Recently, the National Assembly Standing Committee passed a Resolution on adjusting the family deduction of personal income tax applicable from the 2026 tax calculation period. Accordingly:

- The deduction for taxpayers is 15.5 million VND/month (186 million VND/year).

- The deduction for each dependent is 6.2 million VND/month.

Pursuant to Clause 1, Article 7 of Circular 111/2013/TT-BTC, taxable income on income from salaries and wages is the total taxable income minus non-taxable expenses and exempted expenses (if any).

For individuals with dependents, the deduction for each dependent in the 2026 tax calculation period is 6.2 million VND/month.

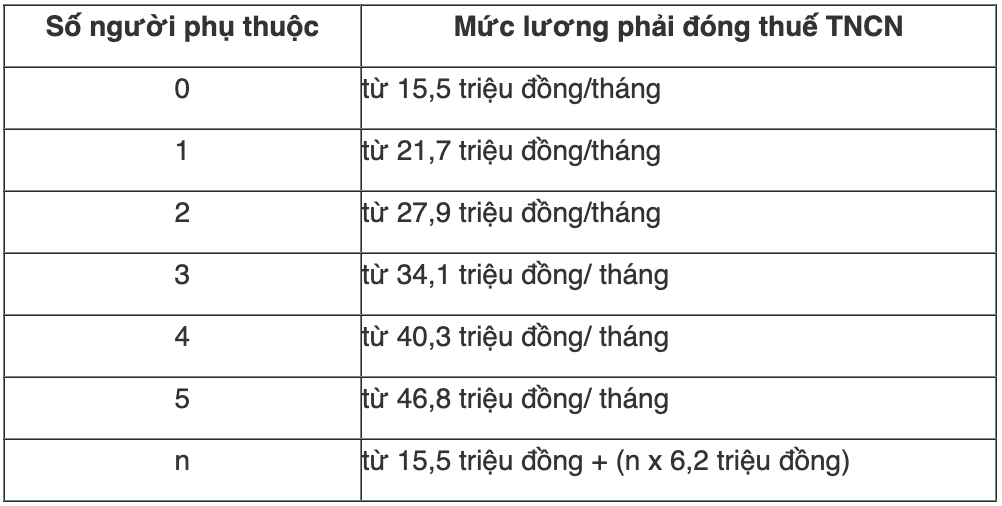

Accordingly, the salary subject to personal income tax corresponds to the number of dependents as follows:

Note: The above income is income from salaries and wages, deducted from the following:

- Insurance contributions, voluntary pension funds, charitable contributions, learning promotion, and humanitarian activities.

- Income is exempt from income tax.

- Income tax-free expenses such as some allowances, subsidies, lunch money, etc.