Domestic silver prices

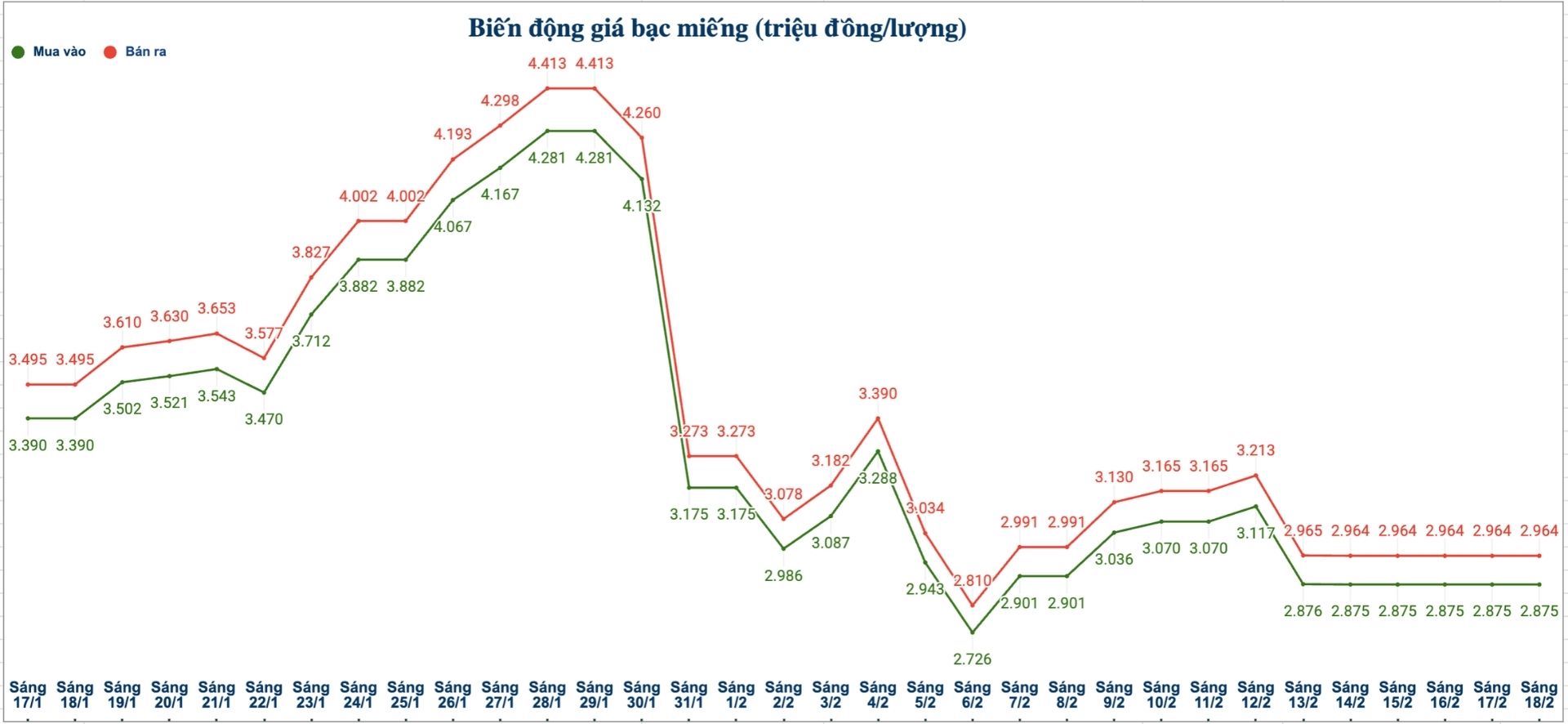

As of 12:55 on February 18, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) is listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling).

