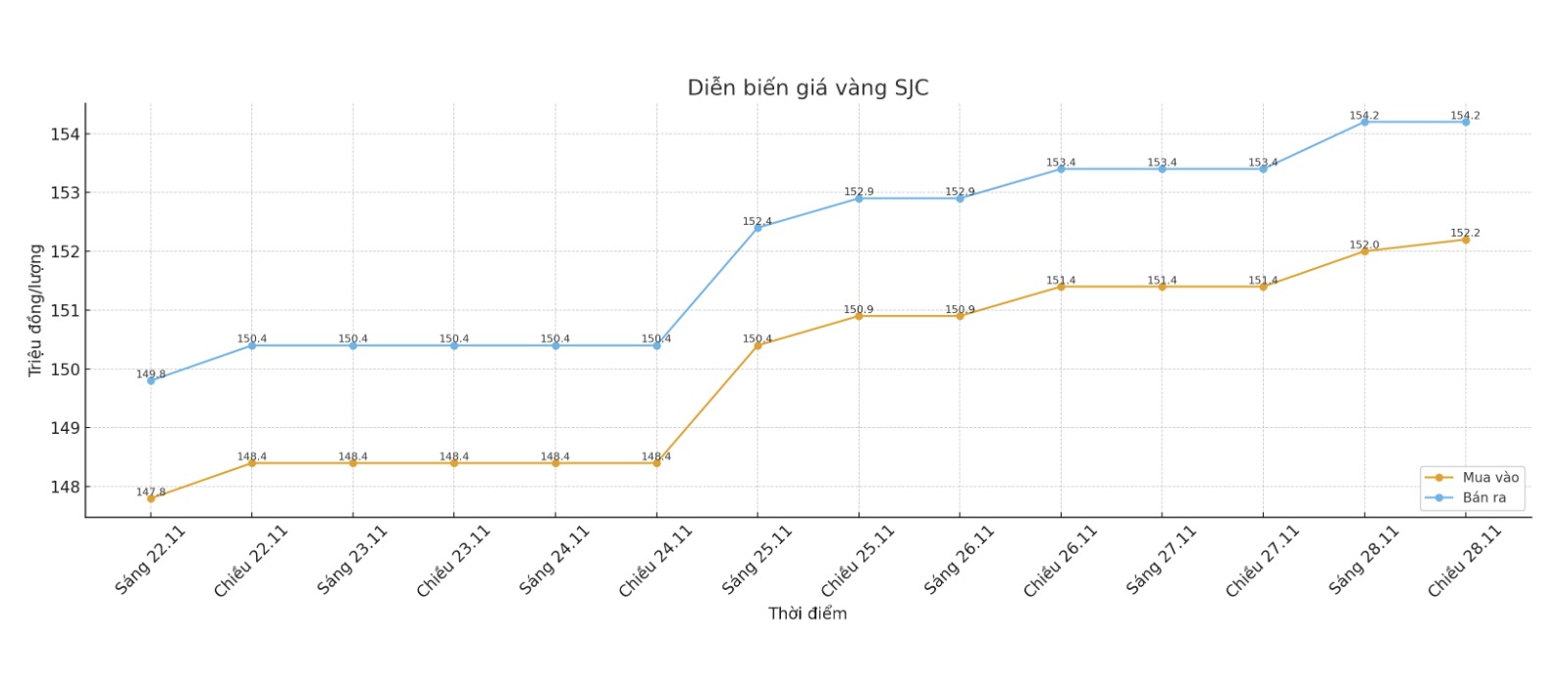

SJC gold bar price

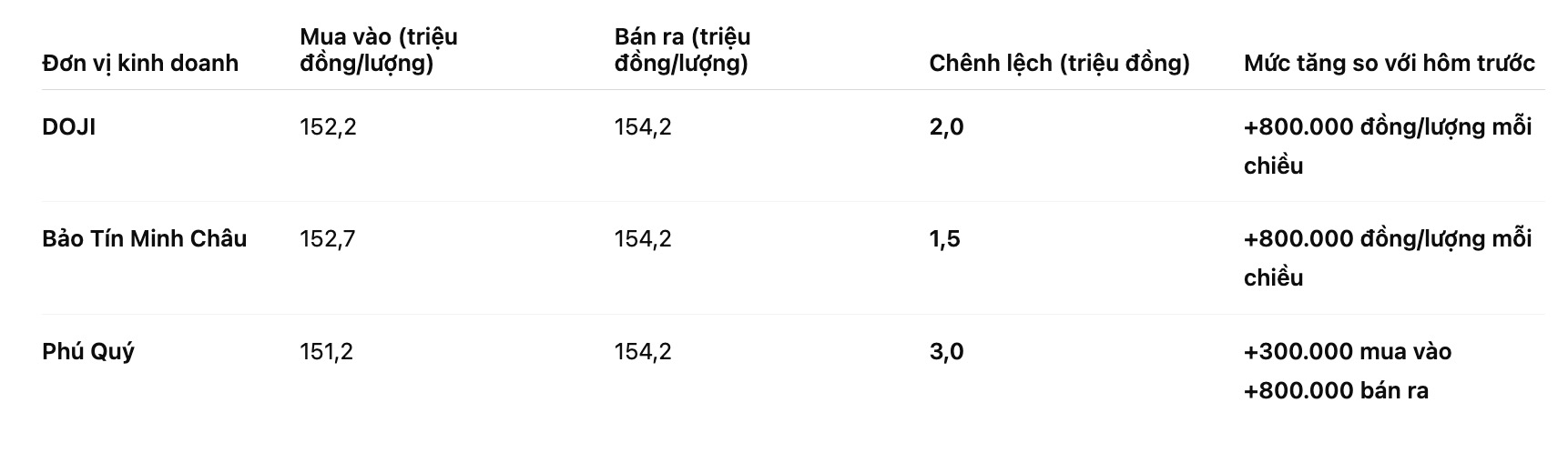

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at VND152.2-154.2 million/tael (buy in - sell out), an increase of VND800,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

