Updated SJC gold price

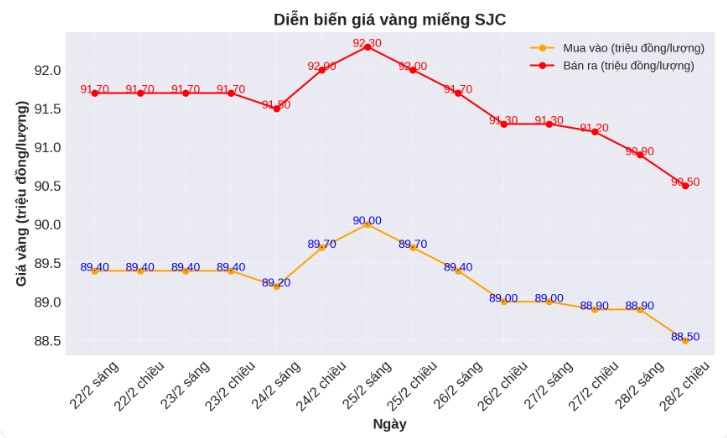

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 88.5-90.5 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 88.5-90.5 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.8-90.5 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.7 million VND/tael.

9999 round gold ring price

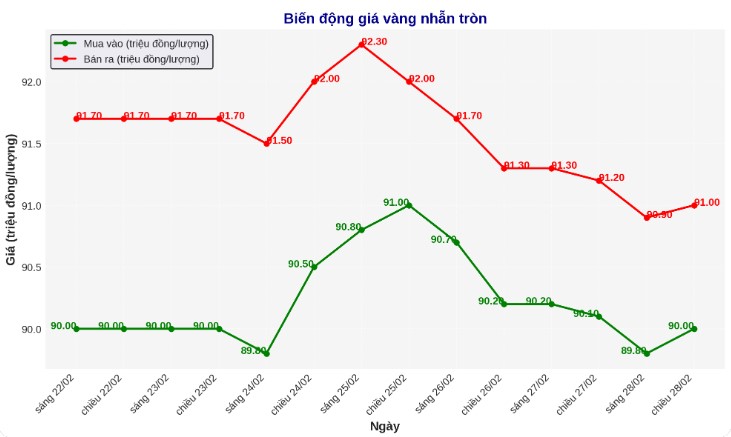

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at VND90-91 million/tael (buy - sell); down VND100,000/tael for buying and down VND200,000/tael for selling. The difference between buying and selling is listed at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.05-91.30 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 400,000 VND/tael for selling. The difference between buying and selling is 1.25 million VND/tael.

World gold price

As of 5:25 p.m., the world gold price listed on Kitco was at 2,861.7 USD/ounce, down 23 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices fell sharply in the context of the USD increasing. Recorded at 5:30 p.m. on February 28, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.320 points (up 0.13%).

According to Kitco, world gold prices fell sharply after US President Donald Trump suddenly made a new statement about the tax, raising concerns about trade tensions.

Analysts said that about half of today's gold price decline came from the stronger USD, the rest was due to direct selling pressure in the gold market.

This sell-off came after US President Donald Trump suddenly announced new tax measures, creating mixed reactions in the market.

We cannot let this disaster continue to hurt the United States. The tax will be in place until it is stopped or severely restricted," Trump wrote on his Truth Social platform.

The market's attention is now focused on the report on the Pepper Performance Price Index (PCE) of the beverage industry, released today (February 28 - local time). According to Fact Set's estimate, January PCE inflation is expected to increase by 0.3% compared to the previous month and 2.5% compared to the same period last year, showing that inflation is still higher than the expectations of the Federal Reserve (FED) and investors.

If inflation continues to remain high, the Fed is likely to keep the benchmark interest rate unchanged instead of cutting as previously expected.

In addition, gold prices are currently under pressure when new US economic data is released. The US Commerce Department announced that long-term commodity orders increased by 3.1% in January, far exceeding analysts' forecast of 1.3%, and reversed the 1.8% decrease in December.

The January long-term orders data showed that demand in the US economy is still quite strong. This is often seen as a positive signal for the USD and could put downward pressure on gold prices because gold is an uninterrated asset.

Meanwhile, data from the National Association of Realtors (NAR) also put more pressure on gold prices. The index of pending home contracts fell 4.6% in January, down to a record low of 70.6 - much lower than the forecast increase of 1.3%.

Compared to the same period last year, the number of contracts decreased by 5.2%, contrary to the expectation of a 6% increase. Housing affordability in the US weakened as mortgage rates ranged from 6.91% to 7.04% in January.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...