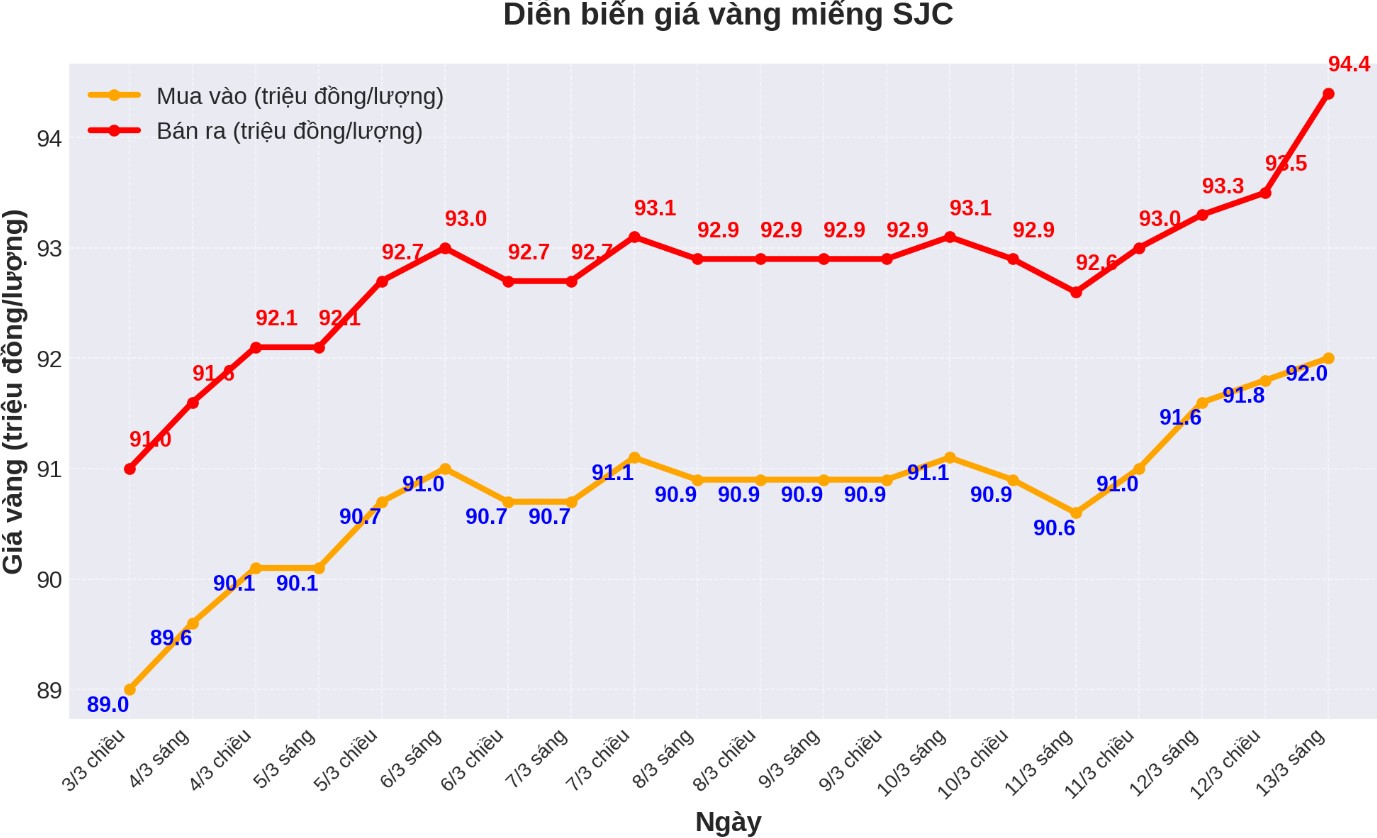

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND92.9-94.4 million/tael (buy - sell), an increase of VND1.1 million/tael for buying and VND900,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND92.9-94.4 million/tael (buy - sell), an increase of VND1.1 million/tael for buying and an increase of VND900,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 93-94.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 2.4 million VND/tael.

