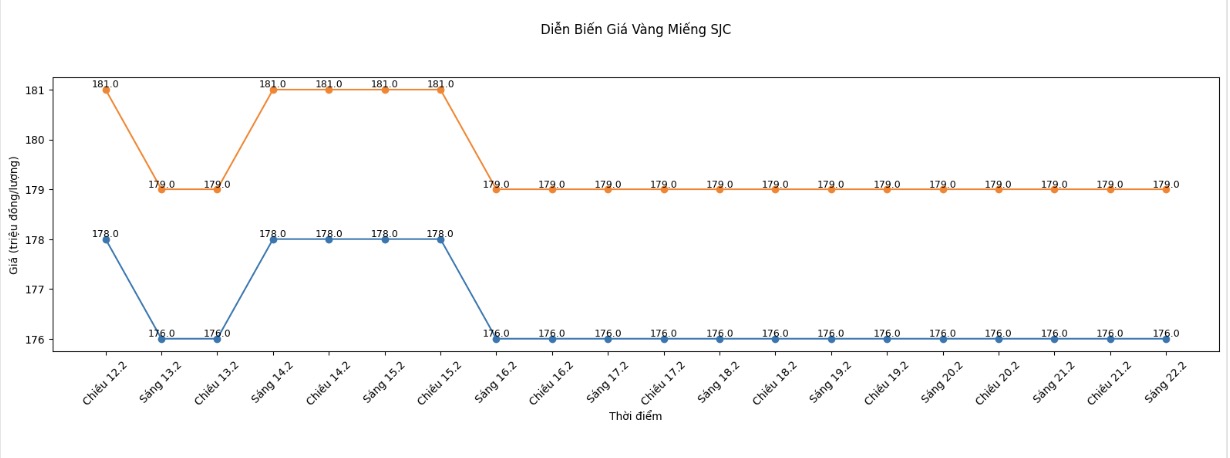

SJC gold bar price

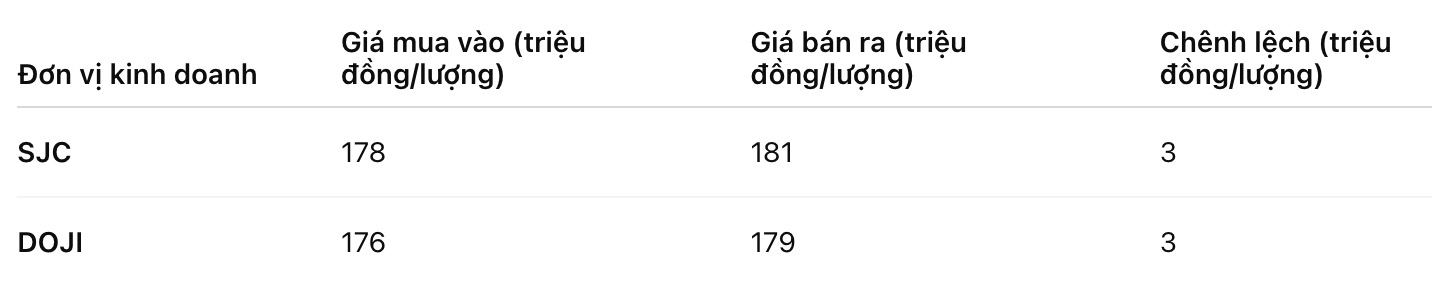

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 178-181 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (February 15), SJC gold bar price at Saigon SJC Jewelry Company remained unchanged during the Lunar New Year holiday.

Meanwhile, DOJI listed SJC gold price at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 15), the price of SJC gold bars at DOJI also remained unchanged.

Although the price remained unchanged, if buying SJC gold bars on February 15 and selling them on today's session (February 22), buyers at Saigon SJC and DOJI Jewelry Company both lost 3 million VND/tael.

