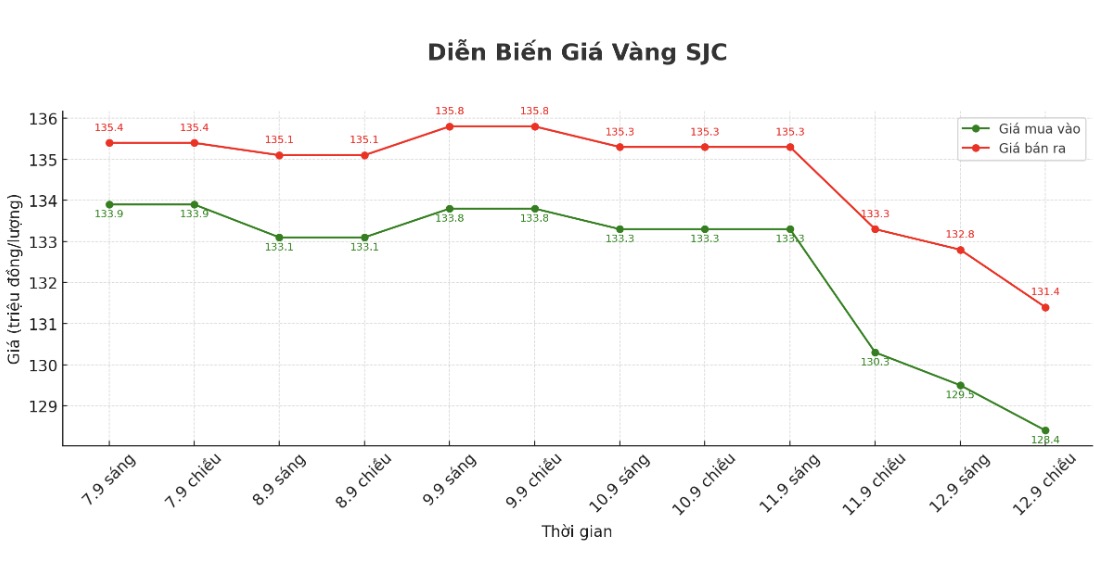

SJC gold bar price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 128.4-131.4 million VND/tael (buy in - sell out), down 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.4-131.4 million VND/tael (buy - sell), down 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 127.5-131.4 million VND/tael (buy in - sell out), down 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 3.9 million VND/tael.

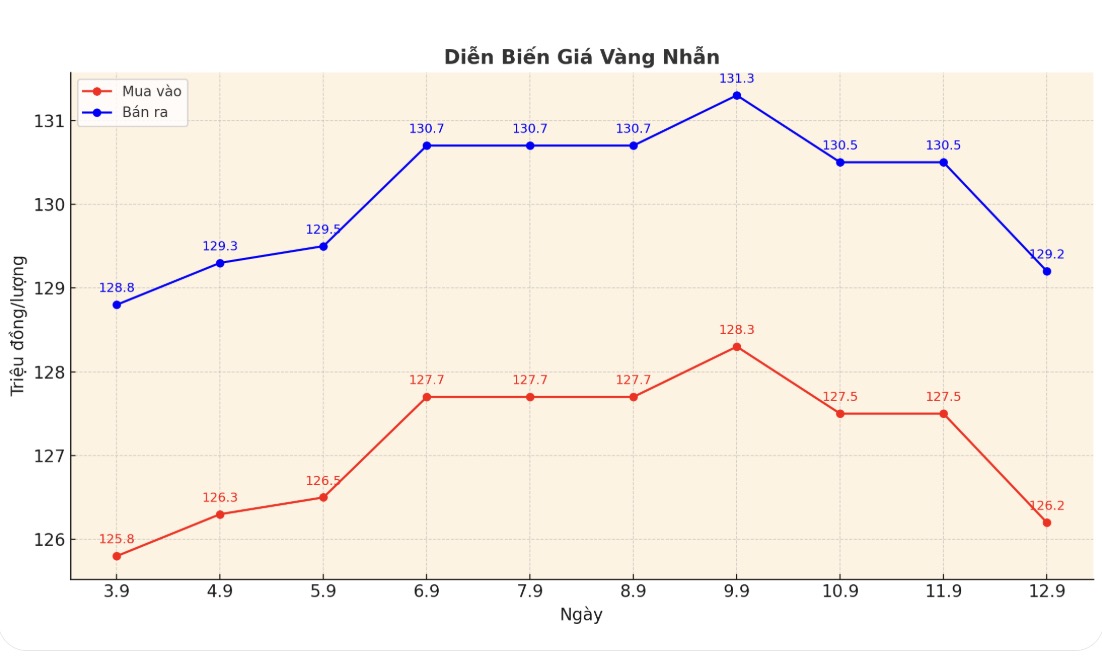

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy - sell), down 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.7-128.7 million VND/tael (buy - sell), down 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