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

World silver price

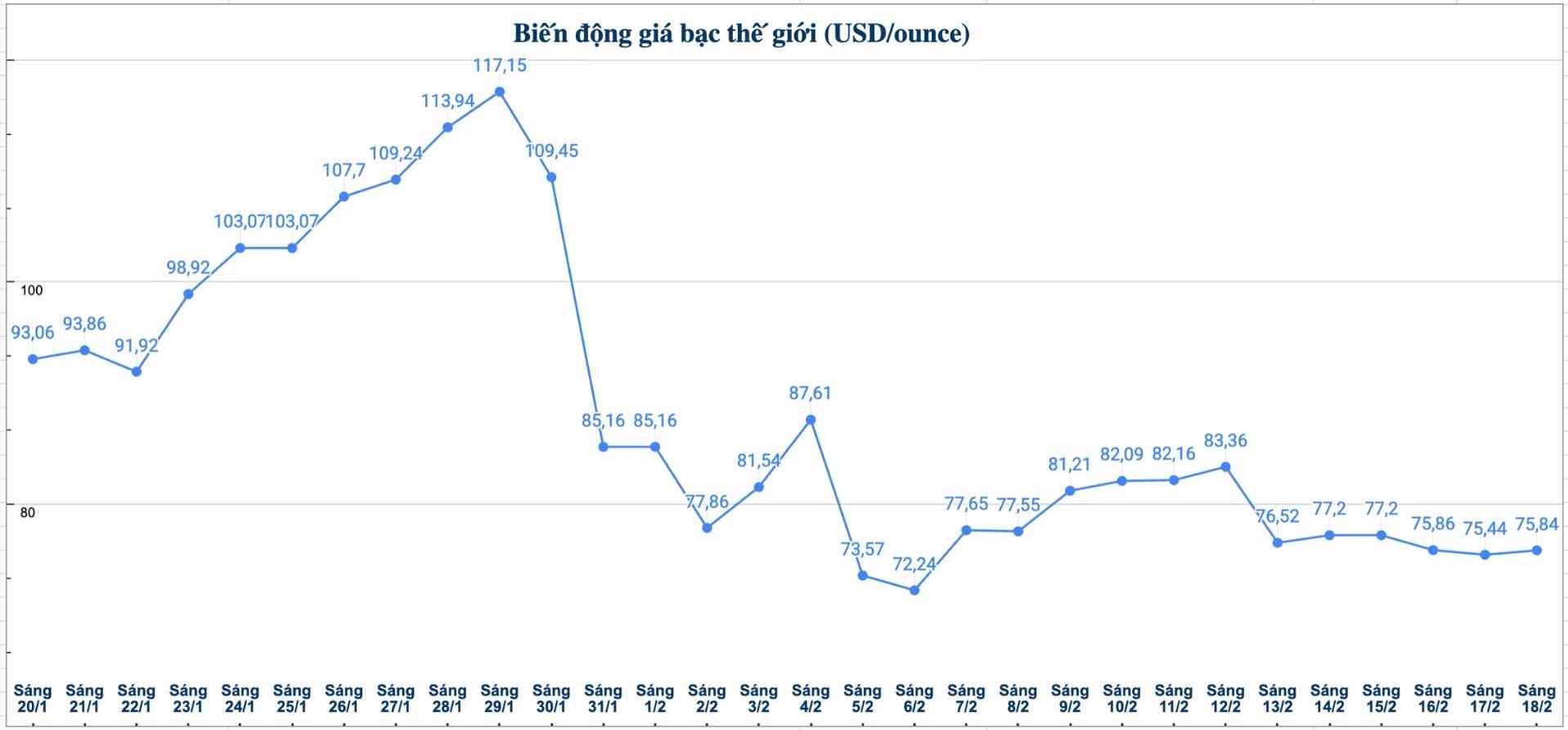

On the world market, as of 12:55 PM on February 18 (Vietnam time), the world silver price was listed at 75.84 USD/ounce; up 0.4 USD compared to yesterday morning.

Causes and forecasts

The silver market continues to fluctuate erratically in recent trading sessions. According to precious metals analyst James Hyerczyk of FX Empire, this development shows that prices may be in the process of finding a balance point to maintain an upward trend.

In the early hours of the session, silver prices decreased slightly and are facing resistance in the area above 70 USD/ounce. Previously, many opinions suggested that the price zone around 70 USD/ounce may be the bottom of the current fluctuation. However, it is still not possible to confirm whether this is a strong enough support zone to keep prices from falling further, and the market needs more time to verify" - he said.

The expert said that if the price falls below the 70 USD/ounce mark, it is highly likely that the market will continue to fall deeply, with the next target possibly being around 56.60 USD/ounce.

James Hyerczyk said that the sharp drop a few weeks ago has significantly affected market sentiment, and such losses are unlikely to be overcome soon. In the current context, the most positive scenario may be that silver prices move sideways for a while to strengthen investor confidence.

In the long term, the upward outlook is still maintained. However, the important thing is whether the market can maintain its current price range or not. If it does, the upward trend may continue in the near future" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...