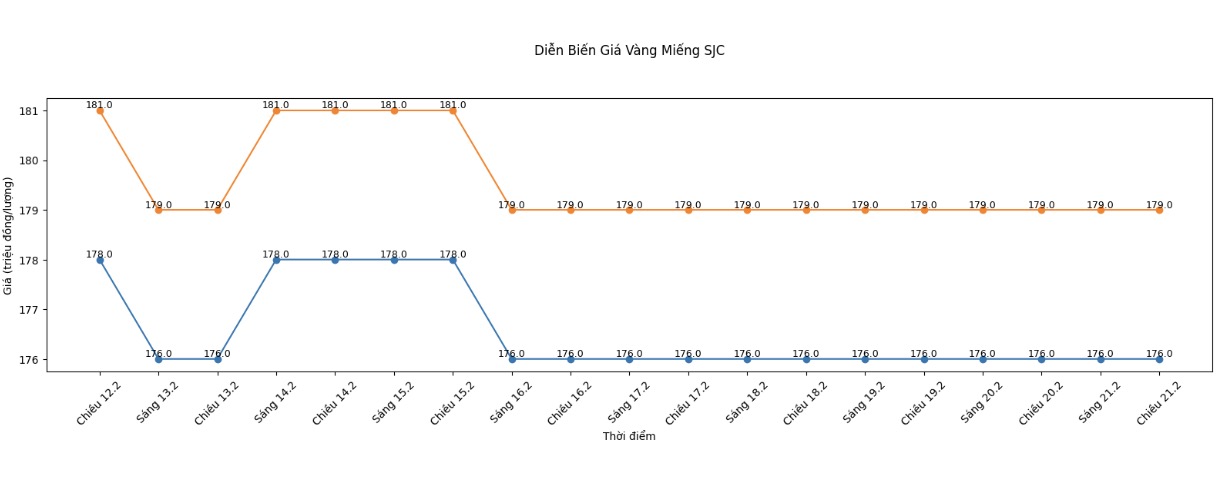

SJC gold bar price

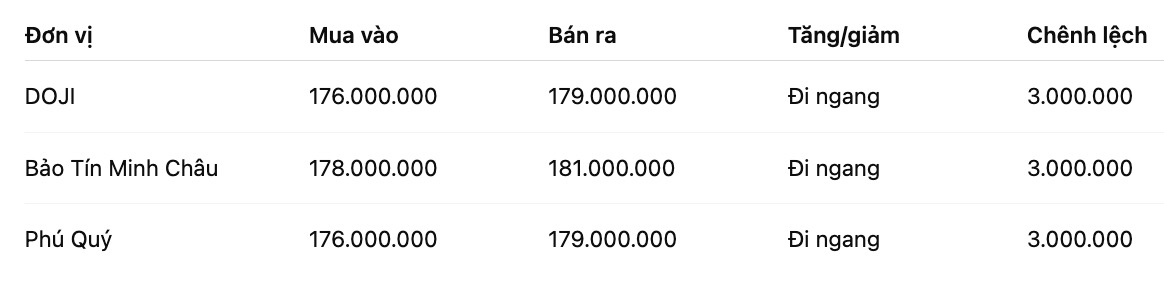

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

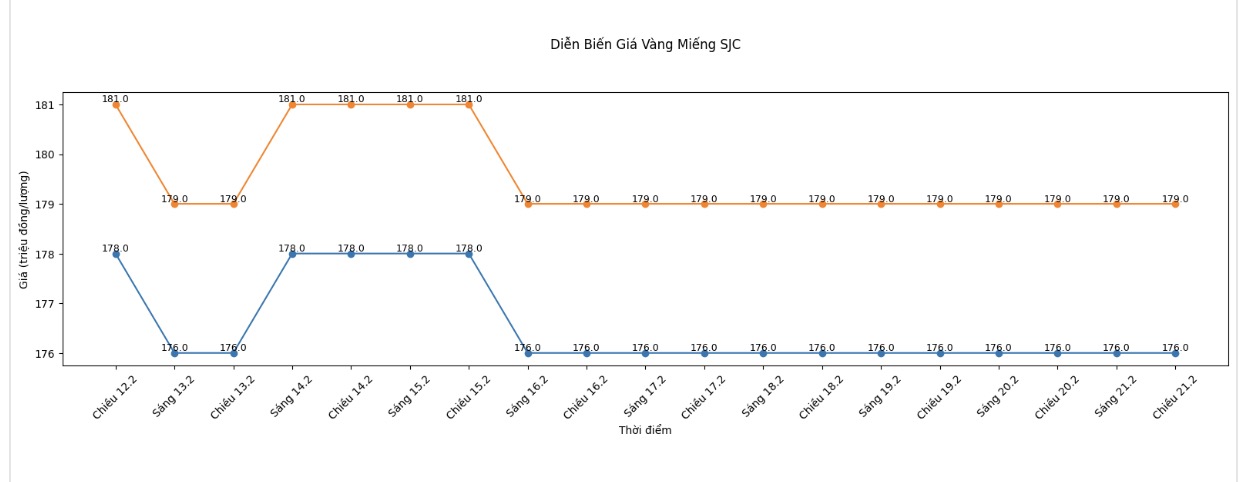

9999 gold ring price

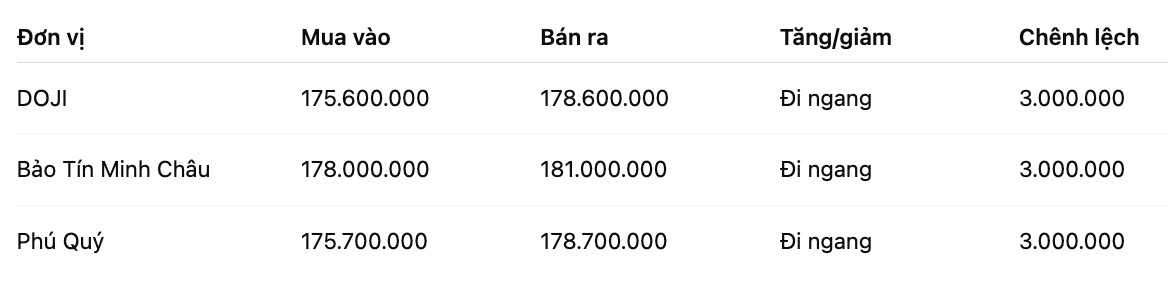

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

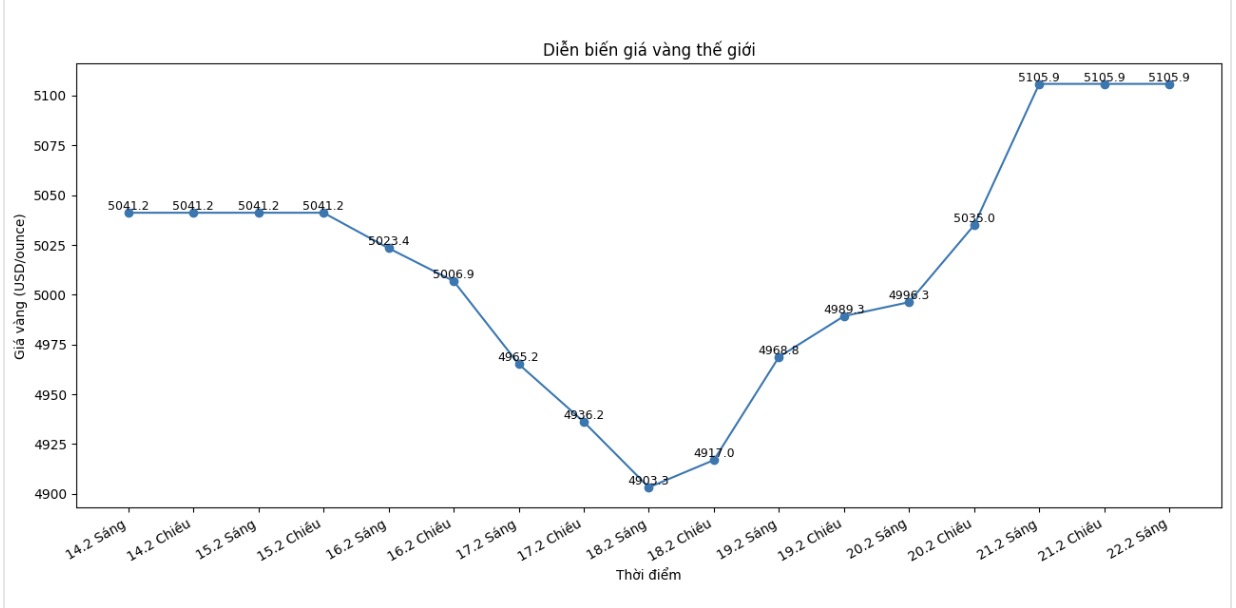

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 5-105.9 USD/ounce.

Gold price forecast

The world gold market enters the new trading week with a relatively positive sentiment, as most Wall Street experts continue to lean towards a price increase scenario. This development is believed to create a spillover effect to the domestic market, in the context that SJC gold prices often tend to be in sync with international fluctuations.

The latest weekly gold survey shows optimistic sentiment prevailing on Wall Street. Among 13 participating experts, 69% expect gold prices to break through 5,100 USD/ounce. On Main Street, 63% of small investors forecast prices to continue to rise for the third consecutive week.

James Stanley - senior market strategist at Forex. com - assesses that buying power is still dominant. According to him, on short-term charts, gold prices have formed a "triangle of increase", a technical signal that often suggests the possibility of a breakthrough upwards. "The threshold of 5,100 USD/ounce is an important milestone. This used to be a support zone, then turned into resistance. Overcoming this zone can further strengthen the upward momentum" - Mr. Stanley said.

Sharing the same view, Rich Checkan - Chairman and COO of Asset Strategies International believes that the recent correction is more technical than reflecting the change of fundamentals. “There is no strong enough information to justify the recent decline. Short-term correction is necessary and the upward trend is likely to return soon,” this expert said.

Some analysts noted that risk-prevention sentiment is still present as the market continues to monitor geopolitical developments. In case tensions in the Middle East escalate, gold may benefit from its role as a safe-haven asset.

Bernard Dahdah - a precious metal analyst at Natixis - predicts that gold prices could rise sharply if a large-scale conflict occurs. According to him, the precious metal may even rise to the 5,500 - 5,800 USD/ounce range in the first few weeks after the incident breaks out.

In terms of economic data, US growth and inflation indicators continue to be important variables. Slowing growth while core inflation remains at a high level may put pressure on the Fed's monetary policy. A weakening real interest rate environment is often seen as a supporting factor for gold - a non-interest-generating asset.

With the current picture, gold is likely to maintain strong fluctuations in the short term. If world gold extends its upward momentum, domestic gold prices may be affected by an increase, although the amplitude depends on supply - demand and buying and selling differences in the domestic market.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...