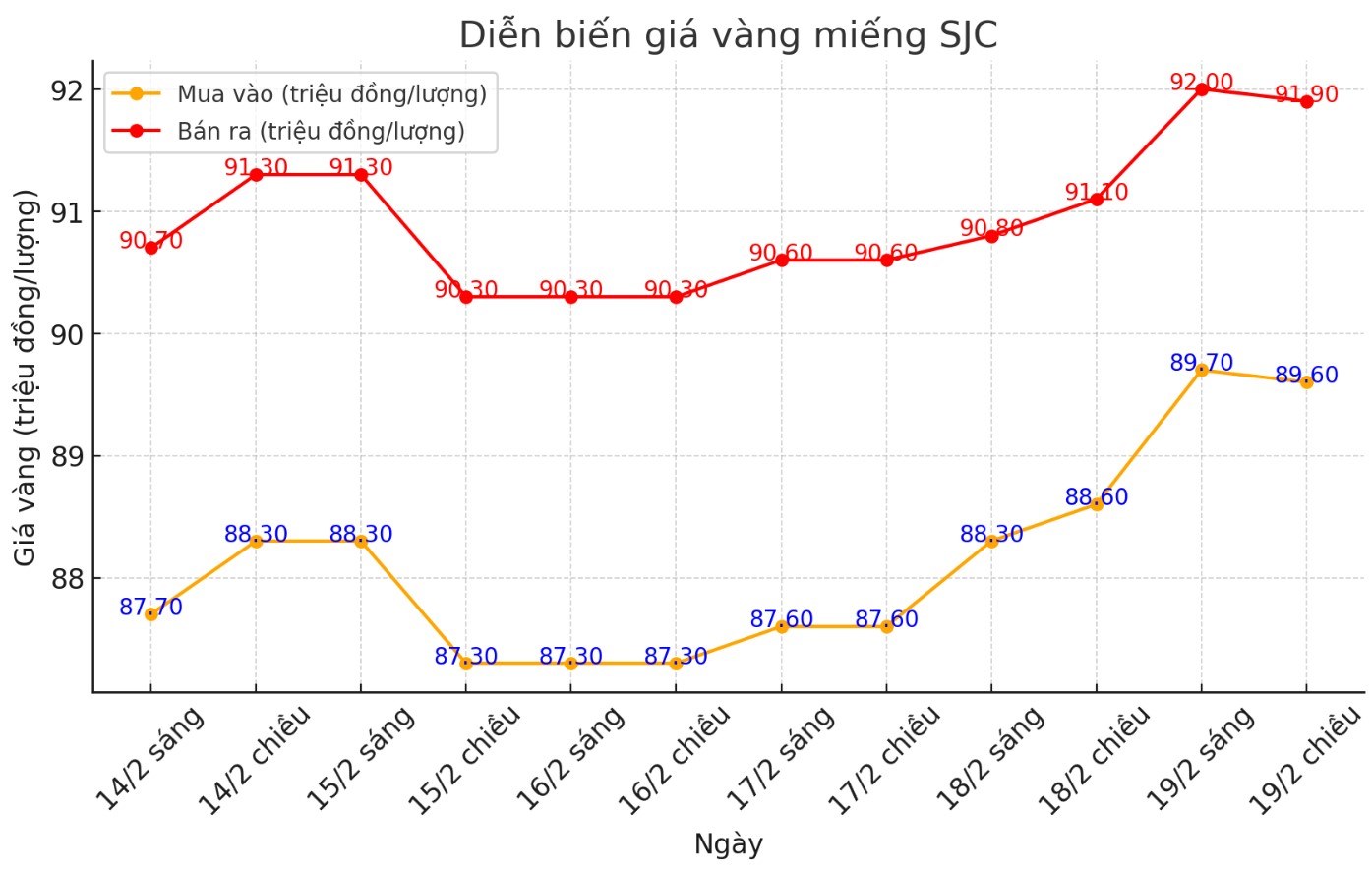

Updated SJC gold price

As of 7:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.6-91.9 million/tael (buy - sell), an increase of VND1 million/tael for buying and VND800,000/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 89.6-91.9 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.3 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND89.6-91.9 million/tael (buy - sell), an increase of VND1 million/tael for buying and VND800,000/tael for selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

