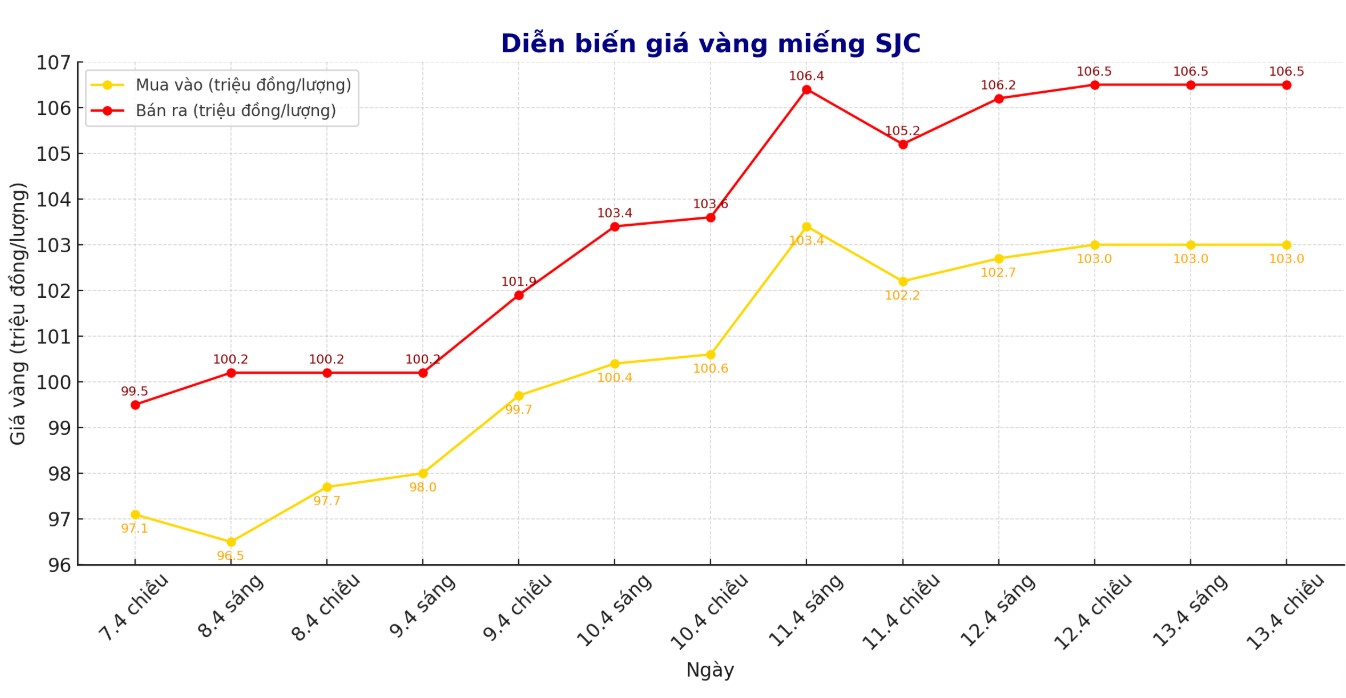

Gold price SJC

Closing the weekly session, Doji Group listed SJC gold price at 103-106.5 million VND/tael (purchased - sold).

Compared to the closing session last week (6.4.2025), SJC gold price in DOJI increased by 5.9 million dong/tael buying and increased by 6.4 million dong/tael to sell.

SJC gold price difference at Doji Group is at 3.5 million VND/tael.

Meanwhile, Saigon SJC VBQ Company listed the price of SJC gold at the threshold of 103-106.5 million VND/tael (purchased - sold).

Compared to the closing session of last week (6.4.2025), SJC gold price at Saigon SJC VBD increased by 5.9 million VND/tael to buy and an increase of 6.4 million dong/tael sell.

SJC gold price difference at Saigon SJC VBD Company at 3.5 million VND/tael.

If buying SJC gold at Doji Group and Saigon SJC VBQ Company on 6.4 and sold today (13.4), gold buyers at Doji Group and Saigon SJC VBD company with 2.9 million VND/tael.

