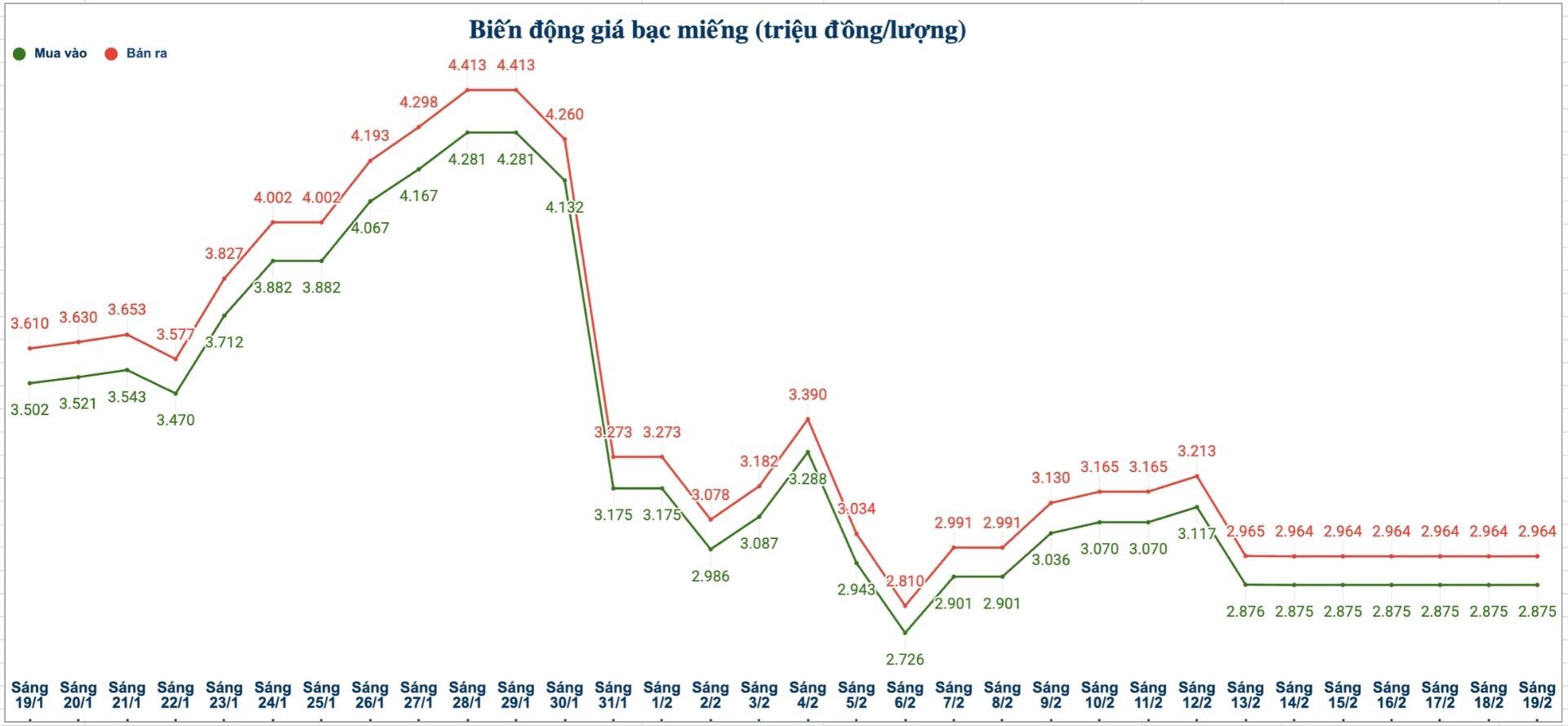

Domestic silver prices

As of 1:20 PM on February 19, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) was listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling).

