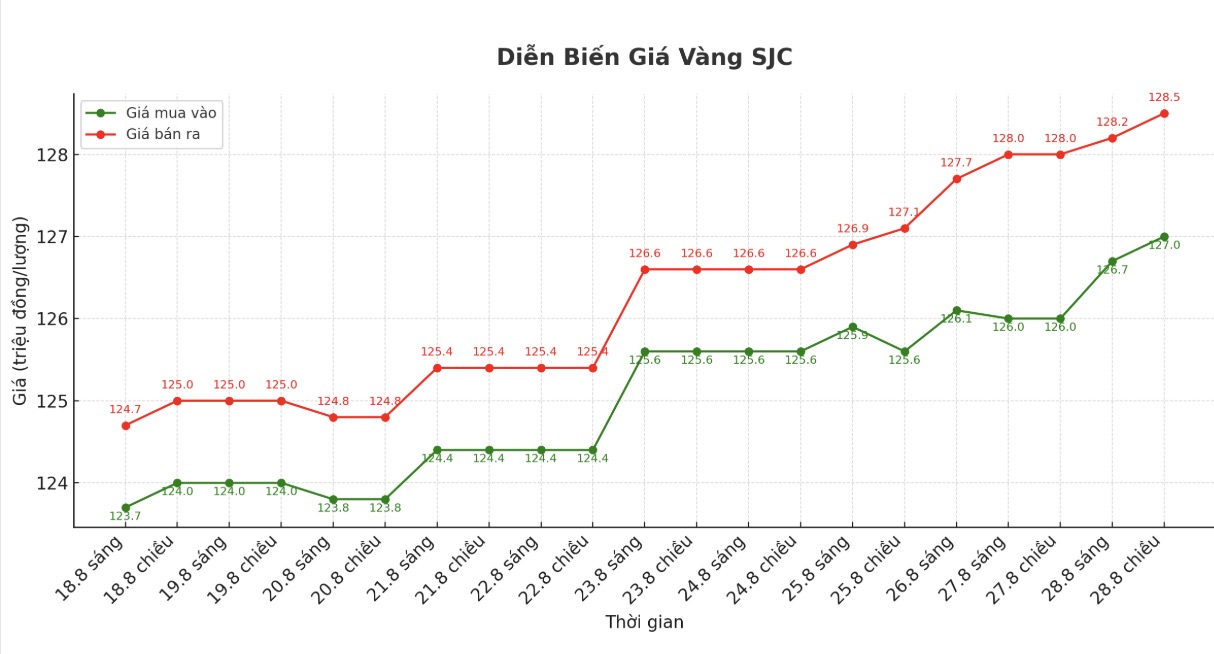

SJC gold bar price

As of 7:45 p.m., DOJI Group listed the price of SJC gold bars at 127-128.5 million VND/tael (buy - sell), a sharp increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 127-128.5 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 126-128.5 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 7:45 p.m., DOJI Group listed the price of gold rings at 120.3-123.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 120.3-123.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 120-123 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

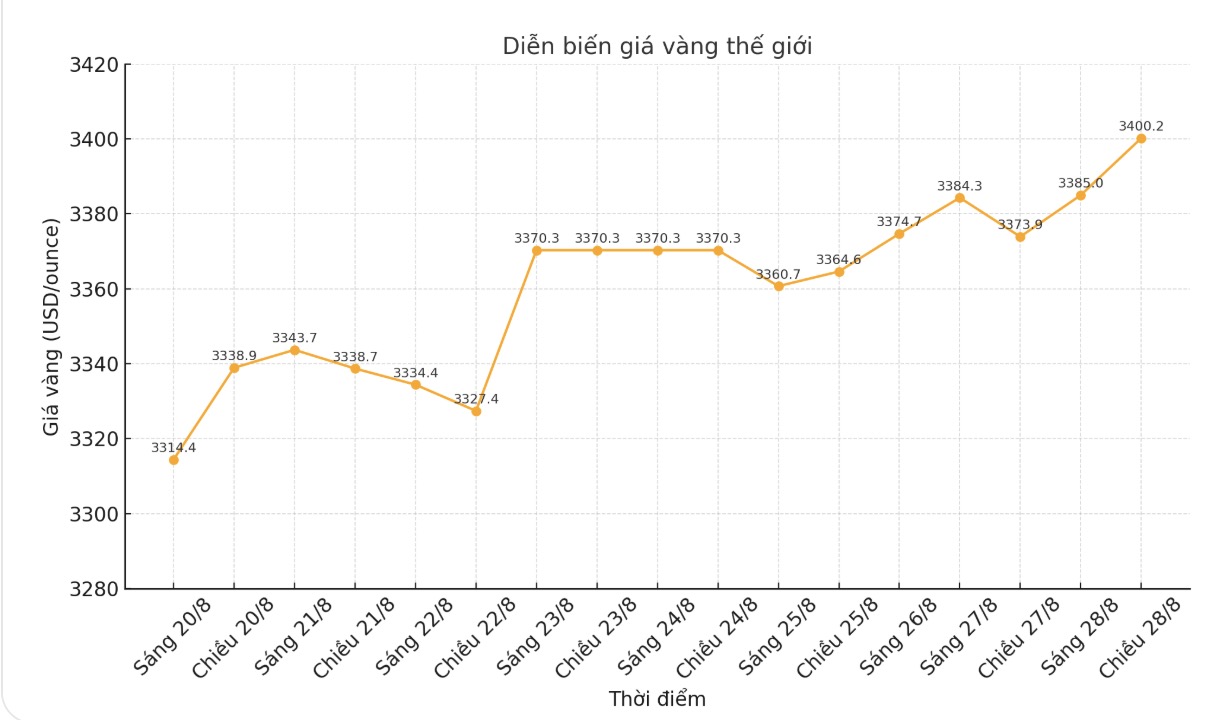

World gold price

The world gold price was listed at 7:45 at 3,400.2 USD/ounce, up 26.3 USD.

Gold price forecast

World gold prices increased as the USD weakened, in the context that investors are waiting for US inflation data to be released on August 29 to predict the policy direction of the US Federal Reserve (FED).

USD Index decreased by 0.3%, making gold more attractive to investors holding other currencies. Analysts say that if the personal consumption expenditure price (PCE) - the FED's preferred inflation measure increases more strongly than expected, the USD and bond yields will increase, putting pressure on gold.

Conversely, weak figures could strengthen expectations of a Fed easing policy, supporting precious metals prices.

According to the CME FedWatch tool, the market now expects an 87% chance of a 0.25 percentage point rate cut at next month's meeting. Gold - which is not interest-bearing - often benefits in a low-interest-rate environment.

A recent speech from New York Fed Chairman John Williams shows that interest rates may fall in the future, depending on upcoming economic data.

Investors also noticed the move of US President Donald Trump when he announced the dismissal of FED Governor Lisa Cook, raising concerns about the independence and reputation of the FED - factors that are considered beneficial for gold.

In other precious metals, spot silver rose 1.2% to 39.08 USD/ounce, platinum inched 0.2% to 1,349.22 USD, and palladium rose 1.1% to 1,103.82 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...