physical demand for gold in major Asian markets remains weak this week, as fluctuations in gold prices make market sentiment cautious. Meanwhile, the plus in China remains stable, while the discount in India is narrowing.

In China - the world's largest gold consumer market, dealers have imposed a price of 10 to 25 USD/ounce on global spot gold prices, compared to a price of 4.2 to 33 USD/ounce on the previous week.

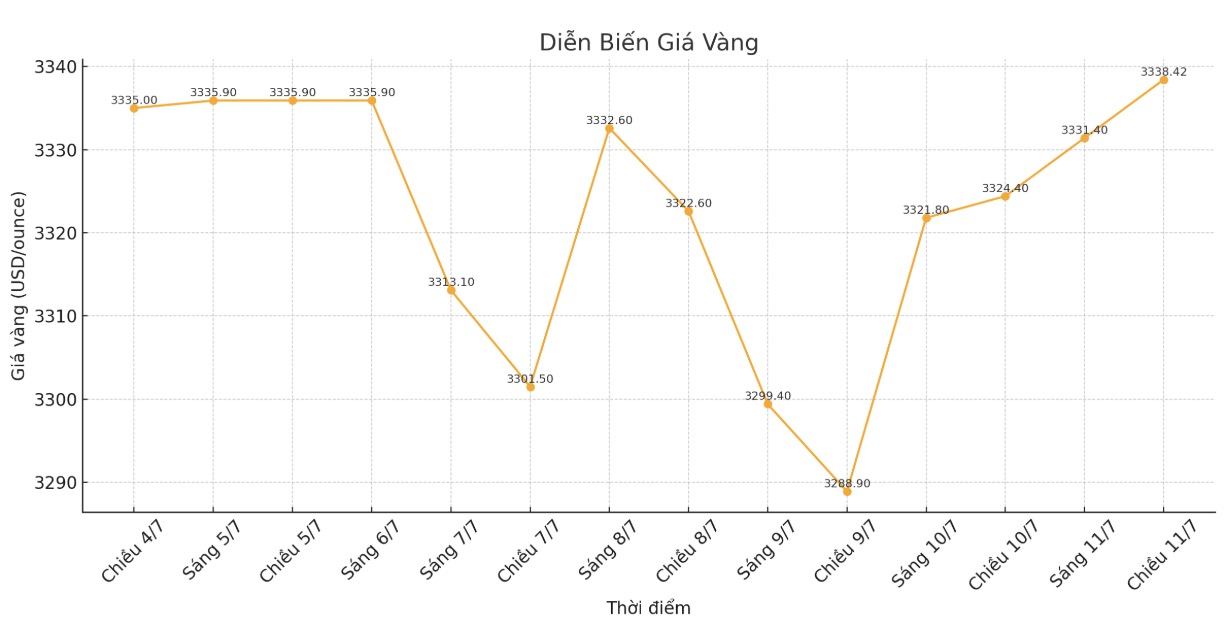

Spot gold prices fell to a more than a week low on Wednesday, falling below $3,300 an ounce, before recovering and trading around $3,335 an ounce at 5:20 a.m. GMT on Friday.

According to Hugo Pascal - a precious metals trader at In Proved, information about the new US trade policy is not enough to stimulate demand for gold in China this week.

In another development, the People's Bank of China has issued regulations to strengthen control of precious metals and gemstone trading activities to prevent violations such as money laundering and terrorist financing.

In India, dealers' discounts have narrowed to a maximum of $8 an ounce (including 6% import tax and 3% sales tax), from $14 last week.

Discount levels are shrinking due to limited supply, as imports in May and June are low, while recycled gold is also scarce, said a Mumbai gold dealer working for a private bank.

Domestic gold prices in India on Friday hovered around 97,300 rupees ($1,133.57) per 10 grams, after reaching a historic peak of 101,078 rupees last month.

Gold demand in India is typically weak during the rainy season from June to September.

In Hong Kong (China), gold is sold at the same price or at a maximum of 1.50 USD/ounce, while in Singapore, the bonus ranges from the same price to 2.2 USD/ounce.

In Japan, gold is traded at a price level of up to 0.5 USD/ounce.

(Ex rate: 1 USD = 85.8350 Indian rupees).