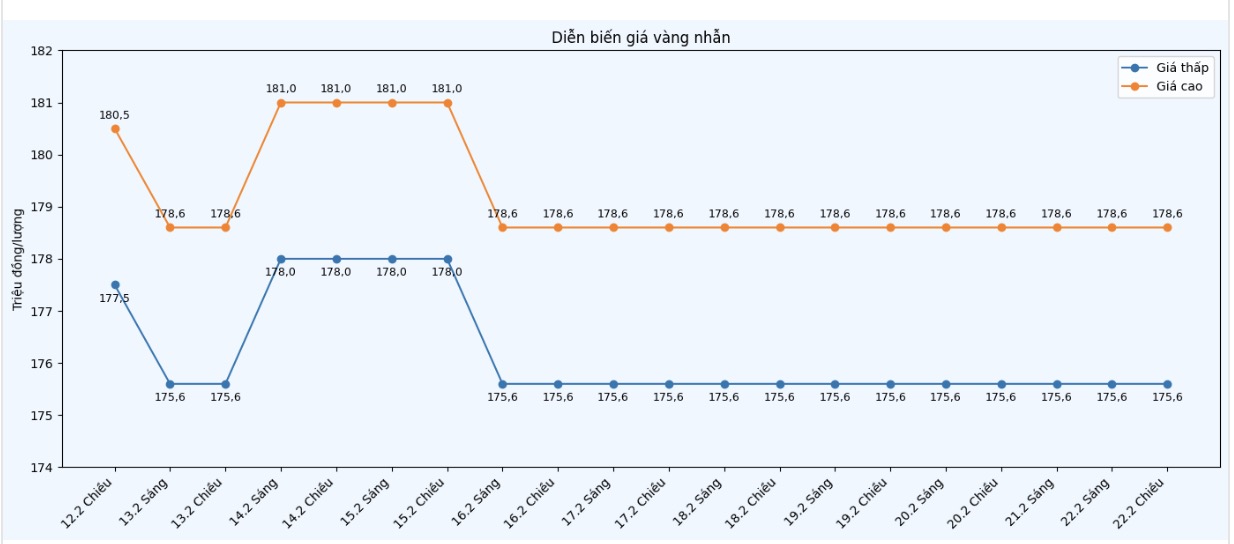

9999 gold ring price

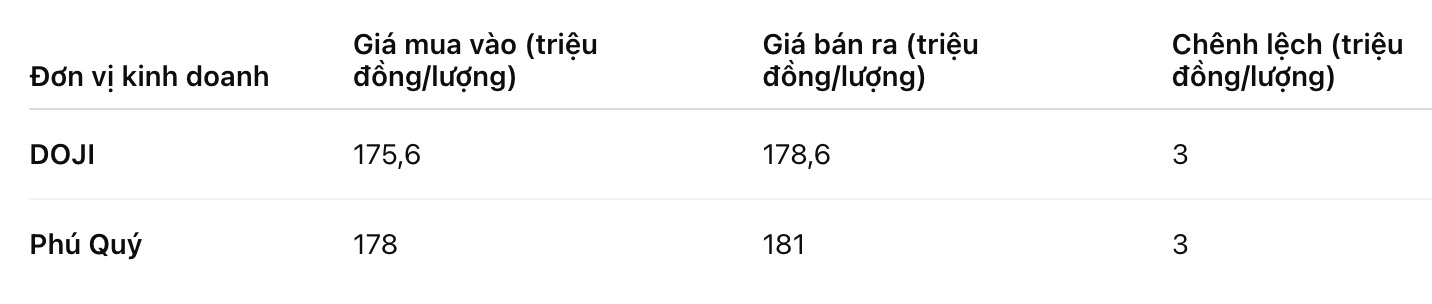

At the same time, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged compared to a week ago. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 2.3 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings on February 8th and selling them today (February 22nd), buyers at DOJI will lose 3 million VND/tael, while the loss for gold ring buyers in Phu Quy is 700,000 VND/tael.

The significant loss difference between business units mainly stems from differences in the timing of price adjustments during the Lunar New Year holiday.

In the past week, world gold prices recorded an upward trend, so it is likely that the domestic market will reflect this upward momentum right in the first trading sessions of the new year. On the morning of February 22, Phu Quy was among the few businesses to update prices early, while most other units have not yet adjusted according to the first session of the Lunar New Year.