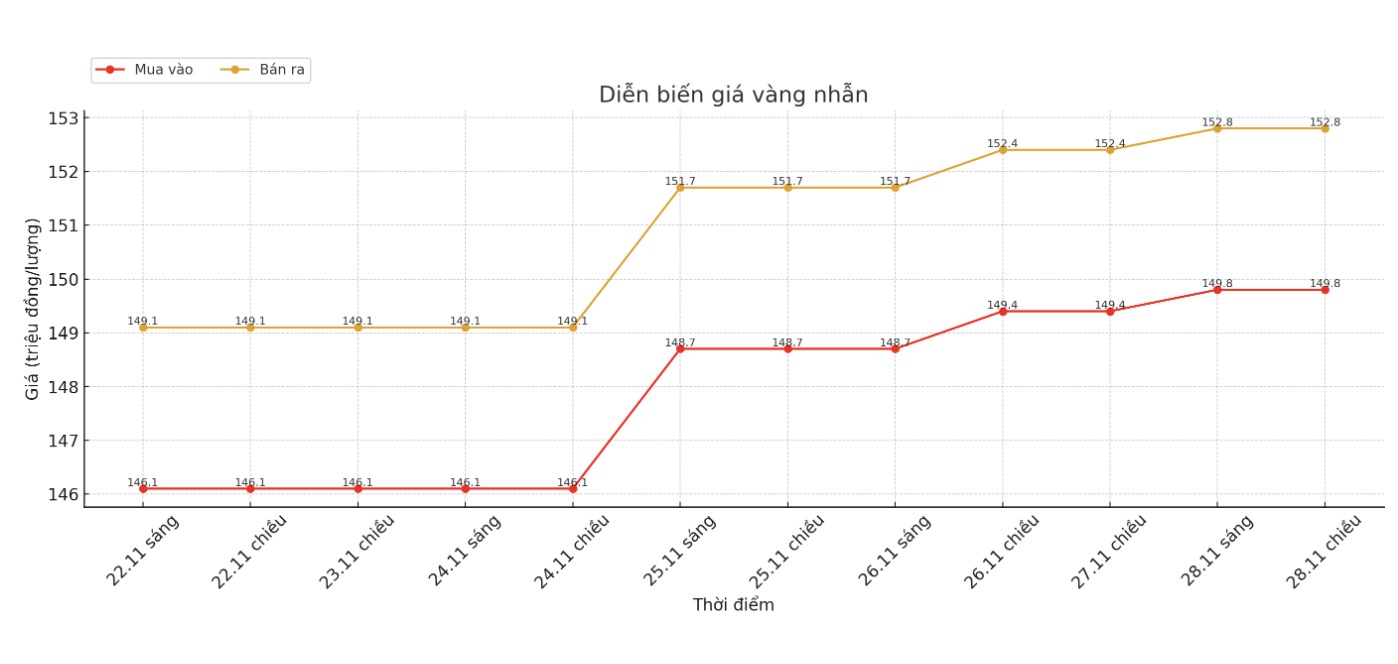

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 149.8-152.8 million VND/tael (buy in - sell out), an increase of 400,000 in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

