Updated SJC gold price

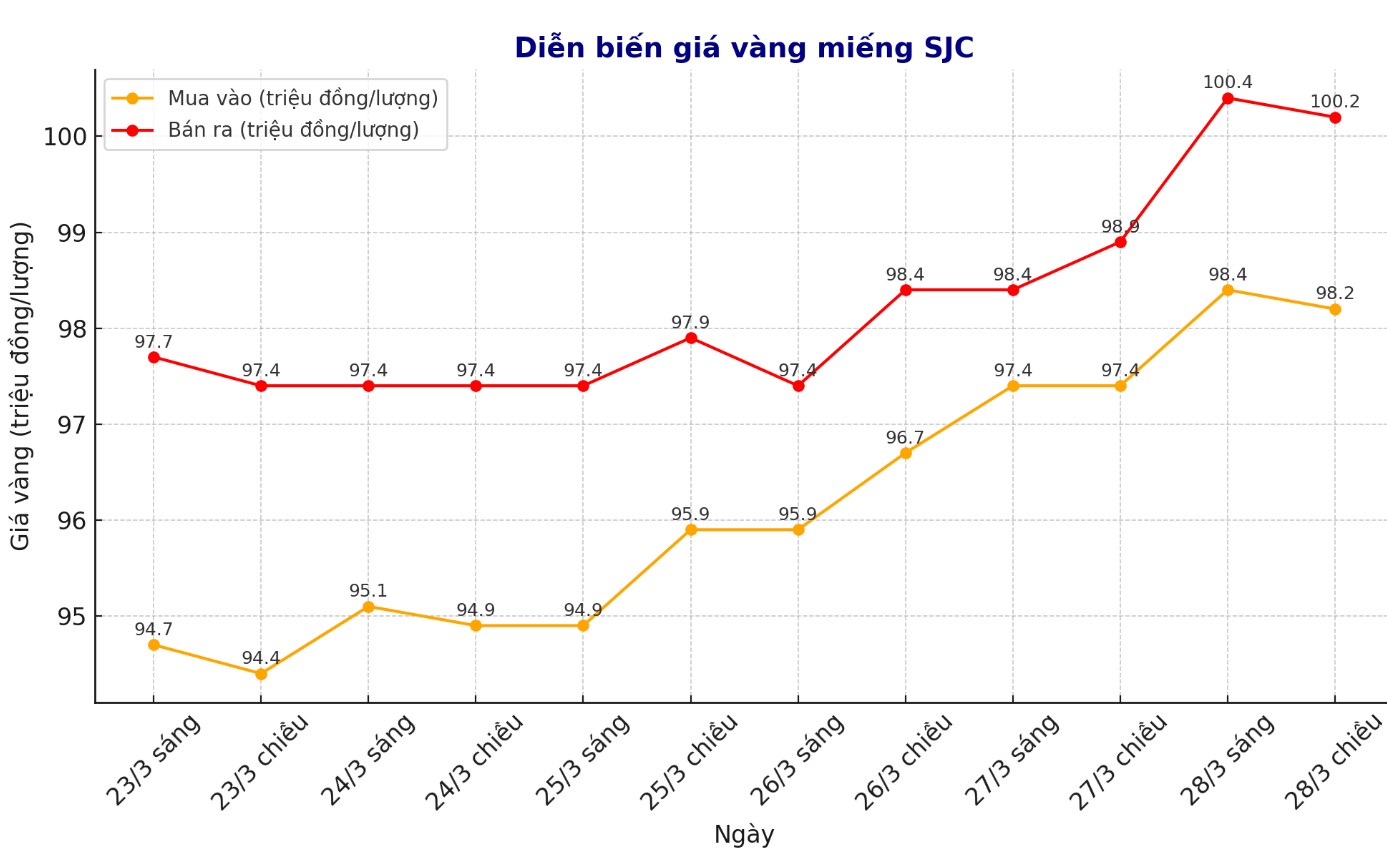

As of 6:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 98.2-100.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 98.2-100 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.3-100.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 1.9 million VND/tael.

