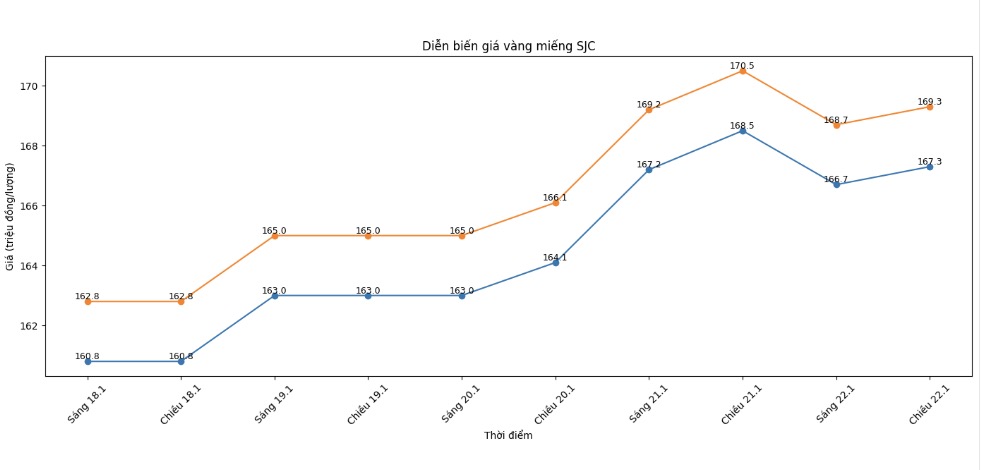

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 167.3-169.3 million VND/tael (buying - selling), down 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 167.3-169.3 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 166.6-169.3 million VND/tael (buying - selling), down 900,000 VND/tael on the buying side and down 1.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.7 million VND/tael.

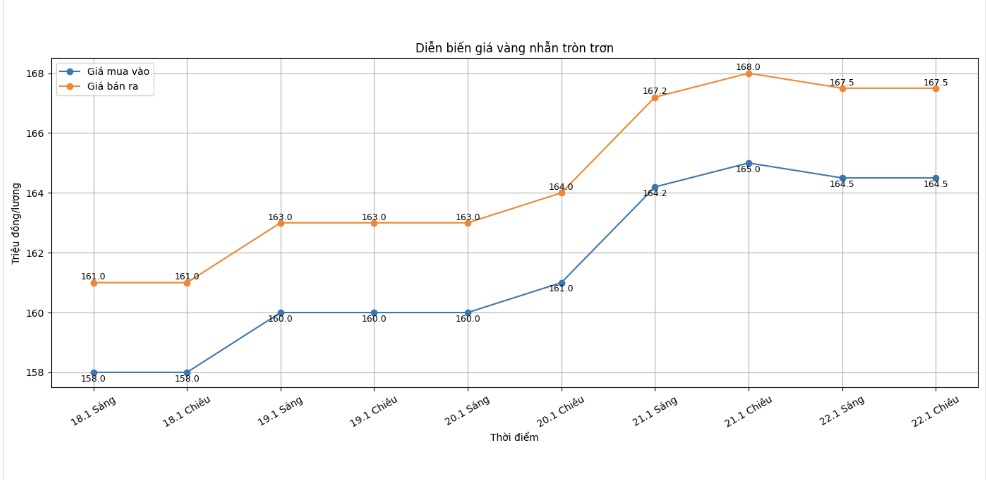

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 164.5-167.5 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 166.3-169.3 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 165.2 - 168.2 million VND/tael (buying - selling), down 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

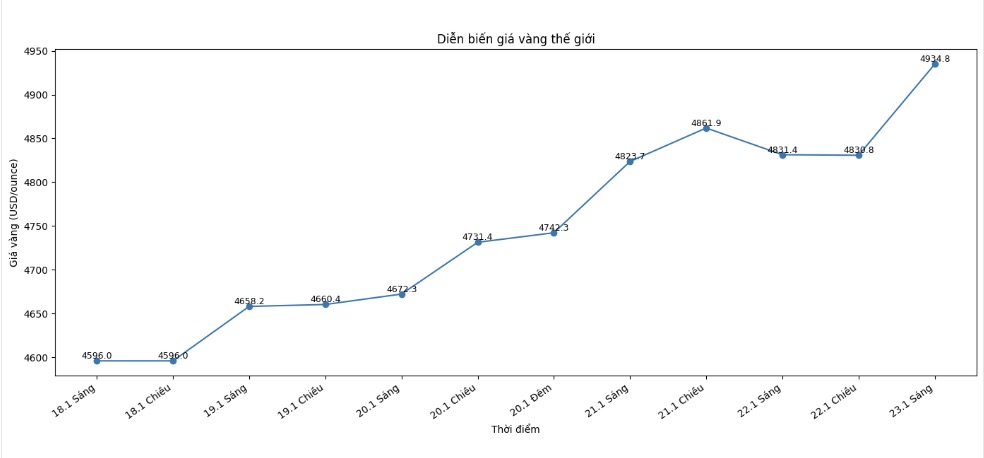

World gold price

At 5:38 am, world gold prices were listed around the threshold of 4,934.8 USD/ounce, a sharp increase of 103.4 USD compared to the previous day.

