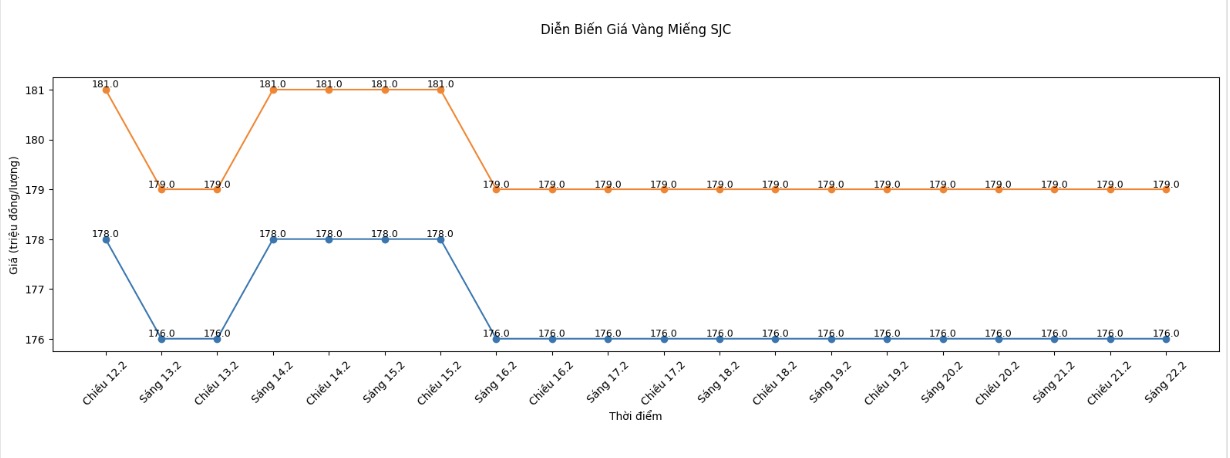

SJC gold bar price

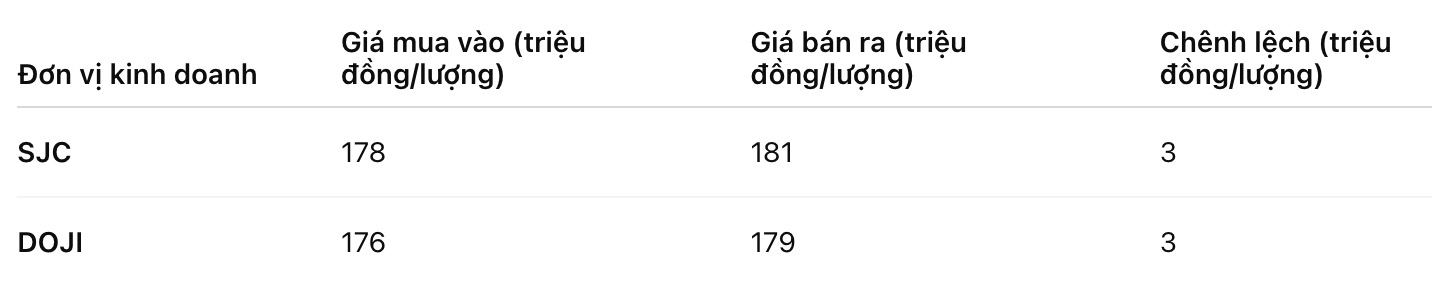

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 178-181 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (February 15), SJC gold bar price at Saigon SJC Jewelry Company remained unchanged during the Lunar New Year holiday.

Meanwhile, DOJI listed SJC gold price at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 15), the price of SJC gold bars at DOJI also remained unchanged.

Although the price remained unchanged, if buying SJC gold bars on February 15 and selling them on today's session (February 22), buyers at Saigon SJC and DOJI Jewelry Company both lost 3 million VND/tael.