9999 round gold ring price

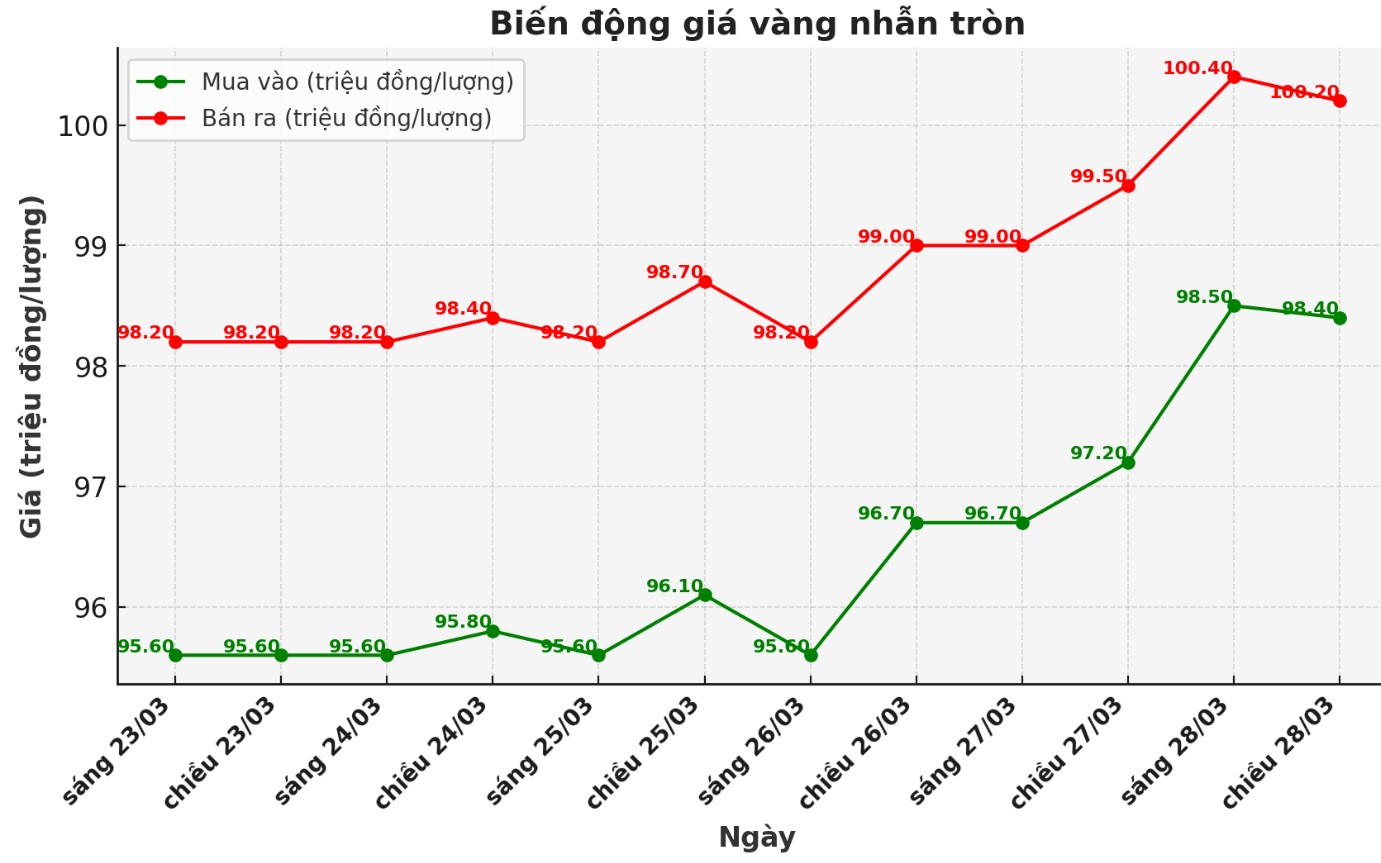

As of 6:45 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.4-100.2 million VND/tael (buy - sell); an increase of 1.2 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell); increased by 1 million VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