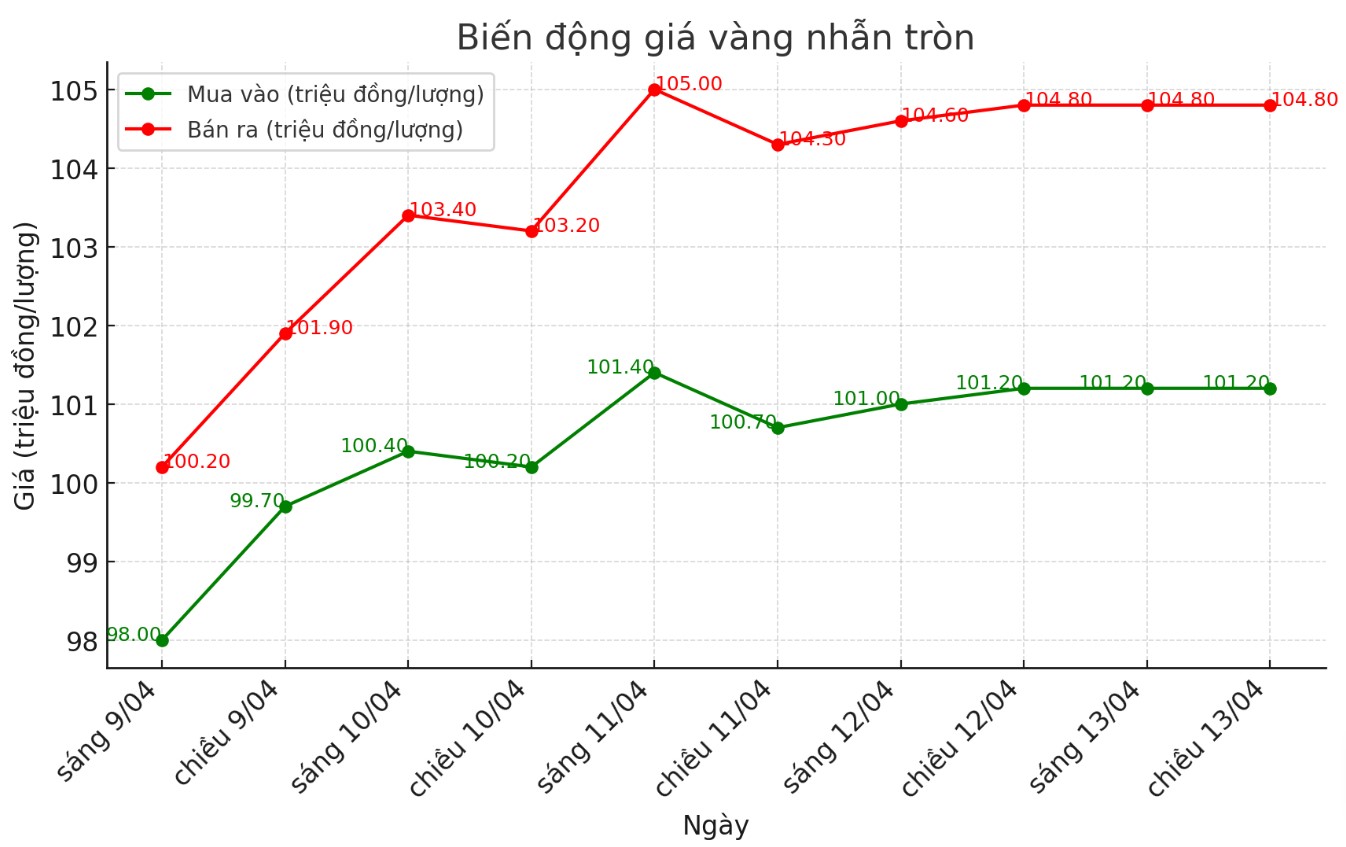

Gold price ring 9999

This morning, the price of gold ring 9999 prosperity at Doji listed at the threshold of 101.2-104.8 million VND/tael (purchased - sold); Increasing 4.5 million VND/tael to buy and increased by 4.7 million/tael to sell compared to the closing session last week. Buying difference - sold at the threshold of 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 101.6-105.1 million dong/tael (bought - sold); Increasing 4.1 million/tael to buy and increased by 4.6 million/tael to sell compared to the closing session last week. Buying difference - sold at the threshold of 3.5 million/tael.

If buying gold rings on session 6.4 and sold today (13.4), buyers in Doji and Bao Tin Minh Chau and profit of 1.1 million dong/tael.

