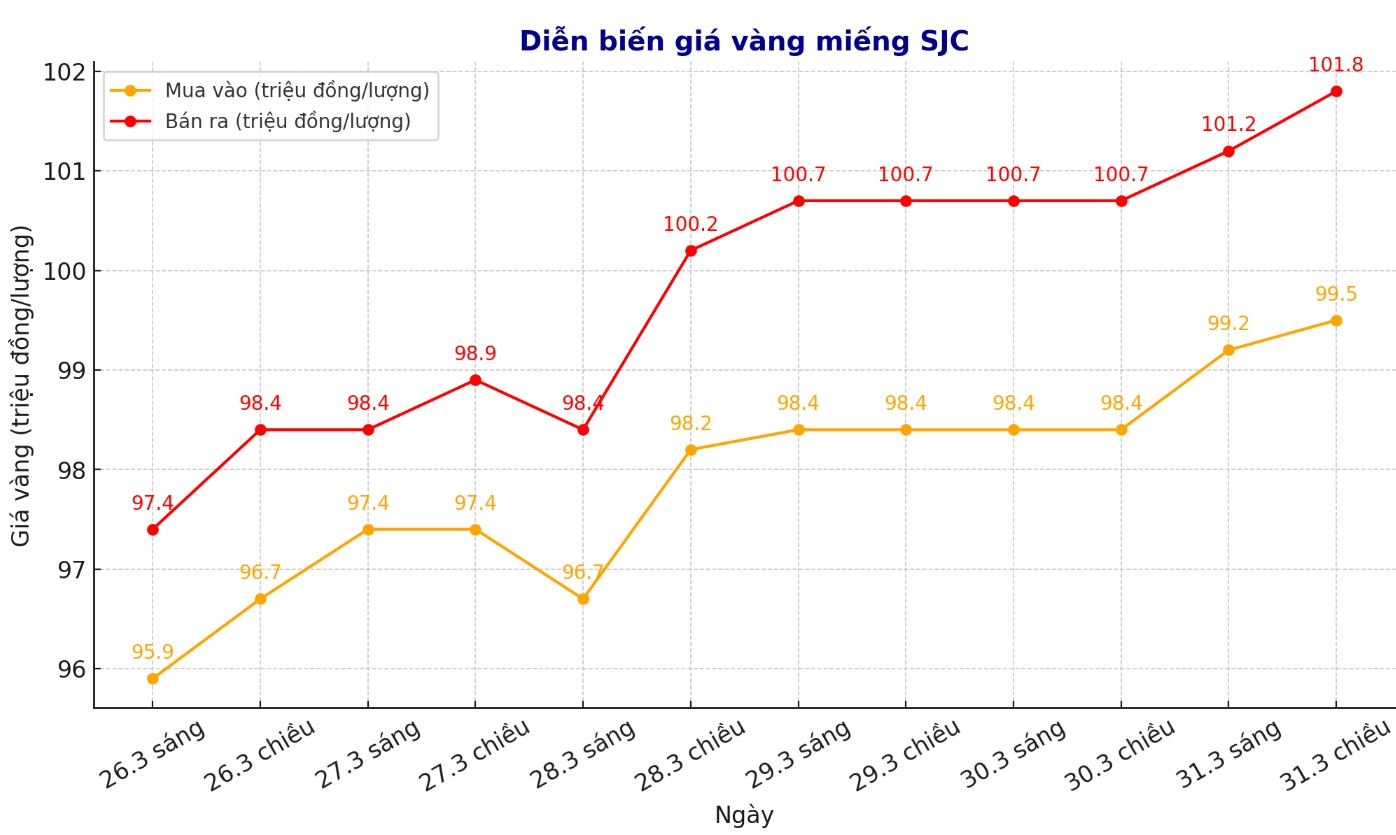

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 99.5-101.8 million/tael (buy - sell), an increase of VND 1.1 million/tael for both buying and selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 99.5-101.8 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 99.5-101.8 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