World gold price

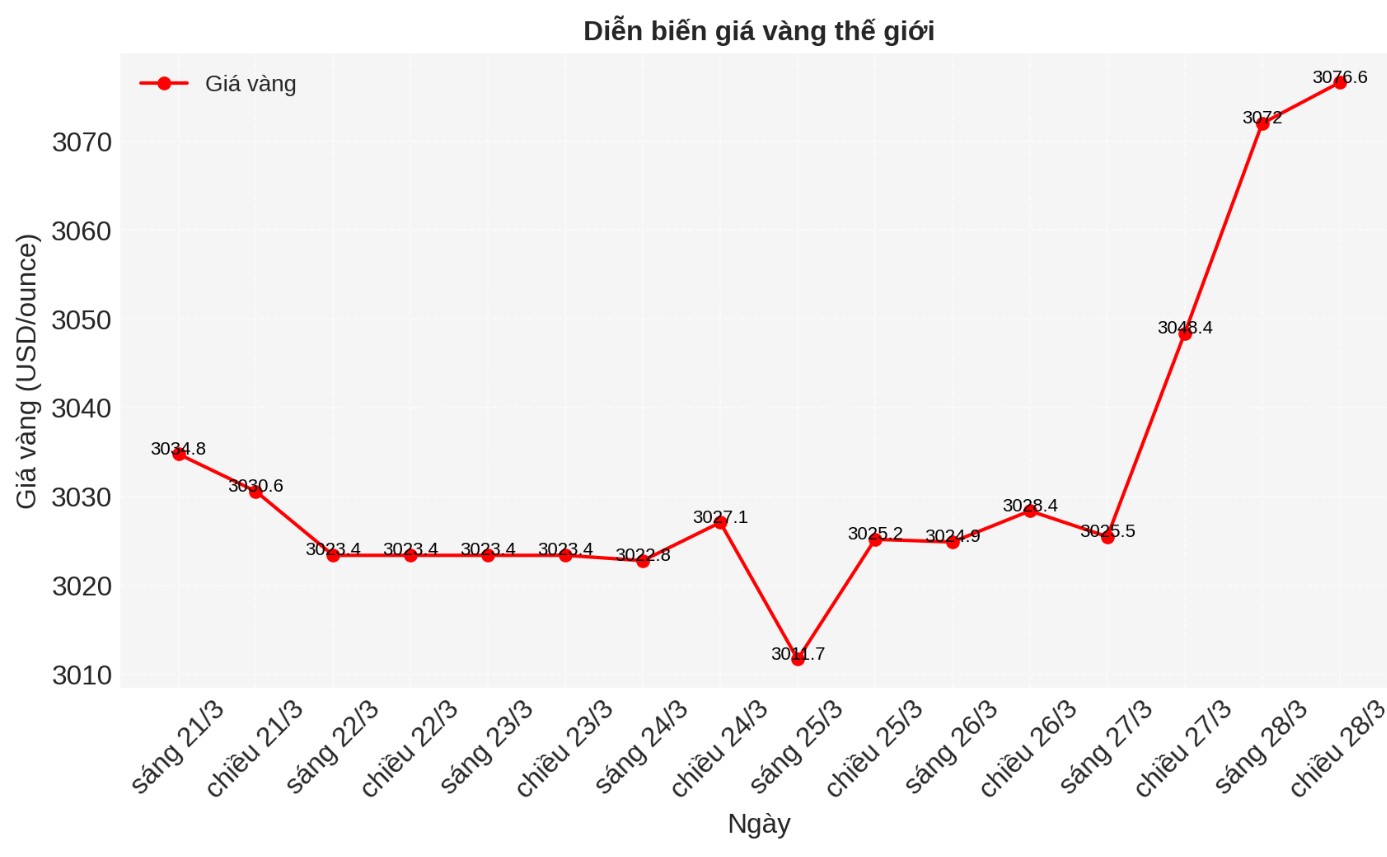

As of 6:45 p.m., the world gold price was listed at 3,076.6 USD/ounce, up 28.2 USD/ounce.

Gold price forecast

World gold prices increased despite the decline of the USD. Recorded at 19:00 on March 28, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.112 points (up 0.12%).

World gold prices are rising. The precious metal received support from investment funds and global factors such as exchange rates, monetary policy and political tensions.

In recent years, increased interest from investment funds has been a key factor driving gold prices. Demand from investors, combined with market sentiment dominated by global trends, news and events, has created a favorable environment for strong fluctuations in gold prices.

These factors promote speculative buying and selling, changing the value of this precious metal.

Gold has long been viewed as a popular hedge against currency market fluctuations. In particular, gold often tends to go in the opposite direction to the USD. That is, as the US dollar weakens, gold becomes cheaper for holders of other currencies.

Conversely, as the US dollar strengthens, gold prices may fall. This makes gold an effective asset value protection tool, especially in the context of economic and monetary instability.

Concerns about trade tariffs, especially US President Donald Trump's decision to impose additional tariffs on Chinese goods, have raised concerns about a global trade war. This not only disrupts the currency market but also makes many people worried about rising inflation in the US.

The escalation of trade tensions became apparent when Mr. Trump announced his plan to impose a 25% tax on imported cars and trucks, expected to take effect next week. "We will impose a 25% tax on all vehicles not manufactured in the US," Trump said at an event at the Department of Labor on March 26.

President Donald Trump sees tariffs as a tool to increase budgets, make up for the committed tax cuts, and support the boost of the struggling US industry.

Central banks around the world have increased their gold purchases in recent years, mainly due to economic and political instability. Demand for gold from central banks has become an important factor affecting gold prices.

According to data from the World Gold Council, global demand for gold, including off-site transactions, has increased by 1% in 2024, reaching a record high. In particular, central banks have accelerated gold purchases in the fourth quarter of the year, reflecting continued increased demand for gold as a safe asset in the context of global instability.

See more news related to gold prices HERE...