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

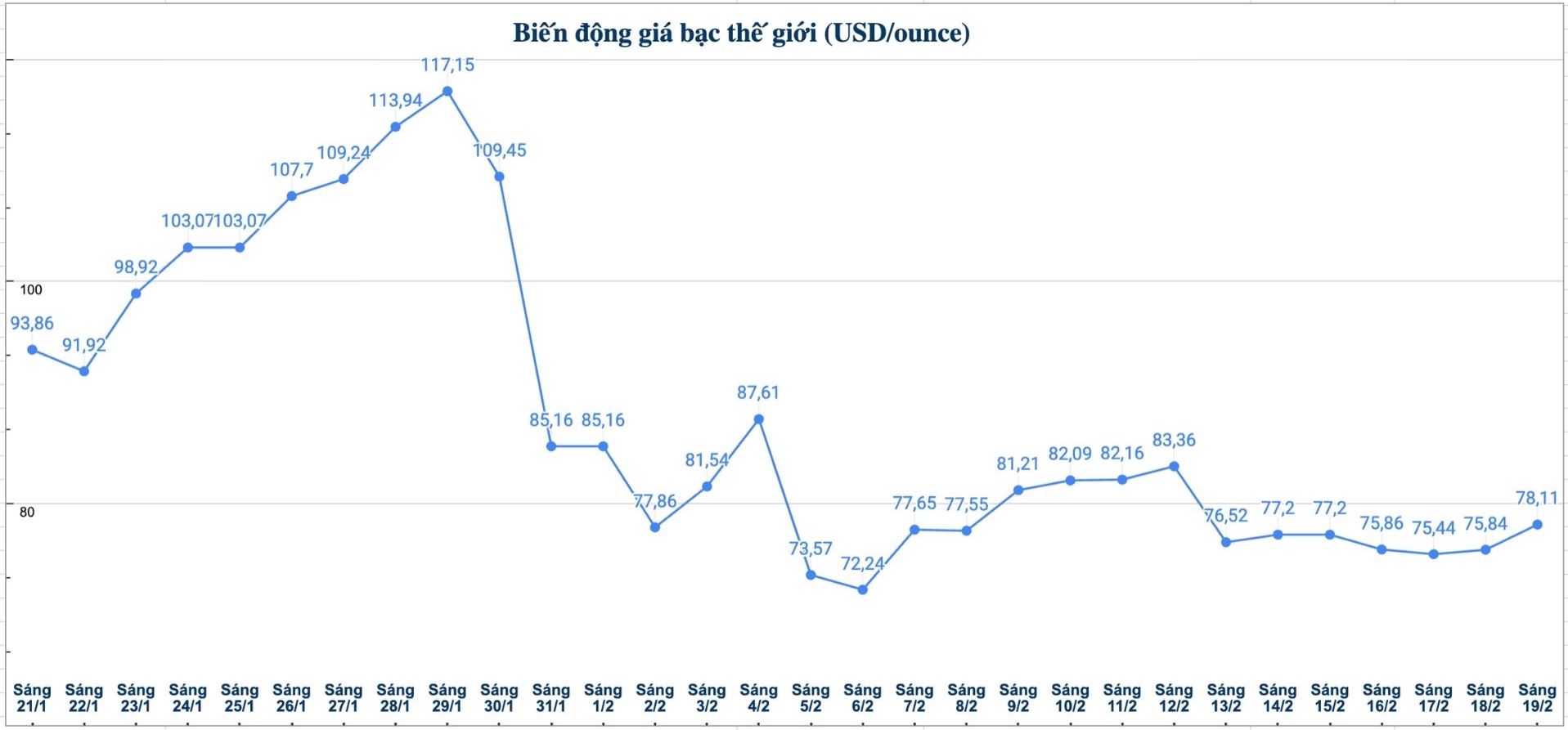

World silver price

On the world market, as of 1:20 PM on February 19 (Vietnam time), the world silver price was listed at 78.11 USD/ounce; up 2.27 USD compared to yesterday morning.

Causes and forecasts

The silver market opened the trading session on Thursday with a slight increase, as the 70 USD/ounce threshold continued to play a supporting role in the context that prices are still struggling to find a clear trend.

Precious metals analyst Christopher Lewis of FX Empire said that in the early hours of the session, buying power appeared around the 70 USD/ounce mark, helping prices rise slightly. However, he believes that the recovery momentum has not really broken through, which shows that the market is still quite cautious and there is no strong reversal signal.

According to current assessments, silver may be forming a new accumulation zone with an estimated fluctuation range of 70 - 90 USD/ounce. It is likely that this range will gradually narrow over time, as the market becomes more stable after a sharp drop a few weeks ago" - the expert said.

Christopher Lewis said that the decline caused significant damage, especially to investors using high leverage, making trading sentiment more cautious.

In the long term, the market will find a sustainable bottom. The remaining question is whether the short-term bottom has formed around 70 USD/ounce or will retreat further, possibly near 50 USD/ounce. However, the scenario of a shock drop to a very low level like in previous collapses is assessed as difficult to repeat in the current context" - Christopher Lewis emphasized.

See more news related to silver prices HERE...