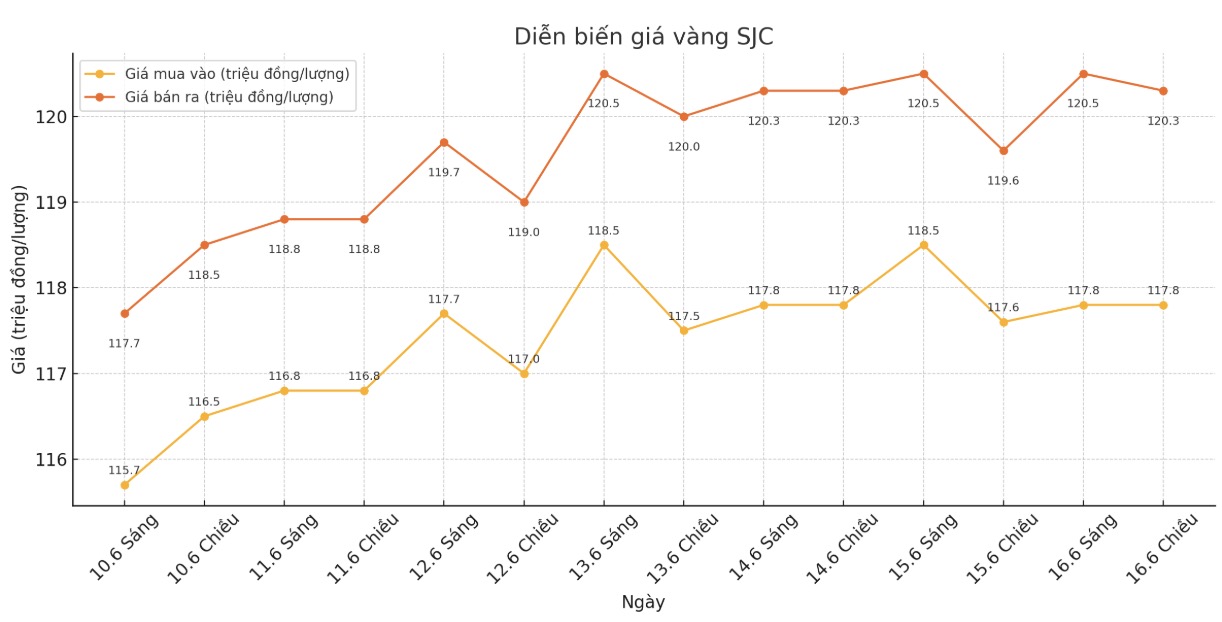

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.619.000 VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy - sell); kept the same for buying and decreased by 400,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