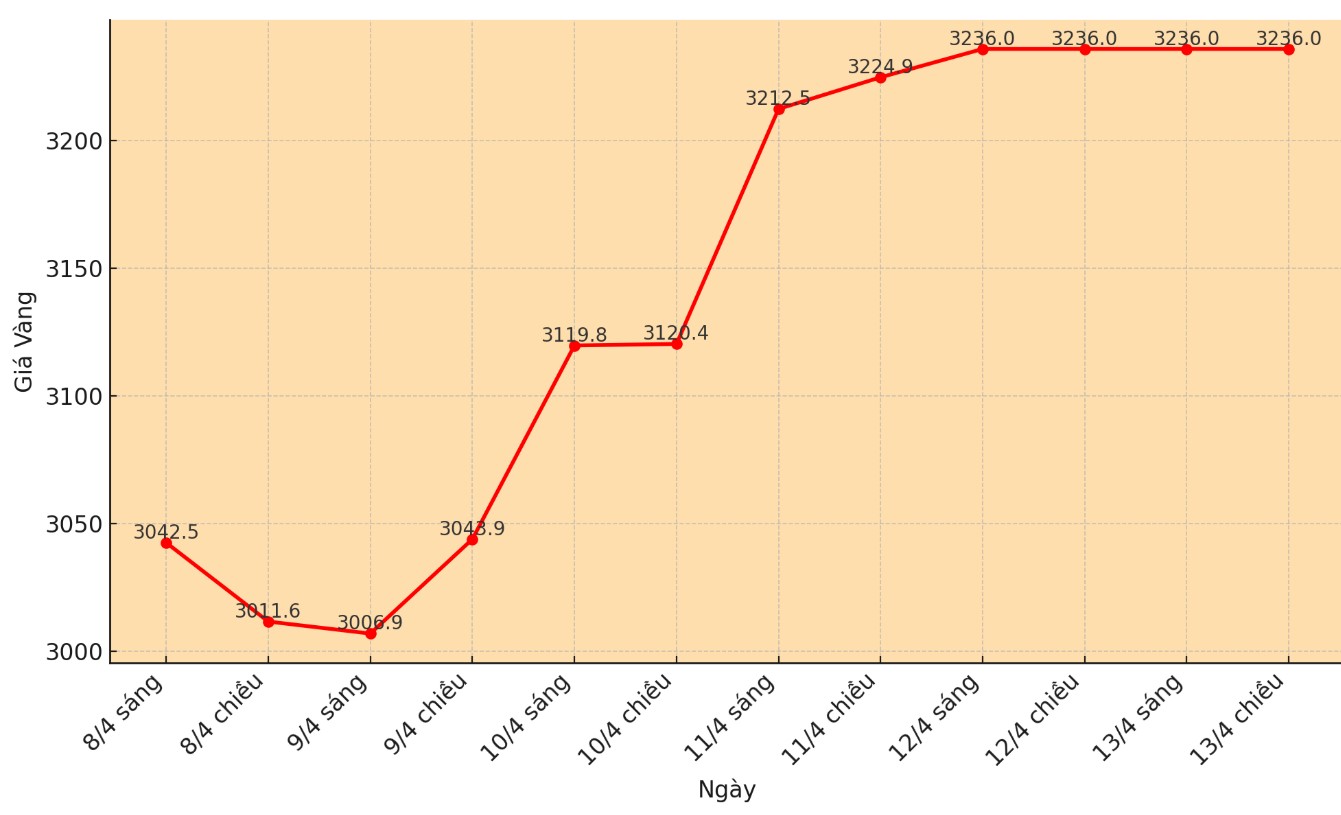

World gold price

Closing the weekly trading session, the world gold price listed on Kitco at the threshold of US $ 3,236/ounce, up to 199.2 USD/ounce compared to the closing session last week.

