treasury bonds.

The weakening USD makes precious metals priced in USD cheaper for buyers abroad.

Spot silver prices fell 0.5% to 95.03 USD/ounce, after hitting a record 95.87 USD on Tuesday. Platinum fell 0.5% to 2,473.80 USD/ounce after hitting a new peak of 2,511.80 USD, while palladium rose 0.1% to 1,881.57 USD.