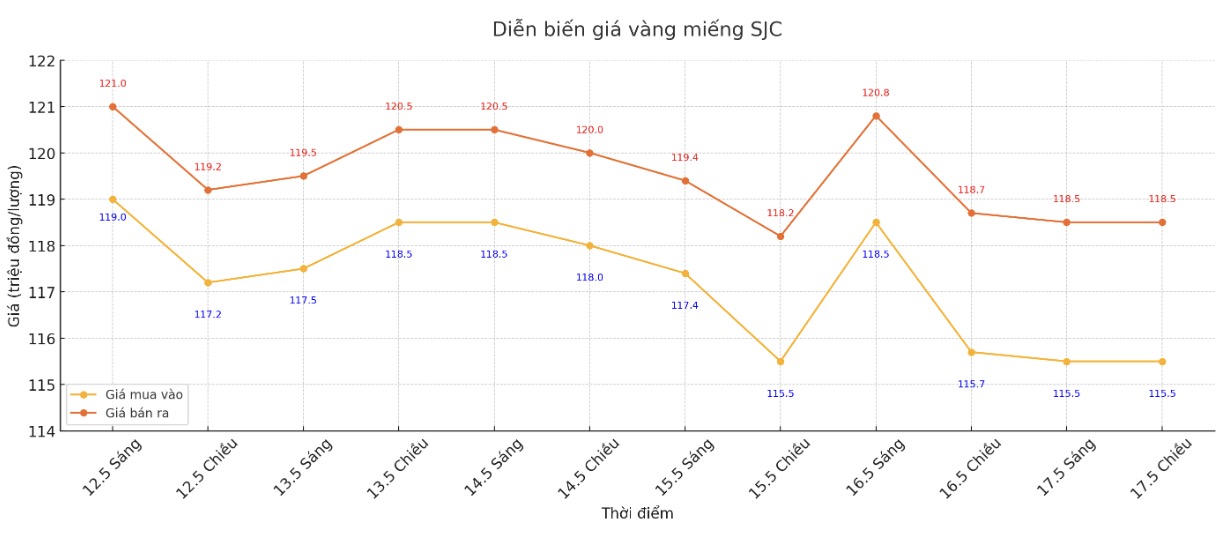

Updated SJC gold price

As of 4:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118.5 million/tael (buy in - sell out), down VND200,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.5-118.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 115.5-118.5 million/tael (buy in - sell out), down VND 200,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 115-118.5 million VND/tael (buy - sell), keeping the same for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

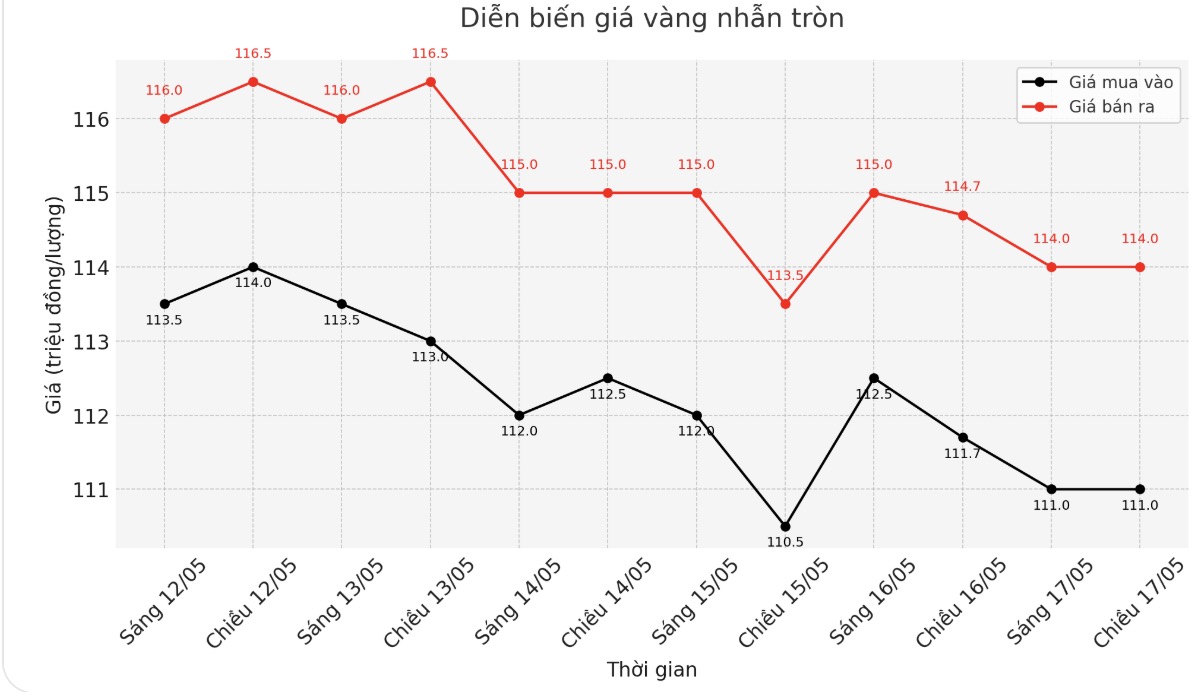

9999 round gold ring price

As of 16:35, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-114 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.8-114.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