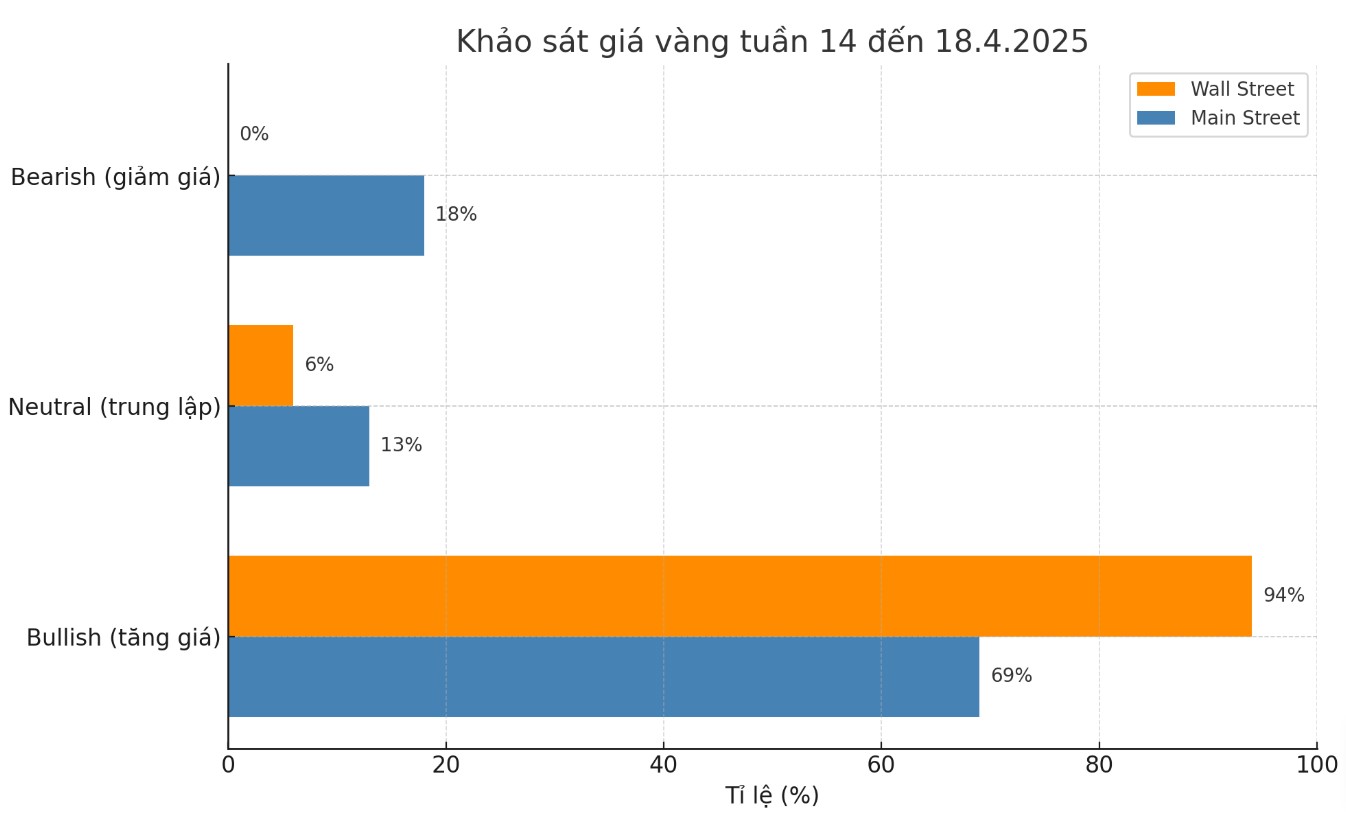

Gold price forecast

The latest weekly gold survey of Kitco News shows that experts in the industry are more optimistic than ever. While small investors also gradually expect more positive when most other assets are weakened.

This week, 16 analysts participated in Kitco News's survey. Wall Street almost absolutely agreed that gold price will continue to increase in the short term.

15 people (accounting for 94%) predicted that gold prices would increase next week, no one thought that gold would decrease. Only one person (6%) thinks that gold will hold at the current high level without increasing.

Meanwhile, 275 investors participated in Kitco's online survey. Psychology of small investors is also more positive when other types of assets are discounted.

189 people (69%) think that gold price will increase next week. There are 50 people (18%) expected gold will decrease, the remaining 36 people (13%) think that the price will go sideways.

Daniel Pavilonis - a high -level commodity broker at Rjo Futures, said the bond market was the main factor that promoted the rise of gold in the past week. "Even before the announcement of tariff measures, gold has begun to raise prices. Despite the fluctuations of concerns, this is generally a strong increase of gold," he said.

Marc Chandler - CEO at Bannockburn Global Forex - said that gold is being strongly supported by the wave of concerns in the global market and the weakening of the dollar. According to him, the financial chaos and the strong decline of USD has overshadowed the negative impact from high interest rates, facilitating the price of gold continuously to set a new record.

Chandler said: "It is now difficult to determine the next resistance level of gold.

Economic data to watch next week

Tuesday (15.4): Announcing the Empire State production survey.

Fourth (16.4): The Central Bank of Canada announced a decision on monetary policy. On the same day, President of the US Federal Reserve (Fed) Jerome Powell will have a speech at the Chicago Economic Club.

Thursday (April 17): European Central Bank (ECB) meeting to discuss policies. The United States announced the number of weekly unemployment benefits, new construction data and construction permits, along with production survey results from Fed Philadelphia.

Note: The article data is comparable to the same time of the previous session.

See more news related to gold price here ...