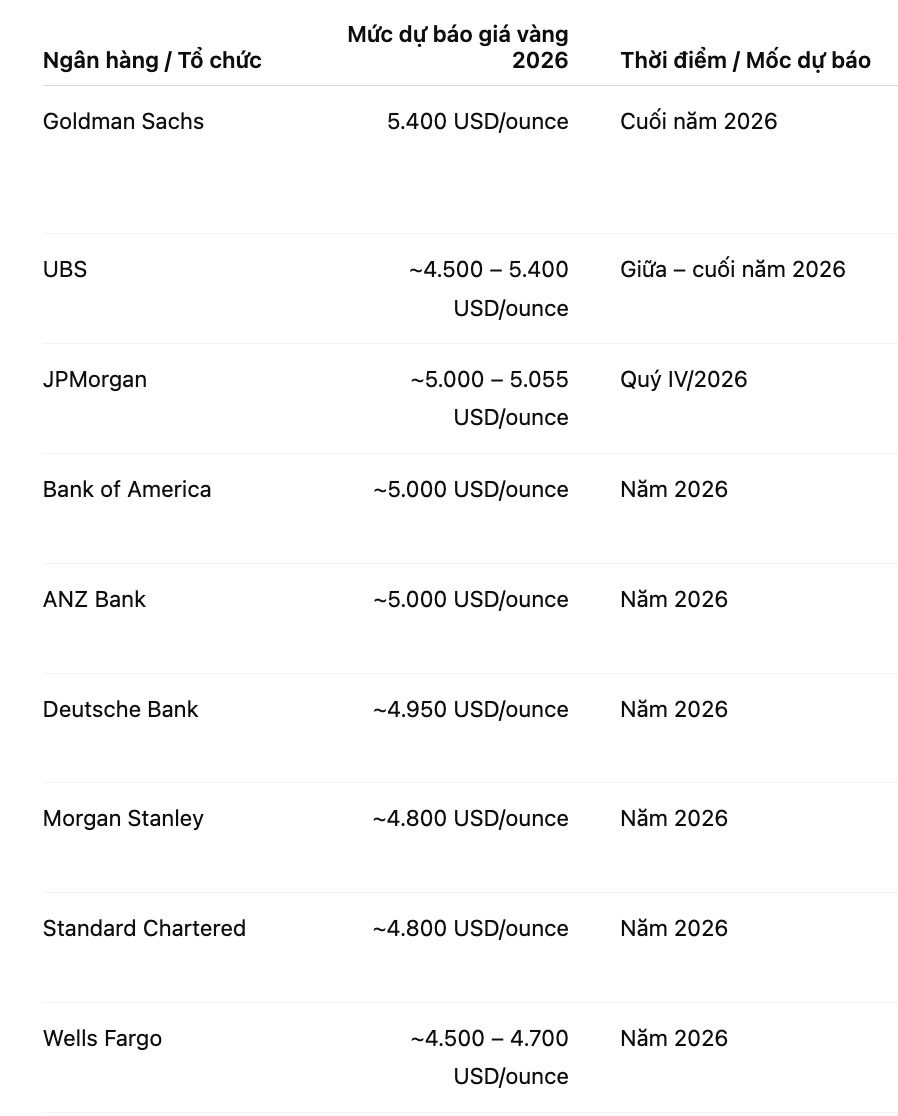

Gold price forecast

World gold prices continue to squeeze into highs and approach new record levels, thereby creating an important support for the domestic gold market. The upward momentum of precious metals is being strengthened by many factors, from the buying trend of central banks to expectations of loosening monetary policy in major economies.

According to Goldman Sachs' assessment, the outlook for gold prices in the medium and long term is still quite positive. This financial group has just raised its gold price forecast for the end of 2026 to 5,400 USD/ounce, 500 USD higher than the previous estimate.

Goldman Sachs believes that the main driving force comes from the trend of diversifying foreign exchange reserves to gold, especially in emerging economies, in the context of global policy risks still existing.

The bank's report emphasizes that private sector investors are seeing gold as a long-term risk hedging tool and are likely not to sell the amount of gold held next year. This helps the gold price level maintain at a high level, even when the financial market appears short-term correction phases.

In addition, Goldman Sachs also expects gold ETF funds in the West to return to a net buying trend, especially as the US Federal Reserve is forecast to cut interest rates in 2026.

From a market perspective, analysts believe that gold prices are currently under intertwined impacts from both technical and psychological factors. The weakening of the USD and the cooling down of US bond yields are creating favorable conditions for cash flow to return to safe-haven assets. In the short term, gold is still fluctuating strongly around the peak due to profit-taking activities, but the main trend is assessed to be upwards.

However, experts also note that adjustment risks may occur if geopolitical tensions cool down quickly or global monetary policy concerns decrease significantly. At that time, a part of investors may narrow risk hedging positions, putting pressure on gold prices in the short term. However, overall, gold is still considered an attractive investment channel in the context that many uncertain factors have not been completely resolved.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...