Gold prices continue to approach the 5,000 USD/ounce mark, supported by escalating geopolitical risks and new threats to the independence of the US Federal Reserve (Fed), thereby maintaining a record increase.

Precious metals climbed to a new peak above $4,967 in Friday's session and headed for a nearly 8% increase in the week, thanks to the weakening USD. Silver also rose to its all-time high, close to the $100/ounce mark, while platinum set a new record. The USD strength index recorded the worst week in seven months, making the group of precious metals cheaper for most global buyers.

Gold is undergoing a period of strong revaluation as cracks appear in the rule-based order formed after World War II," Yuxuan Tang, Head of Macro Asia Strategy at J.P. Morgan Private Bank, said. "Investors are increasingly seeing gold as a reliable protection against risks of difficult-to-quantify regime shifts.

After the strongest year of increase since 1979, gold continued its spectacular breakthrough, increasing by 15% in the first months of this year. US President Donald Trump's Fed attacks, along with military intervention in Venezuela and threats to annex Greenland, have added momentum to "devaluation transactions", where investors withdraw from bonds and currencies to seek refugee assets like gold.

“Gold supply is currently not enough to absorb market and political tensions in the US, making all price resistance thresholds fragile,” Ahmad Assiri, a strategist at Pepperstone Ltd Group, assessed.

Goldman Sachs has raised its year-end gold price forecast to $5,400/ounce compared to the previous $4,900, citing increased demand from private investors and central banks.

The central bank of Poland, currently leading the world in gold purchase volume, reported this week that it has approved a plan to buy an additional 150 tons to respond to increased geopolitical instability. Meanwhile, India's US Treasury bond holdings have fallen to a 5-year low, as the country strongly shifted to gold and other alternative assets, integrating into the trend of leaving the world's largest bond market by many major economies.

Investors are currently waiting for Mr. Trump's choice for the Fed Chairman position after the US President said he had completed interviews with candidates and had someone "in mind". A more moderate leader could boost expectations of interest rate cuts this year – a factor that benefits gold and non-profit assets – especially after three consecutive declines.

Silver, benefiting from the upward momentum of gold, has more than tripled in the past year. This metal is also supported by the historic "sweep of selling positions" and the buying wave of individual investors, causing banks and refineries to struggle to meet unprecedented demand.

The vagueness surrounding China's export licensing policy changes further increases awareness of scarcity, in the context that the market maintains high volatility even as the US avoids extensive tariffs on important minerals, including silver and platinum.

According to former precious metal trader Robert Gottlieb, high prices and strong fluctuations make banks unable to maintain the level of risk as before. “They are forced to narrow their positions very strongly, leading to greater fluctuations and widened price differences”.

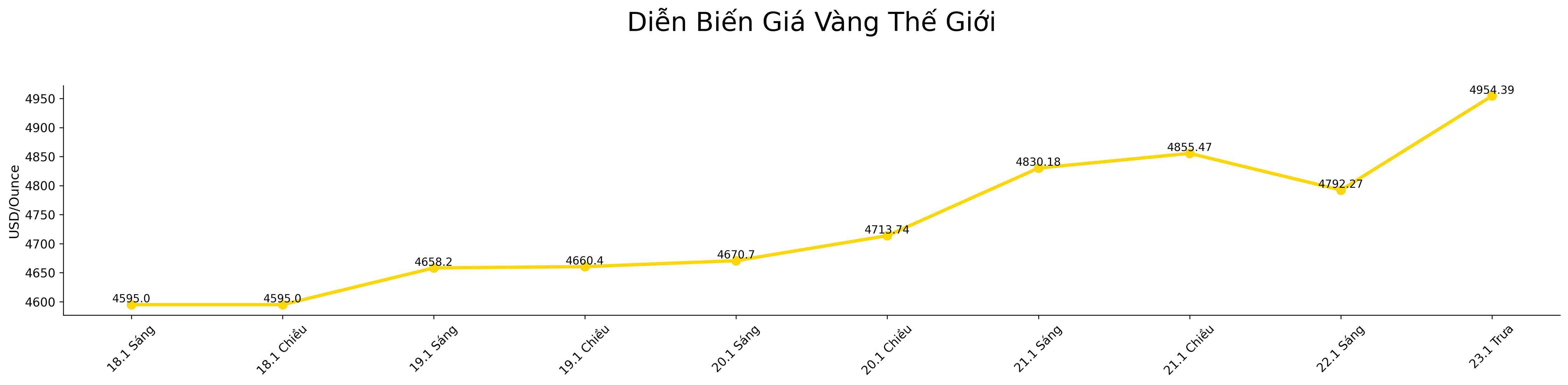

In Singapore, gold prices increased by 0.3% to 4.954.39 USD/ounce in today's noon trading session; silver increased by 2.6% to 98.70 USD; platinum increased by 0.4% after setting a new peak of 2,690.08 USD; palladium decreased slightly. The Bloomberg Dollar Spot index went sideways after a previous 0.3% decrease.