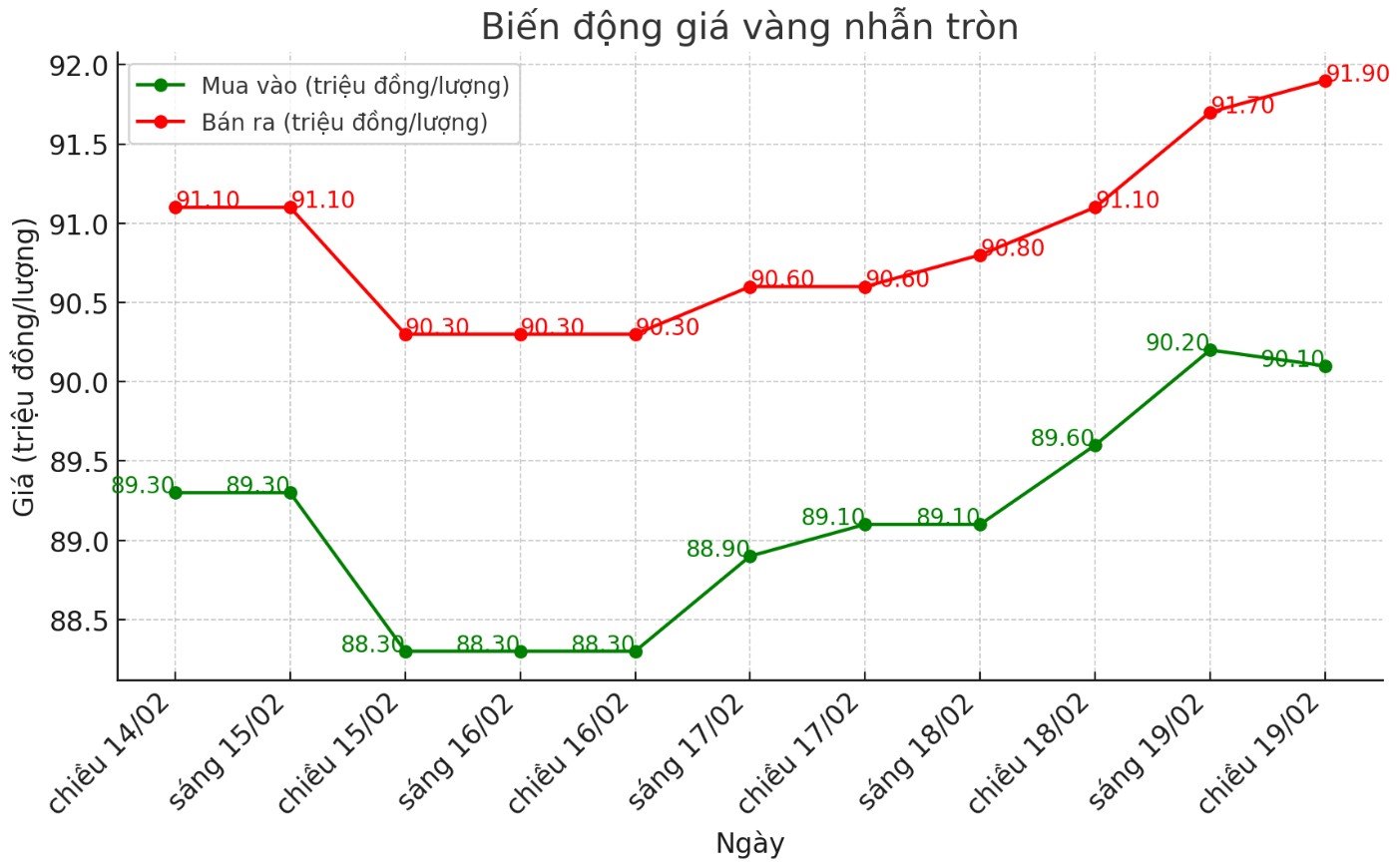

9999 round gold ring price

As of 7:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.1-91.9 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 800,000 VND/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.15-92 million VND/tael (buy - sell); increased by 550,000 VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