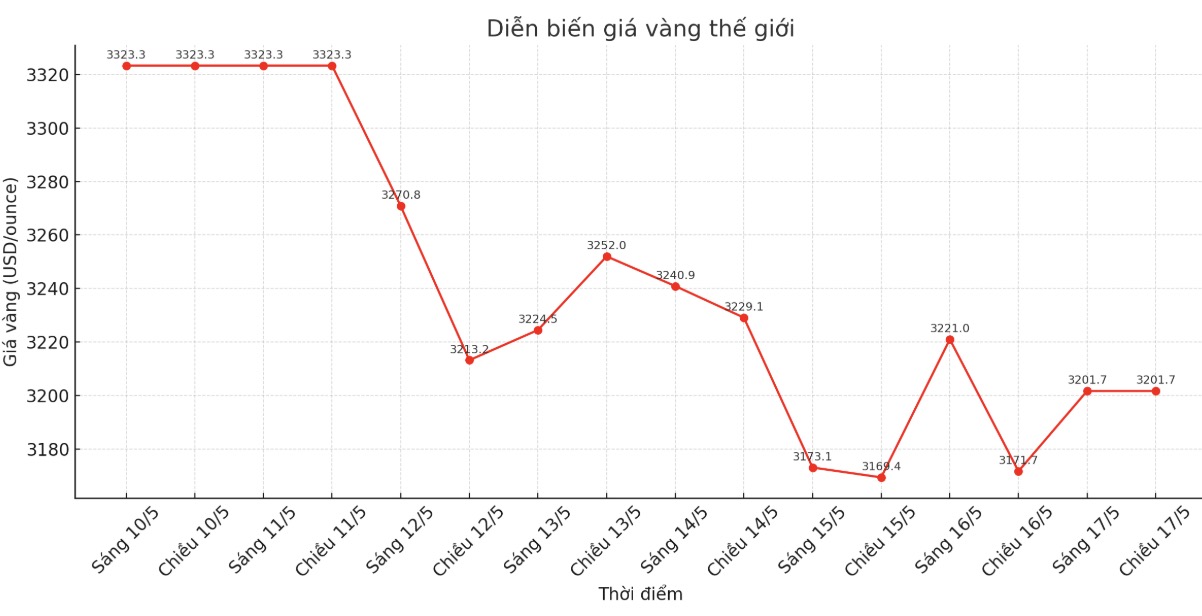

World gold price

At 4:45 p.m., the world gold price listed on Kitco was around 3,201.7 USD/ounce, up 30 USD/ounce.

Gold price forecast

Gold prices rebounded in the trading session at the end of the week after Moody's credit rating agency lowered the US public debt rating by a point.

Shortly after the market closed on Friday, Moody's (Moody's Investors Service - one of the three largest credit rating organizations in the world) lowered its US debt rating from Aaa to Aa1, citing rising interest rates and unsustainable debt growth. At the same time, the company also raised the rating outlook from negative to stable.

Our one-point drop in the 21-point rating scale reflects a more than decade-long increase in government debt and interest rates, which are now significantly higher than in countries with equivalent ratings, Moodys said in a statement.

However, the latest weekly gold survey from Kitco News shows that industry experts are leaning towards a downside price scenario next week.

Adrian Day - Chairman of Adrian Day Asset Management - predicts that gold prices will continue to decline in the coming time when the US adjusts tax rates. However, he said this would open up an attractive buying opportunity afterwards.

Sharing the same view, Adam Button - Head of currency strategy at Forexlive.com - said that the current trend is still bearish due to weak market momentum. However, he expects gold prices to find a bottom, likely still above $3,000/ounce.

Kevin Grady - Chairman of Phoenix Futures and Options - believes that gold prices still have room to decrease in the short and medium term.

I am leaning towards a downward trend next week. When trade deals start to be announced, I think gold prices will retreat to $3,000/ounce," he said.

See more news related to gold prices HERE...