Gold prices surged despite traditional market rules, amid growing concerns about Donald Trump's tough trade policy.

This price increase clearly reflects the trend of investors looking for safe-haven assets in the context of policy instability overwhelming economic platforms that vonically support the market.

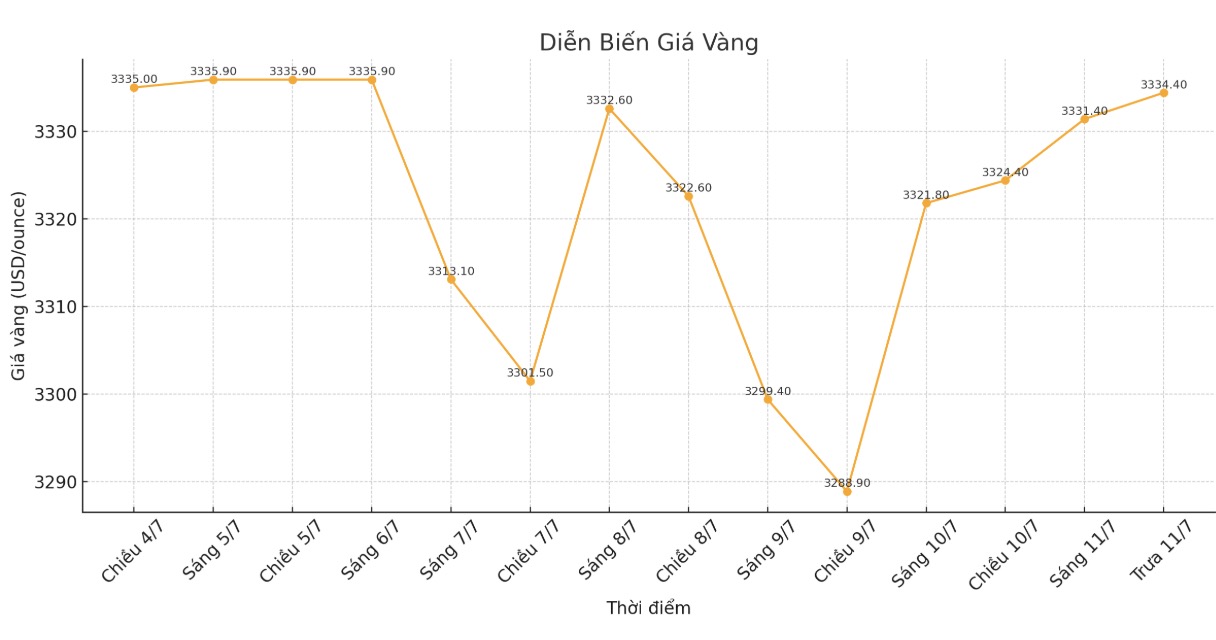

Gold futures continued to recover for the second consecutive session, officially closing the previous 5-session streak of consecutive declines. The contract for delivery in August 2025 increased by 10.5 USD, equivalent to 0.32%, to 3,333 USD/ounce, and then continued to increase by 1.80 USD, reaching 3,335.2 USD/ounce (as of 6:40 USD/s per the evening of the US East Sea - 540 USD/s per the morning of Vietnam on July 12).

This rally is especially noteworthy as gold could rise even as the US dollar strengthens a relationship that often moves in the opposite direction. This break in traditional correlation shows that gold is increasingly popular as a hedge against policy risks, rather than a pure reaction to currency fluctuations.

Meanwhile, silver prices recorded a more impressive increase, jumping 1.02 USD, equivalent to 2.79%, to 37.625 USD/ounce. The metal rebounded strongly in the after-hours trading session and continued to increase to 37.79 USD/ounce at 6:40 p.m., an increase of 0.165 USD.

This increase has brought silver prices to their highest closing price in more than 12 years, approaching the $40 mark - the price that many experts now consider a "light" and no longer a "peak" in 2025.

The advantage of silver over gold shows that strong industrial demand is contributing to the increase of this precious metal.

The unconventional approach to trade policy of the Donald Trump administration has become a key factor driving the increase of precious metals.

Yesterday's announcement of a 50% tax on copper imports, effective from August 1, along with similar tax rates on goods from Brazil, has created a wave of uncertainty in the market.

Policy uncertainty is strong enough to overwhelm inherently unfavorable factors for precious metals, such as a strong US dollar or positive employment data, which shows the risk-off sentiment currently dominating the market.

Recent labor market data shows that businesses are still retaining workers despite many other cooling signals, reducing the possibility of the US Federal Reserve (FED) cutting interest rates soon. The number of initial US jobless claims in the week ended July 5 was 227,000,000, down from the forecast of 235,000.

Typically, positive labor data will reduce expectations of a Fed rate cut, thereby putting pressure on precious metals. However, the continued increase in gold and silver despite this factor shows that the market is prioritizing concerns about geopolitics and trade policy over traditional factors related to monetary policy.

The stability of the precious metal in the face of data that often puts downward pressure on prices shows the current strength of safe-haven cash flow, and emphasizes the level of impact that policy instability is causing on the traditional supply-demand relationship of the market.

The combination of strong trade policies and safe-haven demand creates a very favorable context for the continued increase of precious metals. While traditional economic indicators may suggest a tougher stance from the Fed, it is clear that the market's focus has shifted to policy risks and accompanying economic consequences.