Personnel changes at SBH amid controversy over flood discharge

Song Ba Ha Hydropower Joint Stock Company ( stock code: SBH) has just decided to assign the Chairman of the Board of Directors to temporarily manage the activities of the Board of Directors of the enterprise.

From December 1, Chairman of the Board of Directors Vu Huu Phuc will temporarily manage the Executive Board's operations during the time General Director Nguyen Duc Phu is on leave and working with the competent authority.

The decision was made in the context of controversy over the issue of flood discharge from hydropower plants, after the flood caused particularly serious damage in some localities.... Public opinion raised the issue of how to operate the reservoir of Song Ba Ha Hydropower Plant, the unit that is becoming the focus of attention.

According to the information announced by the enterprise, Song Ba Ha Hydropower Plant has a capacity of 220 MW, moderate useful capacity, mainly for power generation. The lake is located right behind major projects such as Song Hinh, Ayun Ha and Krong H' Nang. At this location, the Ba Ha River Hydropower Plant became the "last gateway" before the water flowed into the densely populated downstream area of Phu Yen (formerly).

Ba Ha River Hydropower Plant maintains positive profits for many years

Song Ba Ha Hydropower Joint Stock Company was established on the basis of the Song Ba Ha Hydropower Plant Production Pre preparation Board under the Hydropower Project Management Board 3, from October 2005 and until June 2006 under the Hydropower Project Management Board 7.

The plan to establish a Joint Stock Company was approved by Vietnam Electricity Group. On December 27, 2007, the General Meeting of Shareholders established Song Ba Ha Hydropower Joint Stock Company for the first time with a charter capital of more than VND 1,242 billion.