World gold price

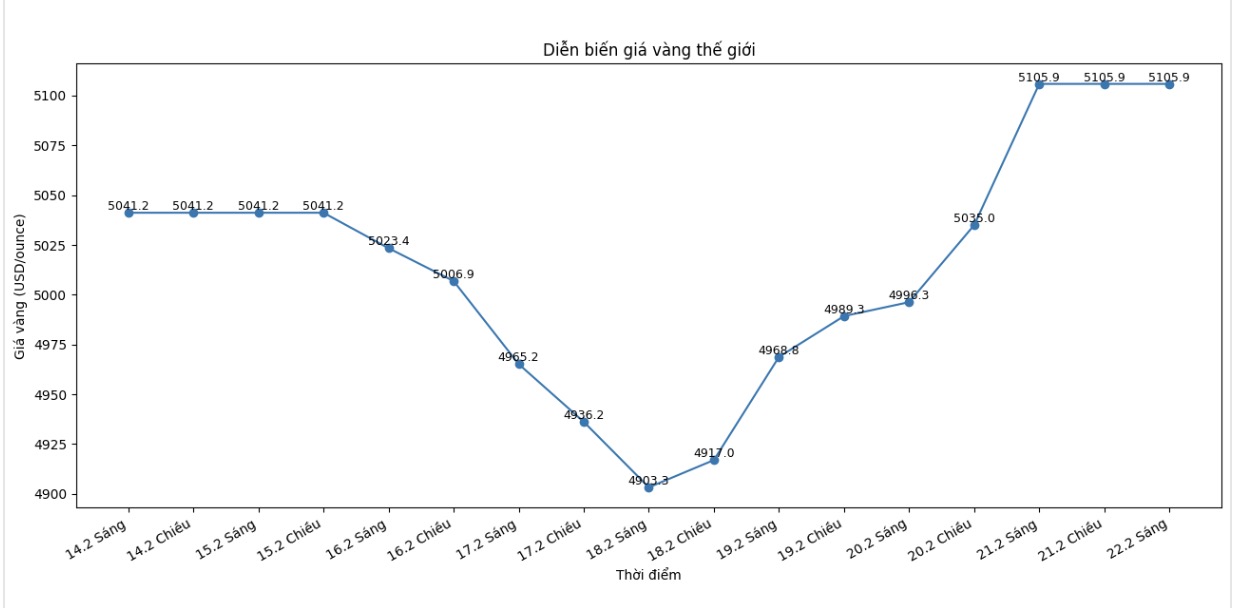

Closing the weekly trading session, world gold prices were listed at 5,105.9 USD/ounce, up 64.7 USD compared to a week ago.

Gold price forecast

After the Lunar New Year holiday, the gold market entered a new trading week with investor sentiment gradually becoming more active again. Many international experts maintain a positive view on the prospects of precious metals, in the context that uncertain economic and geopolitical factors are still present.

The latest survey results show that optimistic trends prevail. Among the 13 analysts participating in the survey, up to 9 people (69%) expect gold prices to break through decisively above the 5,100 USD/ounce mark next week. Only 1 opinion (8%) forecasts a price decrease, while the remaining 3 experts (23%) believe that the risk of increase - decrease is in a balanced state in the short term.

On the side of individual investors, the online survey recorded 298 votes also reflecting positive sentiment. 189 small traders (63%) predicted that gold prices would continue to rise, 53 people (18%) predicted weakening and 56 opinions (19%) said that the market could move sideways.

Agreeing with this view, Rich Checkan - Chairman and COO of Asset Strategies International said that the recent correction is more technical than reflecting the change of fundamental factors. He assessed that the dominant trend of gold still leans towards increase, as the market has not seen strong enough information to reverse direction.

Next week, the economic data release schedule is relatively sparse but there are still noteworthy indicators. On Tuesday morning, the market turned its attention to the February US Consumer Confidence Report. On the same evening, US President Donald Trump's State of the Union address was expected to bring more signals about policy orientation.

By Thursday, the weekly number of US jobless claims will be an important indicator of labor market health. The data series closed on Friday morning with the February Producer Price Index (PPI) report - a factor that could affect inflation expectations and the interest rate roadmap.

In addition, the reopening of the Chinese market after the long Tet holiday is also expected to create more momentum for gold price movements in the short term. If world gold maintains its upward momentum, domestic gold prices are likely to fluctuate in the same direction.

See more news related to gold prices HERE...