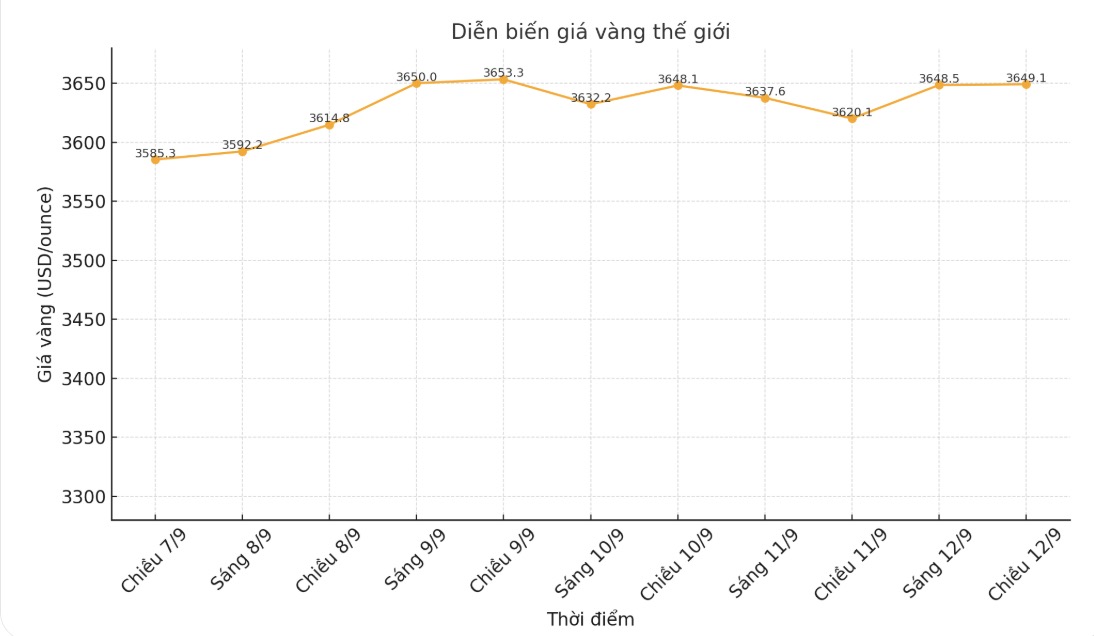

World gold price

The world gold price was listed at 5:40 p.m. at 3,649.1 USD/ounce, up 29 USD.

Gold price forecast

World gold prices increased on Friday, hovering near the record set earlier in the week, as weak US labor data reinforced expectations that the US Federal Reserve (FED) would cut interest rates many times from now until the end of the year, thereby boosting demand for this precious metal.

The market is preparing for the Fed to cut interest rates at its next meeting. The forecast is not just a one-time cut, while US President Donald Trump's desire to lower interest rates also increases the attractiveness of gold" - UBS expert Giovanni Staunovo commented. Mr. Trump continued to call on Fed Chairman Jerome Powell to cut key interest rates on Wednesday.

With these supporting factors and capital flows into exchange-traded funds (ETFs) recently, we expect gold prices to rise to $3,900/ounce by the middle of next year, Staunovo added.

The holdings of SPDR Gold Trust, the world's largest gold ETF, increased to a three-year high last week.

In another development, UBS has raised its world gold price forecast by $300, to $3,800/ounce by the end of 2025, and $200, to $3,900/ounce by mid-2026.

The reason for this adjustment is due to expectations that the US Federal Reserve (FED) will loosen monetary policy and a weak USD due to interest rate cuts as well as geopolitical risks.

The Swiss bank also adjusted its forecast for gold held by ETFs, saying that by the end of 2025, it will surpass 3,900 tons, approaching the record of 3,915 tons set in October 2020.

We maintain our view that gold is an attractive asset and continue to hold the metal in our global asset allocation portfolio. Our analysis shows that the ratio of gold allocation to an average of one-digit (%) is optimal, UBS said in a report.

In other markets, spot silver rose 1.4% to $42.2 an ounce, near a 14-year high, platinum rose 0.5% to $1,385.09, and gold rose 1% to $1,199.68. All three metals are on track for a weekly gain.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...