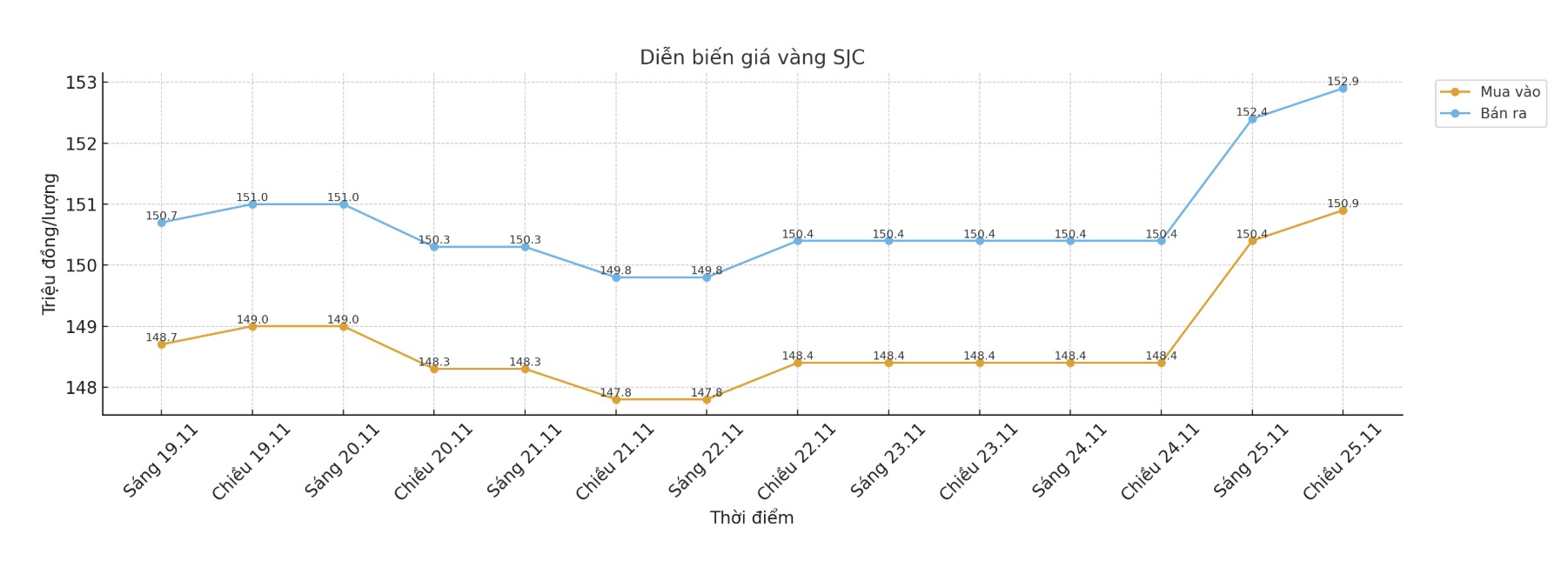

SJC gold bar price

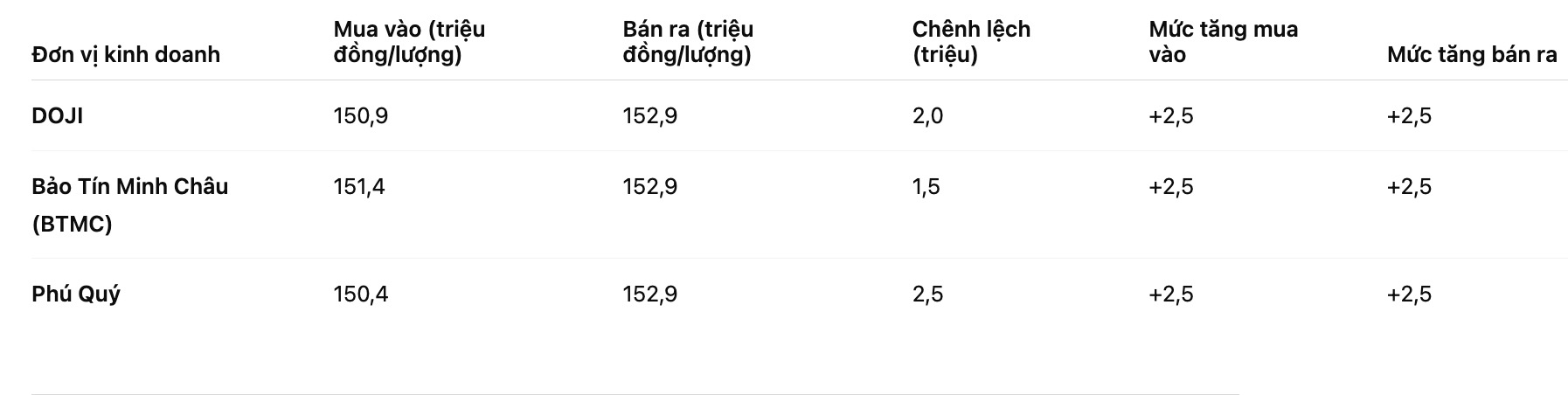

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND150.9-152.9 million/tael (buy in - sell out), a sharp increase of VND2.5 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.4-152.9 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.4-152.9 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 148.7-151.7 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.6-152.6 million VND/tael (buy - sell), an increase of 2.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.2-152.2 million VND/tael (buy - sell), an increase of 2.4 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:12 p.m., at 4,130 USD/ounce, up 61.5 USD compared to a day ago.

Gold price forecast

The recent gold rally was driven by a splash from Federal Reserve Governor Christopher Waller, who called for a rate cut in December as the US labor market weakens. Gold often benefits from low interest rates because this precious metal does not yield.

The six-week US government shutdown - the longest in history - has delayed the release of much of the important economic data, making statements by central bank officials a rare source of clues for traders to predict the Fed's next move.

New York Fed President John Williams also said on Friday he sees room for a short-term rate cut, while the stock market is currently pricing in a nearly 80% chance of the Fed cutting interest rates by 0.25 percentage points at its last meeting of the year.

The market has had some strong fluctuations recently in response to the Feds statements, said Mr. Luca Bindelli, Director of Investment Strategy at Lombard Bank Odier & Cie SA. This shows the markets high sensitivity to any signal from the Fed.

Traders are currently monitoring the delayed economic data, including retail sales and the Producer Price Index (PPI) for September, due on Tuesday, along with weekly jobless claims on Wednesday.

Any accompanying statements from Fed officials could be final comments before the central bank enters a media "blackout" period starting on November 29.

After retreating from a record high of more than 4,380 USD/ounce in October, gold prices have entered an accumulation phase, as some investors worry that the increase has taken place too quickly. However, the precious metal has continued to increase by nearly 60% since the beginning of the year, heading for the year with its strongest increase since 1979, supported by large purchases from central banks and capital flows into ETFs.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...