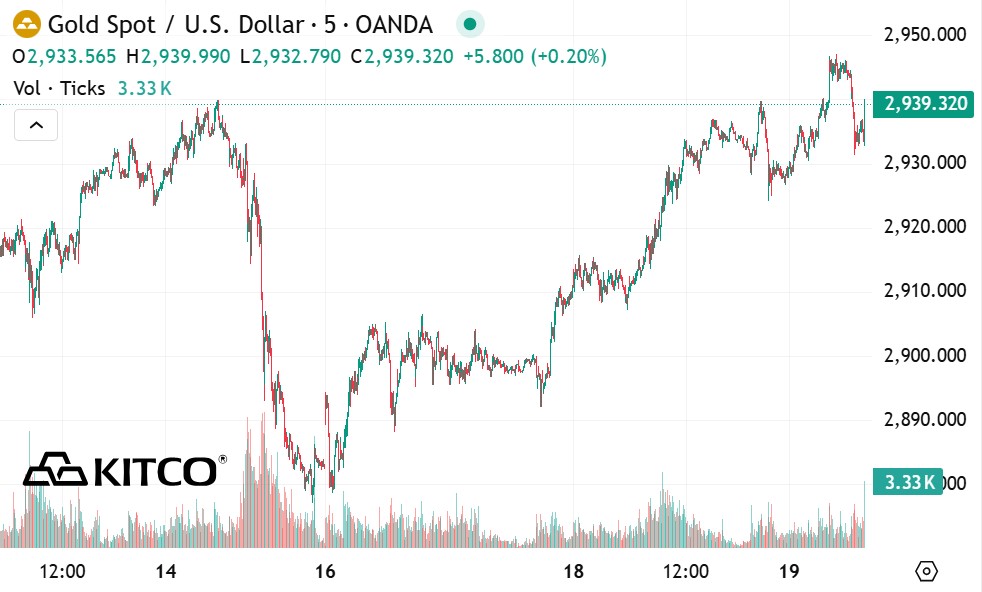

World gold price

As of 20:05, the world gold price listed on Kitco was at 2,939.3 USD/ounce, up 24.6 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased despite the increase of the USD. Recorded at 20:05 on February 19, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.030 points (up 0.07%).

The gold market has largely recovered after a strong sell-off last Friday. Although the precious metal is expected to continue to fluctuate in the short term, an investment firm believes that the long-term uptrend of gold will remain firm.

In the latest research report, Adam turnquist - chief technical strategist at LPL Financial - said that in the short term, gold is in a state of overbought conditions and is vulnerable to new selling pressure, which could push prices to support level near 2,800 USD/ounce. However, in the long term, even if the gold price reaches 3,000 USD/ounce, this precious metal is still quite cheap.

Andy Schectman - Chairman of Miles Franklin Precious Metals believes that gold prices have been held back, but this is about to end as supply is scarce. Gold flows from London and the US could resell gold.

"One of the most worrying problems in the current gold market is the increasing difficulty in finding physical gold buyers. Currently, it takes the LBMA six to eight weeks to deliver gold in essence, it is almost a form of bankruptcy, he said.

In China, some major banks have announced that they are out of gold products due to strong demand. In South Korea, the country's foundry has temporarily stopped selling gold bars due to tight supply.

Schectman also pointed out that the world's largest gold ETF - SPDR Gold Trust (GLD) has just had 16 tons of gold withdrawn. He said this could be a sign that institutional investors are withdrawing physical gold from the fund, reflecting a loss of confidence in the "paper gold" market.

Investors continue to rush into gold bars to seek safe haven as concerns about economic growth continue to increase after US President Donald Trump's tax plan.

Tradus Nikos Tzabouras said Trumps comments could disrupt global trade and complex supply chains.

With uncertainty engulfing the global economy and a broader geopolitical context under the Trump administration, gold will continue to be an asset that benefits naturally from risk-offs and central bank purchases, said Tzabouras.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...