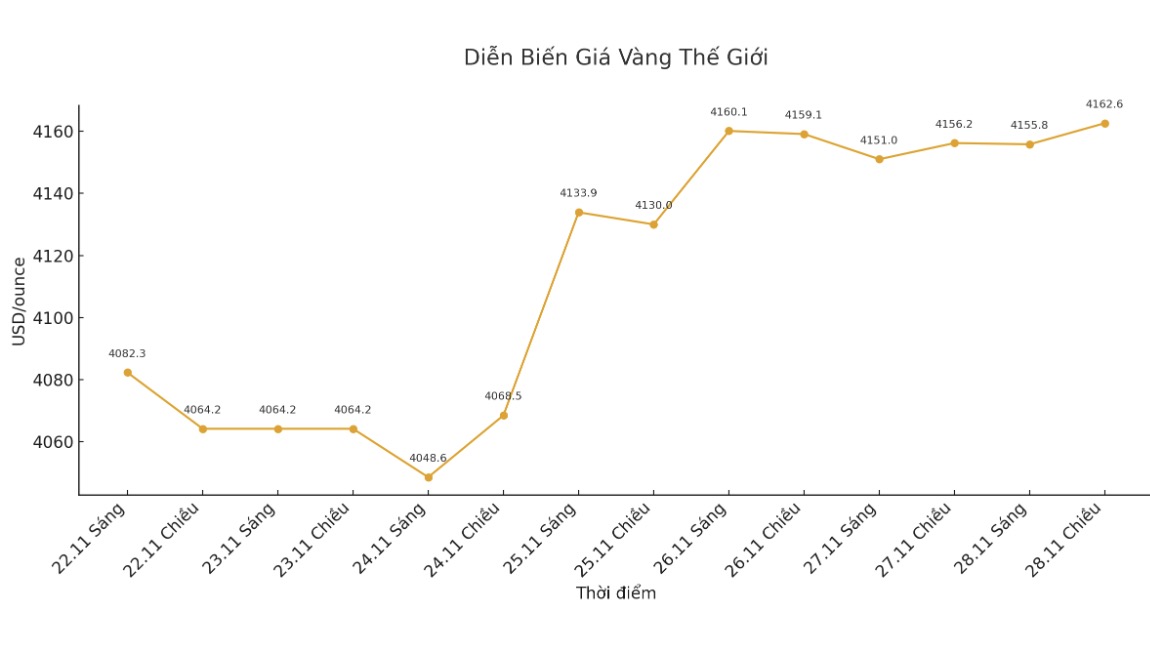

World gold price

The world gold price was listed at 6:00 p.m., at 4,162.6 USD/ounce, up 6.4 USD compared to a day ago.

Gold price forecast

sameer Samana - Director of Global and Real Estate stocks at Wells Fargo Investment Institute - said that the multi-year uptrend of gold is still intact. He said there was no harm in the uptrend, although the possibility of prices continuing to accumulate was entirely possible.

Wells Fargo predicted the US Federal Reserve (Fed) will cut interest rates at its December meeting, but it is also likely that they will wait until January. Regardless of the scenario, interest rate cuts are a given.

Samana believes the Fed will become more dovish as US President Donald Trump continues to make personnel nominations, especially when the successor to Fed Chairman Jerome Powell is chosen, possibly in December.

He said Kevin Hassett is currently the leading candidate. Market members will increasingly pay attention to Mr. Hassett's statements, which, according to Samana, will likely resemble the view of Governor Miran and aim for an interest rate of the 2% range.

This will reduce one of the biggest hurdles for gold: The opportunity cost of holding non-yielding assets. Interest rates, especially real interest rates, when decreased, will support gold prices. That could also lead to another weakening of the US dollar.

In a recent interview, Ms. Roukaya Ibrahim - Director of Commodity Strategy at BCA Research - said she is neutral on gold for the next three months due to uncertainties surrounding the Fed's monetary policy.

Gold has struggled to attract new upward momentum as the market begins to rule out the possibility of a rate cut next month. Interest rate cut expectations were revised after Fed Chairman Jerome Powell said a December cut was not certain. This neutral view has supported the US dollar and yields, creating resistance for gold.

However, in recent days, market expectations have reversed and the possibility of a rate cut has been brought back into the balance. According to the CME FedWatch tool, the market now expects a more than 80% chance of the Fed cutting interest rates next month.

As a result, gold prices are not only holding support above $4,000/ounce but are also testing the important resistance zone around $4,160/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...