Analysts at JP Morgan (one of the world's largest US-based financial - banking corporations) said that the above forecast is based on the assumption that investor demand and demand for gold from central banks will remain around 566 tons per quarter in 2026.

Gold continues to be our most confident asset this year, and we expect room for price increases as the market enters the Fed rate cutting cycle, said Ms. Natasha Kaneva, Head of Global Commodity Strategy at JP Morgan.

Mr. Gregory Shearer - Head of Basic Metals and Quarter metals Strategy - said that the gold price increase prospects are supported by "the Fed's interest rate cutting cycle accompanied by concerns about stagnant inflation, concerns about the Fed's independence and the need to defend against the risk of currency depreciation".

Referring to the role of the US dollar, JP Morgan emphasized the current trend not a story of de-dollarization or devaluation of the US dollar, but a story of asset diversification, as foreign investors are gradually shifting a small portion of their portfolio from US assets to gold.

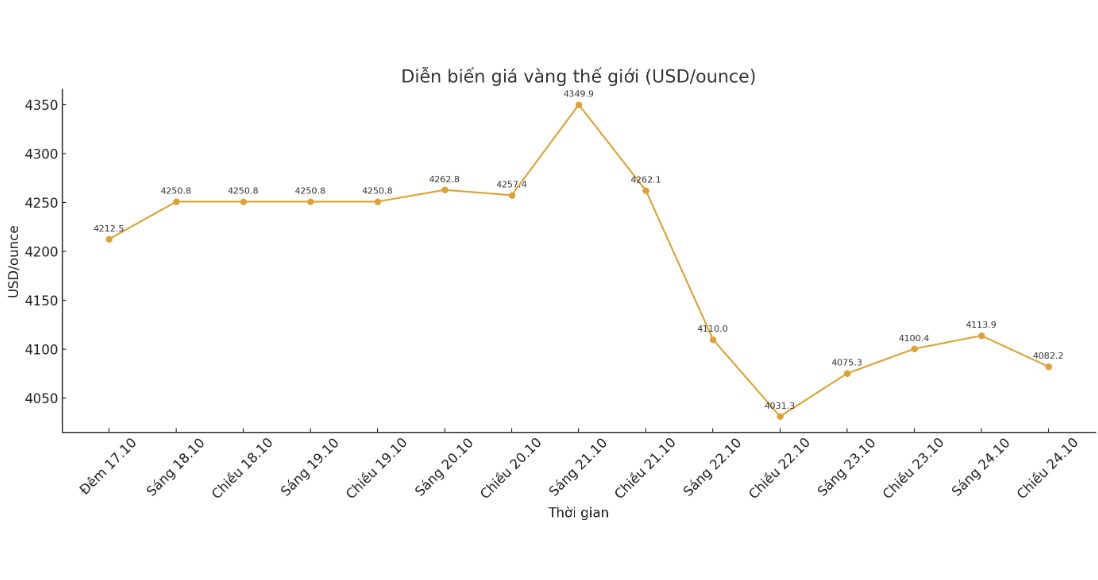

Analysts also said that the recent correction is a positive signal. The price decline reflects that the market is digesting the gains too quickly since August, Kaneva explained.

Its normal to worry about big fluctuations... The story is very clear: there are too many buyers, and almost no sellers, she said.

Kaneva reaffirmed her long-term target of $6,000/ounce by 2028, while emphasizing that gold should be viewed from a long-term investment perspective.

The world spot gold price was listed at 2:51 p.m. on October 24 at 4,082.2 USD/ounce.

See more news related to gold prices HERE...