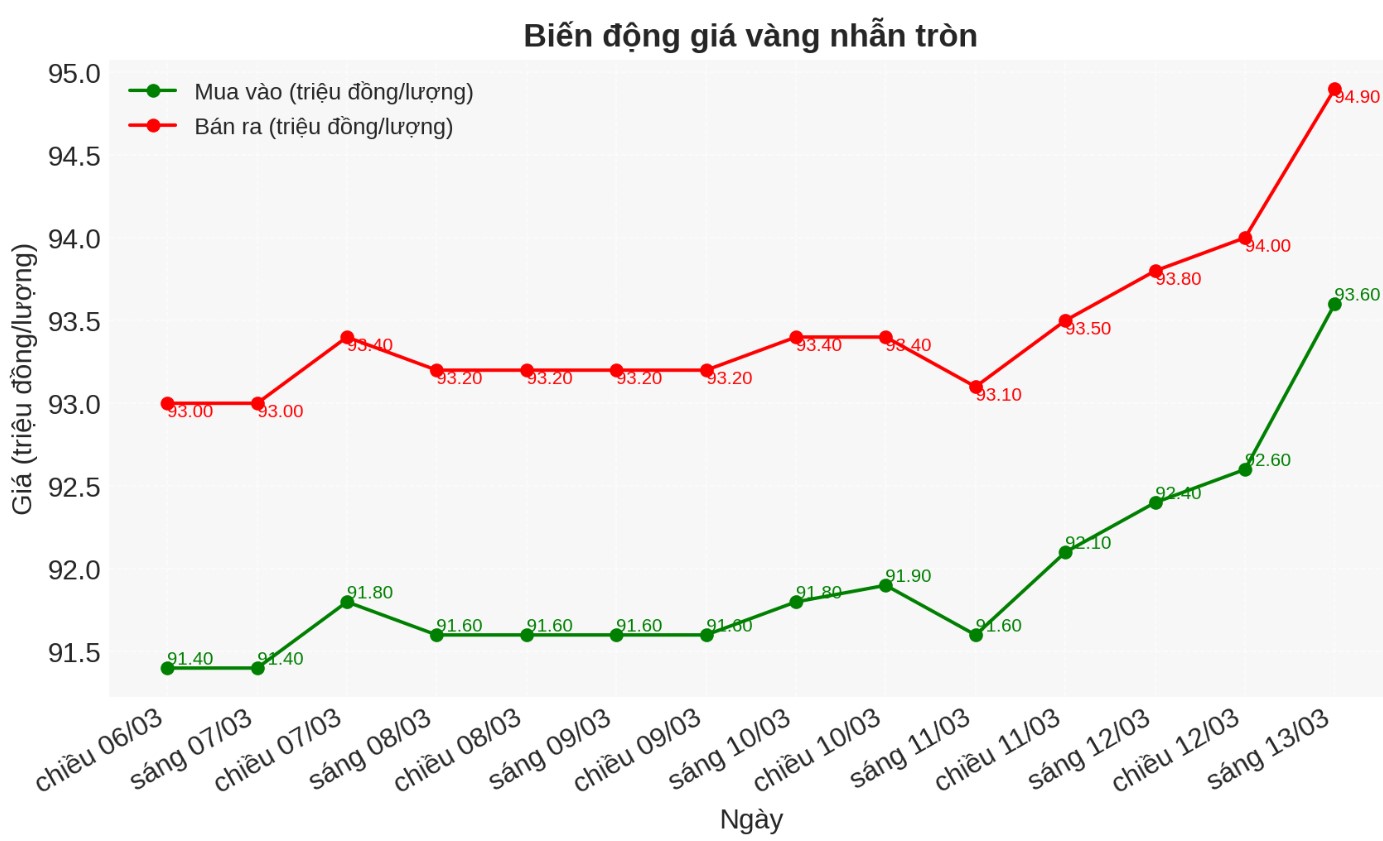

9999 round gold ring price

As of 5:45 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND93.6-94.9 million/tael (buy - sell); increased by VND1 million/tael for buying and increased by VND900,000/tael for selling. The difference between buying and selling is listed at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 93.4-95 million VND/tael (buy - sell); increased by 850,000 VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

