The 2026 Tet bonus is an income item that many workers are interested in, especially the personal income tax obligation arising when receiving the bonus.

According to the provisions of point e, clause 2, Article 2 of Circular 111/2013/TT-BTC regulating taxable income from personal income from salaries and wages, the 2026 Tet bonus is not included in the bonus amounts deducted when determining taxable income.

Accordingly, the 2026 Tet bonus is identified as income subject to personal income tax.

In addition, the 2025 Personal Income Tax Law was newly passed by the National Assembly on December 10, 2025. In which, regulations related to income from business, from salaries and wages of resident individuals apply from the tax period of 2026.

Meanwhile, Lunar New Year 2026 falls on February 17, 2026. Therefore, the 2026 Tet bonus will be taxed according to new regulations.

The tax base for income from salaries and wages is taxable income and tax rates, specifically as follows:

Personal income tax = taxable income x tax rate.

Accordingly, to calculate the amount of tax payable, it is necessary to calculate taxable income and tax rates.

Taxable income: Taxable income = Taxable income - Deductions.

In which, taxable income = Total income - Exempt items.

The deductions include personal deductions (15.5 million/month) and dependent deductions (6.2 million/month/dependent person), compulsory insurance premiums.

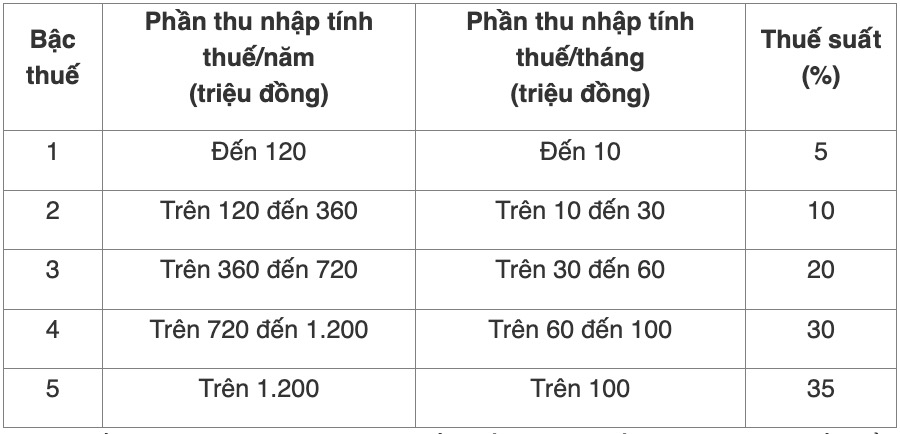

Tax rate in the Partial Progressive Tax Schedule specified in Article 9 of the 2025 Personal Income Tax Law:

The time to determine taxable income from salaries and wages is the time when organizations and individuals pay income to taxpayers or the time when taxpayers receive income.

According to Article 11 of the 2025 Personal Income Tax Law, resident individuals are entitled to deductions from taxable income before tax calculation for income from salaries and wages of the following amounts:

Charity and humanitarian contributions, including: Contributions to organizations and facilities for caring for and nurturing children in particularly difficult circumstances, people with disabilities, and elderly people without shelter;

Contributions to charity funds, humanitarian funds, and education promotion funds; Contributions to organizations with the function of mobilizing sponsorship established and operating in accordance with the law.

Organizations, establishments and funds specified in this clause must be authorized by competent state agencies to establish or recognize, operate for charity, humanitarian, and educational purposes, not for profit purposes.

Expenses for health, education - training of taxpayers and dependents of taxpayers are deducted from income before tax calculation according to the level prescribed by the Government.

The expenses specified in this Article must meet the conditions on invoices and documents according to the provisions of law and must not be paid from other sources.