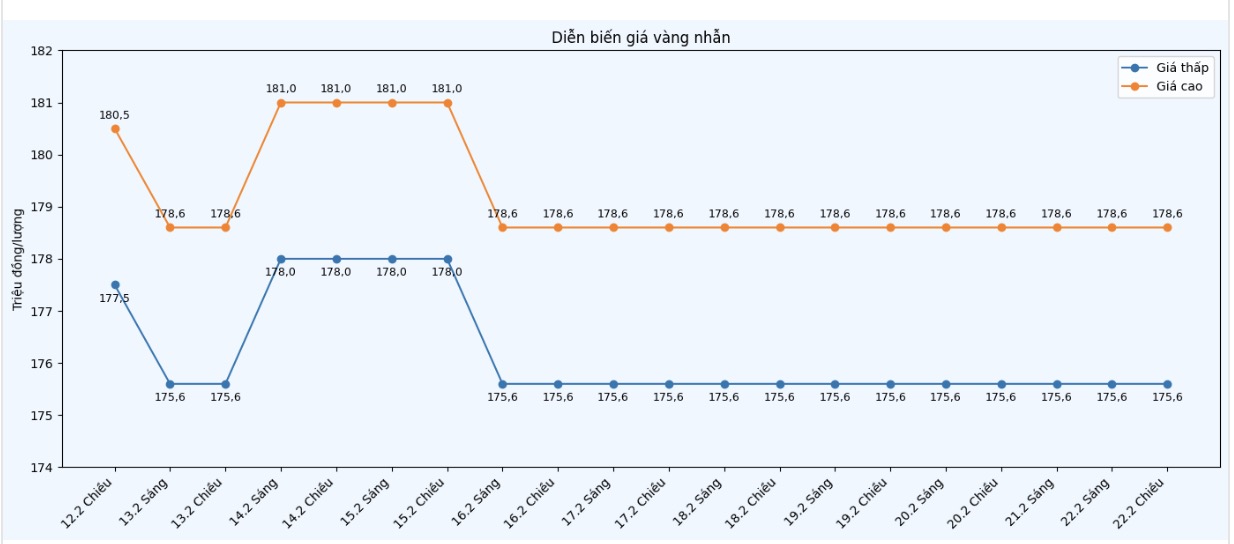

9999 gold ring price

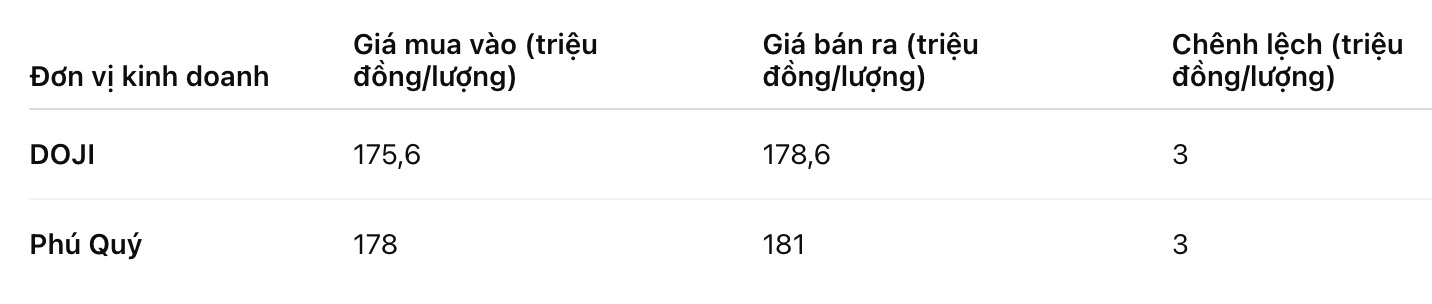

At the same time, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged compared to a week ago. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 2.3 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings on February 8th and selling them today (February 15th), buyers at DOJI will lose 3 million VND/tael, while the loss of gold ring buyers in Phu Quy is 700,000 million VND/tael.

The significant loss difference between business units mainly stems from differences in the timing of price adjustments during the Lunar New Year holiday.

In the past week, world gold prices recorded an upward trend, so it is likely that the domestic market will reflect this upward momentum right in the first trading sessions of the new year. On the morning of February 22, Phu Quy was among the few businesses to update prices early, while most other units have not yet adjusted according to the first session of the Lunar New Year.