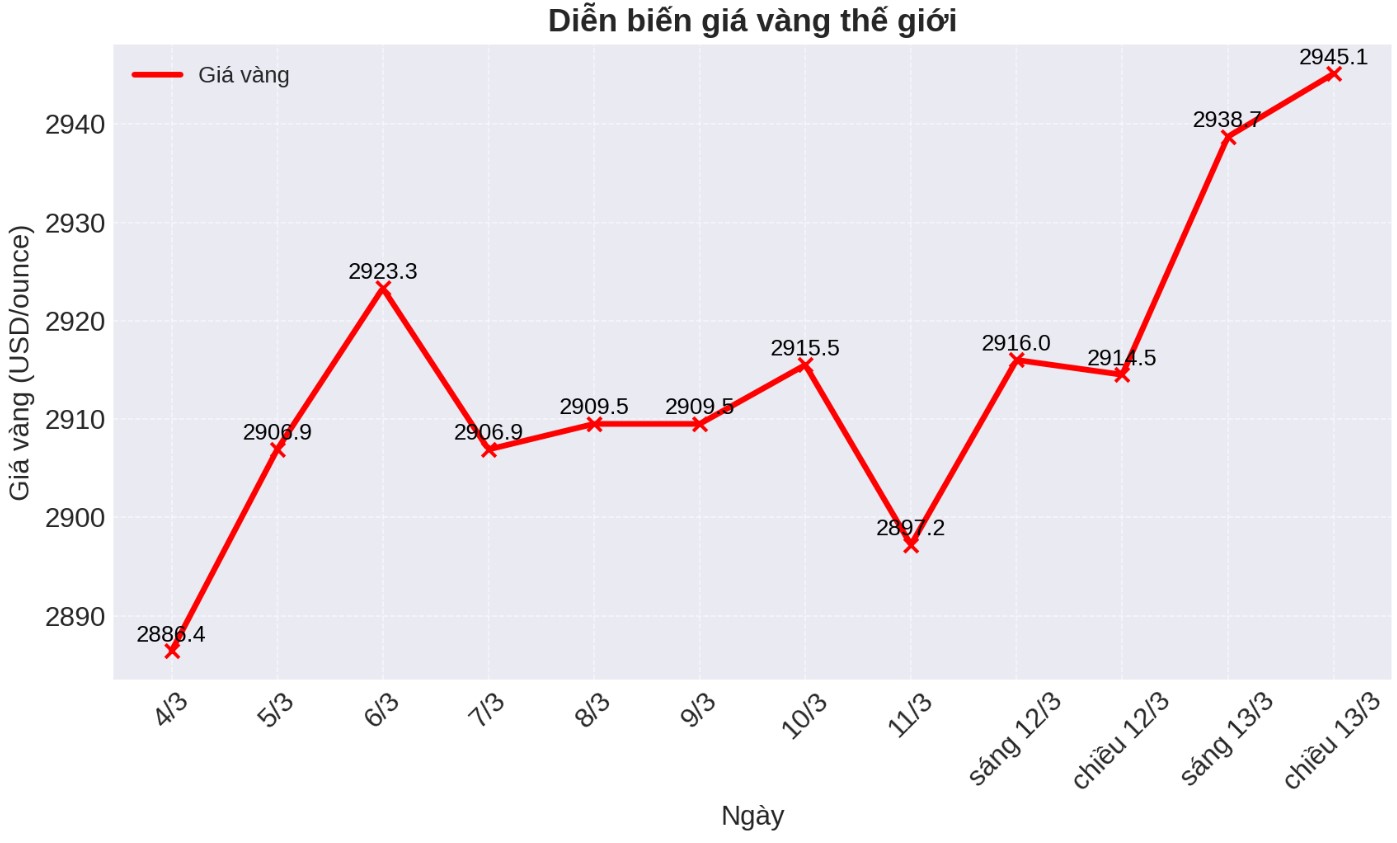

World gold price

As of 6:10 p.m., the world gold price listed on Kitco was at 2,945.1 USD/ounce, up 30.6 USD/ounce.

Gold price forecast

World gold prices increased despite the increase of the USD. Recorded at 6:15 p.m. on March 13, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.735 points (up 0.14%).

Gold prices continued to rise, reaching a two-week high two weeks before new economic data from the US. According to the US Bureau of Labor Statistics on Wednesday, the Consumer Price Index (CPI) increased by 0.2% last month, lower than the 0.5% increase in January. This figure is weaker than economists' forecasts, who expect a 0.3% increase.

In the 12 months to October, core inflation increased by 2.8%, down from 3.0% in the previous month. This figure is also lower than the general forecast of 2.9%.

The core CPI - an index that eliminates volatile food and energy prices - increased by 0.4% in February, equal to the increase in January. Economists forecast this figure to increase by only 0.3%. The report also showed that core CPI increased 3.1% over the past 12 months.

Expert Edward Meir - Marex commented: "The $3,000/ounce threshold is the next reasonable target and can be achieved in the next few months. The consumer price index (CPI) data for February 2025 is quite positive, but I think the impact of tax increases has not been fully reflected in the inflation index".

In mid-month, Goldman Sachs raised its year-end world gold price forecast to $3,100/ounce, up from $2,890 in the previous scenario. The bank said strong demand for gold from central banks will contribute to pushing precious metal prices up by 9% by the end of the year. In addition, gold ETFs have also increased their purchases as interest rates cooled down.

Goldman Sachs believes that this trend will compensate for pressure to adjust positions from investors as instability declines. However, if policy risks remain high, especially concerns about US import tariffs, gold could reach $3,300 thanks to speculative cash flow.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...