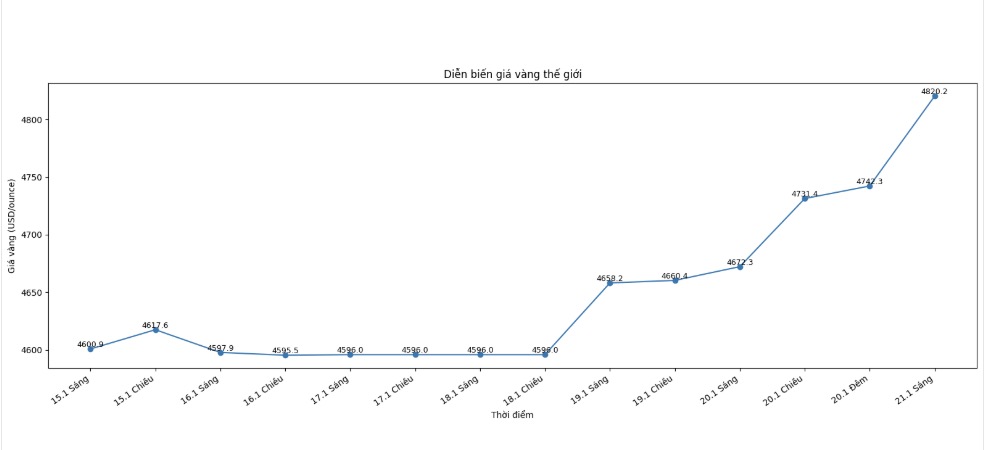

Gold prices increased sharply in a short time, continuously exceeding the milestones of 4,700 USD and 4,800 USD/ounce, pushing the precious metal market into a state of high volatility.

Gold and silver simultaneously set new record highs as safe haven demand increased in the context of risk-avoidance sentiment covering the global market. This upward momentum did not come from a single factor, but is the result of a combination of many simultaneous forces.

First of all, the psychology of seeking safe haven assets plays a key role. Increased geopolitical tensions between the US and Europe, especially related to trade and strategic issues, have caused investors to worry about widespread risks. In that context, gold and silver – which are considered traditional "hideouts" – have become priority options for preserving asset values.

Besides geopolitical factors, strong fluctuations in global financial markets also contribute to boosting precious metal prices. Stocks in many countries simultaneously declined, while the bond market appeared a sell-off wave, especially in Japan, which increased the level of instability. When risky investment channels are less attractive, cash flow tends to shift to gold and silver.

Another important reason is the increase in long-term bond yields, reflecting concerns about fiscal prospects and inflation. Although increasing yields often put pressure on gold, in the current context, the instability of the global debt market makes investors prioritize holding precious metals as a long-term risk hedging measure.

In addition, the developments of the USD also confirm the price trend. The recent weakening of the greenback has made gold and silver – which are valued in USD – more attractive to investors holding other currencies.

Finally, technical factors and speculative cash flow also contributed to exacerbating the upward momentum. When gold and silver prices continuously surpassed important resistance levels, buying power in the trend was strongly activated, pushing prices to new highs in a short time.

Summarizing the above factors shows that the current increase in gold and silver prices is not temporary, but reflects the high level of caution of the market in the face of uncertainties that are present in the global economy.

See more news articles about gold prices on Lao Dong Newspaper here...