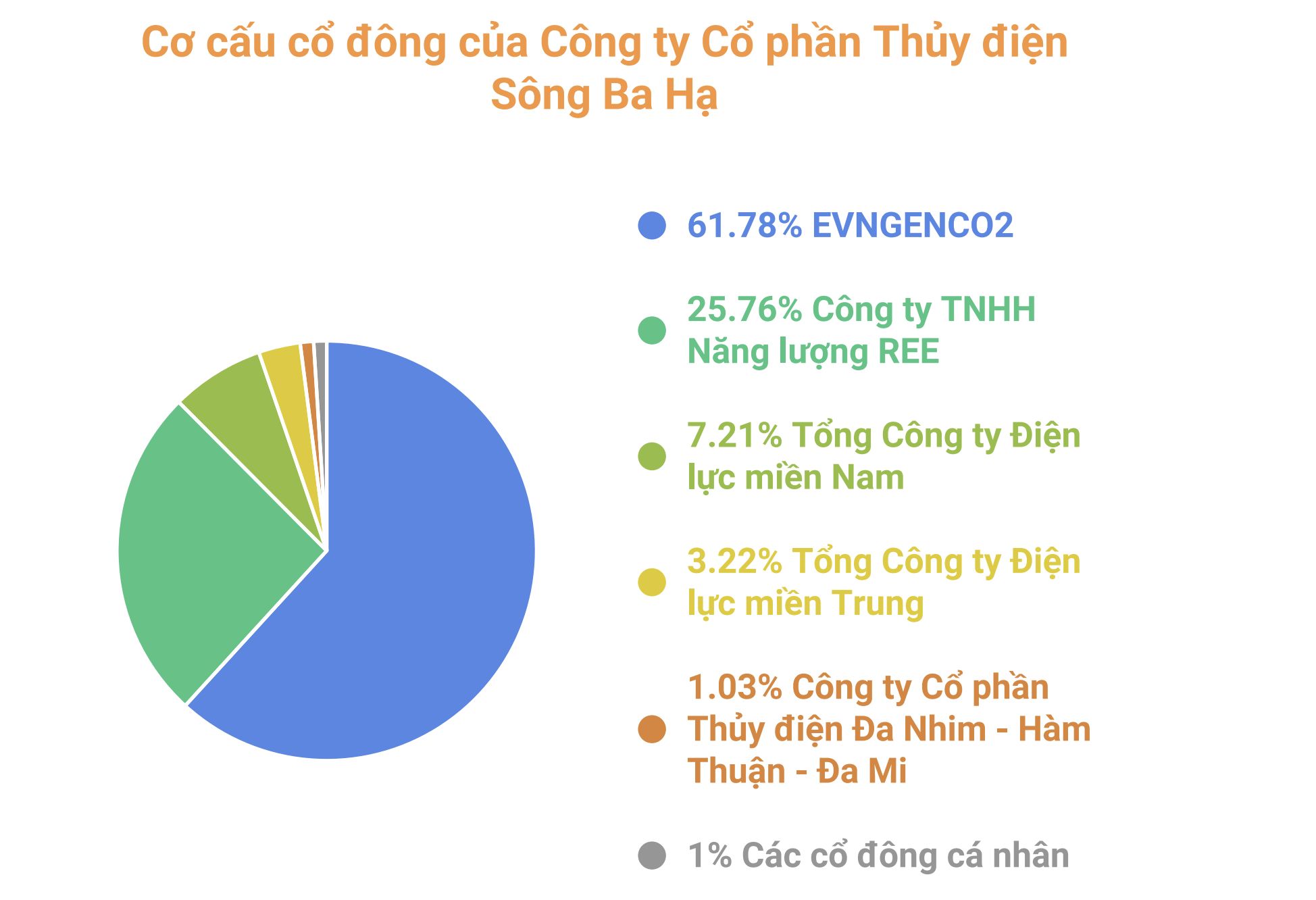

The shareholder structure includes: Power Generation Corporation 2 - EVNGENCO2 (whelming a controlling stake in Vietnam Electricity Group) owning 61.78% of charter capital; REE Energy Company Limited owning 25.76%; Southern Power Corporation owning 7.21%; Central Power Corporation owning 3.22%; Da Nhim - Ham Thuan - Da Mi Hydropower Joint Stock Company owning 1.03%; the rest belongs to individual shareholders.

According to the financial report for the third quarter of 2025, SBH's net revenue reached VND 323 billion, up 34% over the same period last year. The capital price decreased from VND 99.7 billion to VND 87.9 billion, helping the gross profit increase sharply by 66% to VND 235 billion. After accounting for costs, after-tax profit in the third quarter of 2025 reached VND188.6 billion, up 50% over the same period.