World gold price

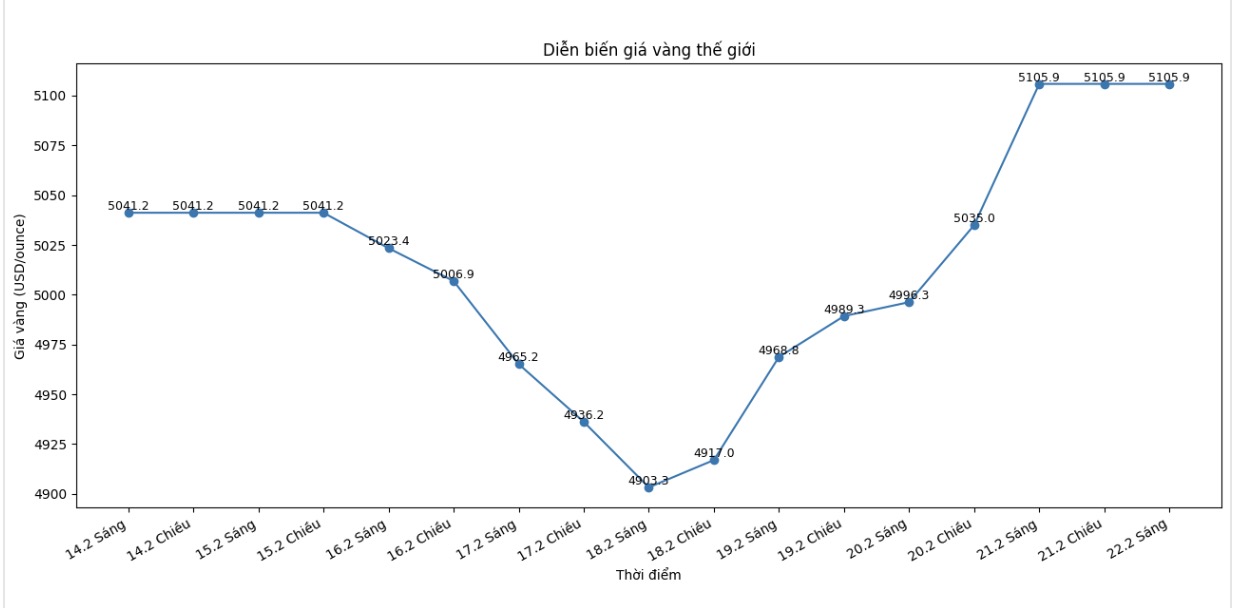

Closing the weekly trading session, world gold prices were listed at 5,105.9 USD/ounce, up 64.7 USD compared to a week ago.

Gold price forecast

After the Lunar New Year holiday, the gold market enters a new trading week in the context of investor sentiment gradually becoming more active again. Many international experts maintain a positive view of the price trend of precious metals, as global risk factors are still present. The developments of world gold are expected to continue to play a leading role, thereby affecting the domestic price level.

James Stanley - senior market strategist at Forex. com - said that buyers are showing clear advantages in short-term timeframes.

According to him, the "rise triangle" model formed on the technical chart is often a signal to strengthen breakthrough potential. The 5,100 USD/ounce mark is considered a key zone: once playing a supporting role, then turning into resistance, and now becoming a "line" that buying power needs to cross to establish a new upward momentum.

From another perspective, Rich Checkan - Chairman and COO of Asset Strategies International believes that the recent adjustment is more technical than reflecting fundamental changes.

He assessed that the market has not seen a foundational factor strong enough to reverse the dominant trend. Therefore, the decreases are considered short-term corrections, which may create a foundation for the next upward cycle.

Notably, geopolitical scenarios continue to be an important variable. Some analysts warn that gold prices may react strongly if US-Iran tensions escalate. Bernard Dahdah (Natixis) forecasts that gold is likely to increase significantly in the first weeks if conflict breaks out, even expanding the amplitude to the 5,500 - 5,800 USD/ounce range. However, he also noted that after the shocking increase, the market may cool down when investors re-evaluate the actual impact.

Recent US economic data also contributes to shaping expectations. Slowing growth while core inflation remains at a high level raises predictions that the US Federal Reserve (Fed) may consider a more flexible interest rate roadmap. The declining real yield environment is often seen as a supporting factor for gold, due to reduced opportunity costs to hold non-performing assets.

In the short term, investors will closely monitor a series of information such as consumer confidence, the number of unemployment claims and the US producer price index (PPI).

See more news related to gold prices HERE...