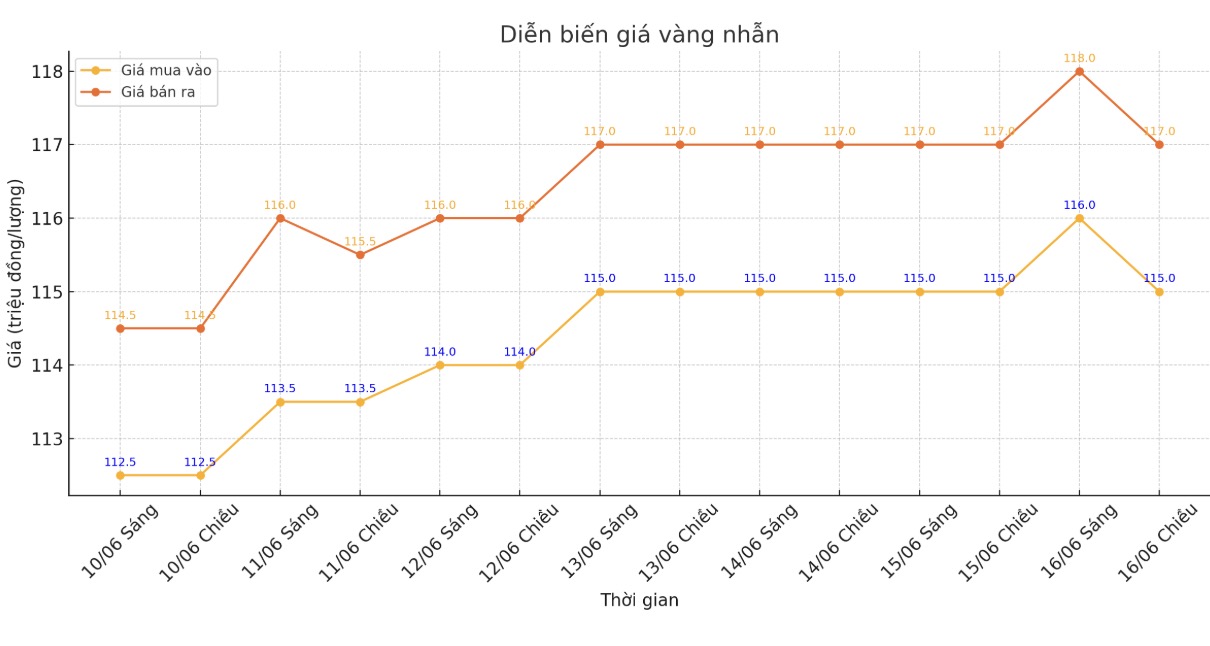

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

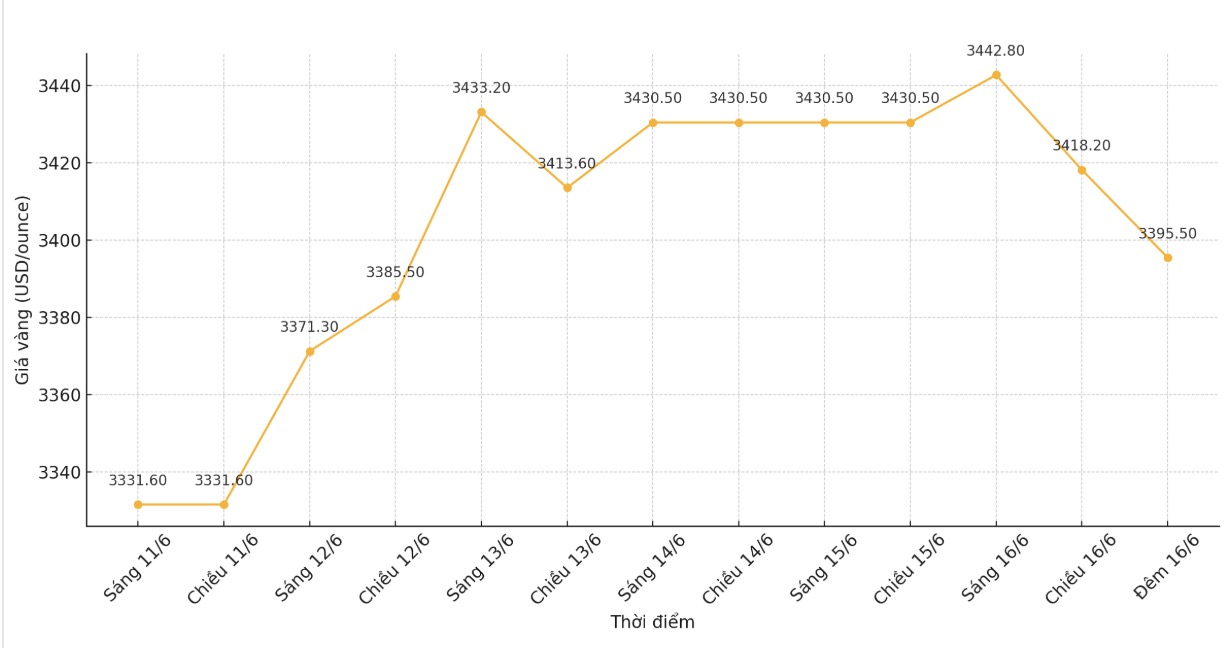

World gold price

The world gold price was listed at 9:10 p.m. at 3,395.5 USD/ounce, down 50.7 USD/ounce compared to a day ago.

Gold price forecast

Gold prices fell sharply due to improved risk-off sentiment, reflected in the increase in stock markets in the US and other places.

Silver prices are almost flat. August gold contract is currently down 20.3 USD, down to 3,432.5 USD/ounce. July silver prices remained steady at 36.355 USD/ounce.

Asian and European stocks last night had mixed movements but generally tended to increase. Today's US stock indexes are expected to open higher in New York. The war between Israel and Iran continues, causing the market to be cautious but not to the point of panic. The two countries have been embroiled in armed conflicts for decades.

An analysis company said that if crude oil prices do not skyrocket, investors will not be too worried. The unpredictable scenario will be Iran's blockade of the Hormuz Strait, which carries about 20% of global crude oil production.

Other news last night showed that China's industrial production in May increased by 5.8% compared to the same period last year, lower than the forecast of 6.0% due to trade tensions with the US affecting exports.

China's exports to the US in May fell 34.5% year-on-year, despite US President Donald Trump's postponement of tariffs in mid-May. China's retail sales in May increased by 6.4% thanks to domestic consumption stimulus packages.

The G7 will meet earlier this week in Canada. Meanwhile, the Federal Open Market Committee (FOMC) meeting also took place this week, but the US Federal Reserve (FED) is expected not to cut interest rates.

Technically, speculators for August gold prices are still holding a clear advantage in the short term. The next target for buyers is to close above $3,500/ounce. In contrast, the target for the seller is to pull the price below the important technical support level of $3,313.1/ounce.

The first resistance level was determined at 3,477.3 USD/ounce, followed by 3,500 USD/ounce. The first support was at $3,400/ounce, followed by $3,358.5/ounce.

Key outside markets today saw the USD index fall. WTI crude oil prices decreased, trading around 72.5 USD/barrel. The yield on the 10-year US government bond is at 4.45%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...