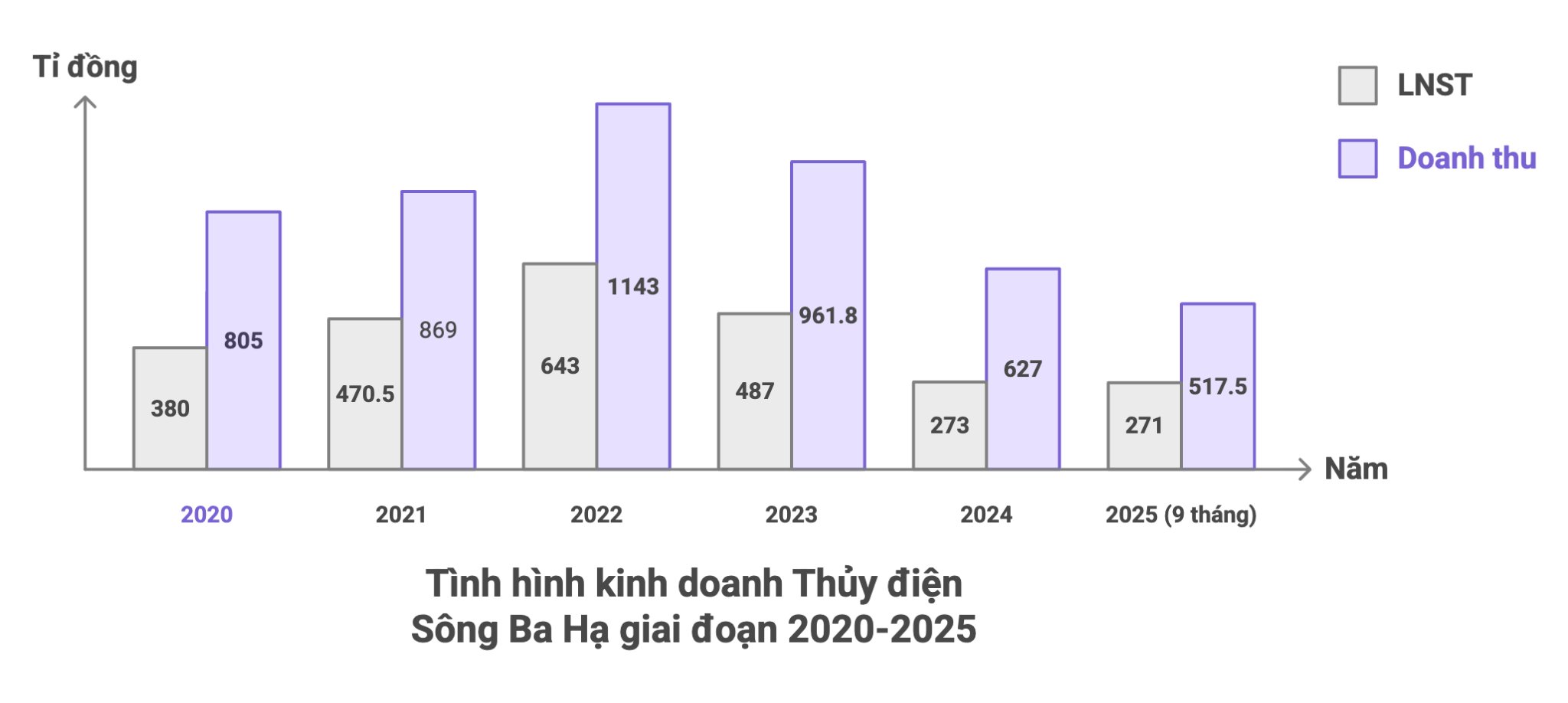

In the first 9 months of 2025, the enterprise recorded revenue of VND 517.5 billion, up 36% over the same period. All revenue is from sales activities. Profit after tax in the first 9 months reached VND 271 billion, up 133% over the same period last year.

Statistics in the past 5 years show that SBH's profits have remained high, each year recording hundreds of billions of VND. In 2020, revenue reached VND 805 billion, profit after tax was VND 380 billion. In 2021, revenue reached VND 869 billion, profit after tax was VND 470.5 billion. In 2022, revenue will reach VND 1,143 billion, profit after tax will be VND 643 billion. In 2023, revenue will reach 961.8 billion VND, profit after tax will be 487 billion VND. In 2024, revenue will reach VND 627 billion, profit after tax will be VND 273 billion.

A positive financial picture

Regarding asset structure, as of September 30, 2025, total assets of Song Ba Ha Hydropower Plant reached VND 2,034 billion, up 14.2% over VND 1,781 billion at the beginning of the year. Of which, cash, cash equivalent and term deposits reached VND922 billion, accounting for 45.3% of total assets.

Of which, the term deposit alone recorded VND836 billion, an increase of VND75 billion compared to VND761 billion at the beginning of the year, equivalent to an increase of nearly 9.9%. This is the item that accounts for the largest proportion of the group of assets with high liquidity of enterprises.

Maintaining a large scale of term deposits shows that SBH is prioritizing cash flow preservation and optimizing idle capital through safe short-term investment channels, in the context of power production activities heavily dependent on hydrological conditions and fluctuations in the electricity market.

Short-term receivables as of the end of the third quarter of 2025 at SBH reached VND454 billion, with VND454 billion being short-term receivables from customers.

The outstanding debt of Song Ba Ha Hydropower Plant as of September 30, 2025 recorded a significant increase compared to the beginning of the year. Total short-term debt reached VND244.7 billion, a sharp increase of nearly 84% compared to VND133.1 billion at the beginning of the year. Mainly due to increased taxes and payables to the State, short-term payables and other short-term payables such as dividends and payable profits.

As of the end of the third quarter of 2025, the company's equity reached VND 1,789 billion, up 8.5% compared to VND 1,648 billion at the beginning of the year. In which, the owner's contributed capital is at VND 1,242.25 billion, unchanged from the beginning of the year. The increase in equity capital mainly comes from development investment funds reaching 228.1 billion VND, an increase of 81.9 billion VND compared to 146.2 billion VND at the beginning of the year, equivalent to an increase of about 56%. Un distributed after-tax profit also increased from VND 211.6 billion to VND 271 billion, an increase of VND 59.4 billion, equivalent to 28.1%.