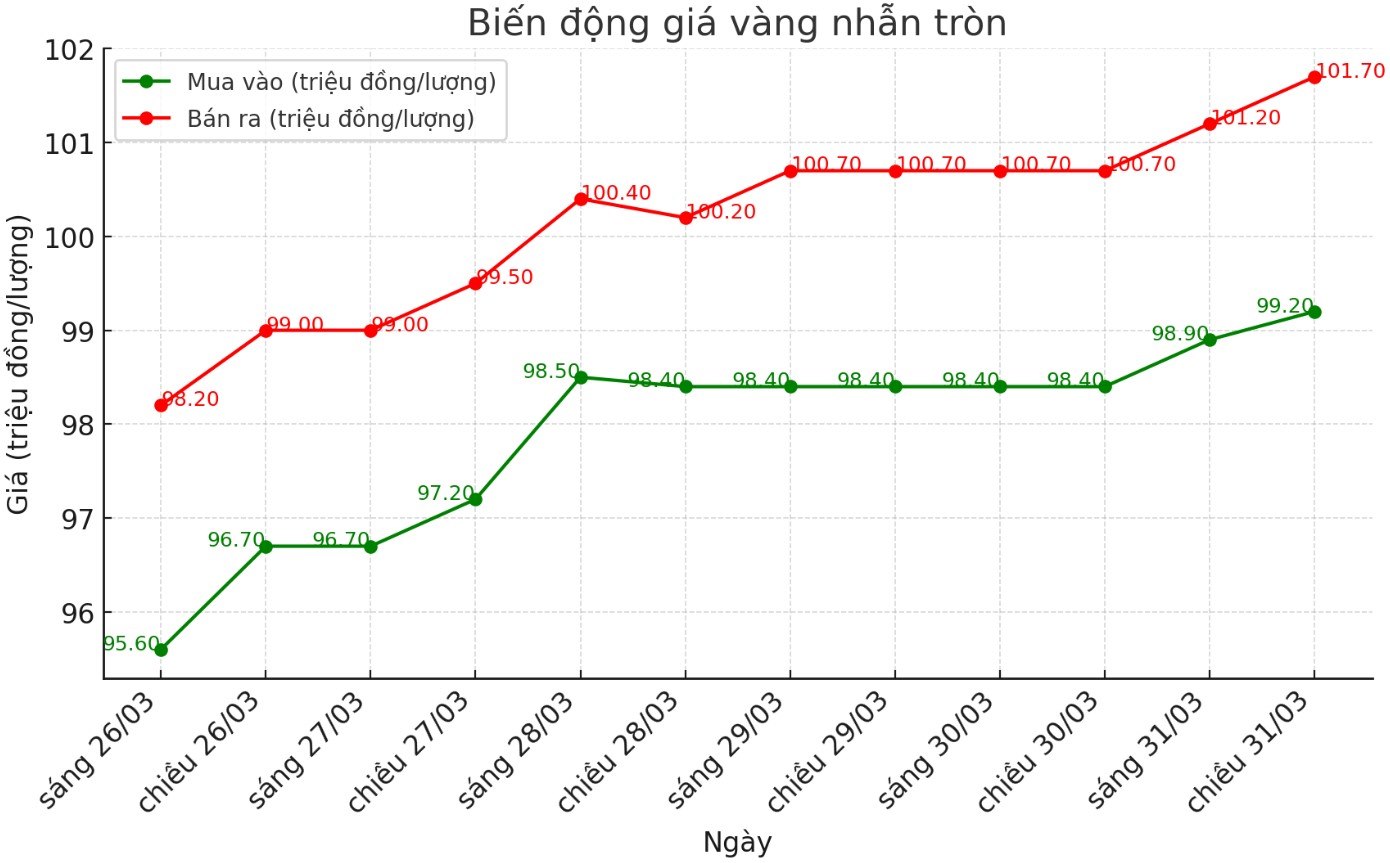

9999 round gold ring price

As of 6:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.2-101.7 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 1 million VND/tael for selling. The difference between buying and selling is listed at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 99.6-101.9 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling is 2.3 million VND/tael.

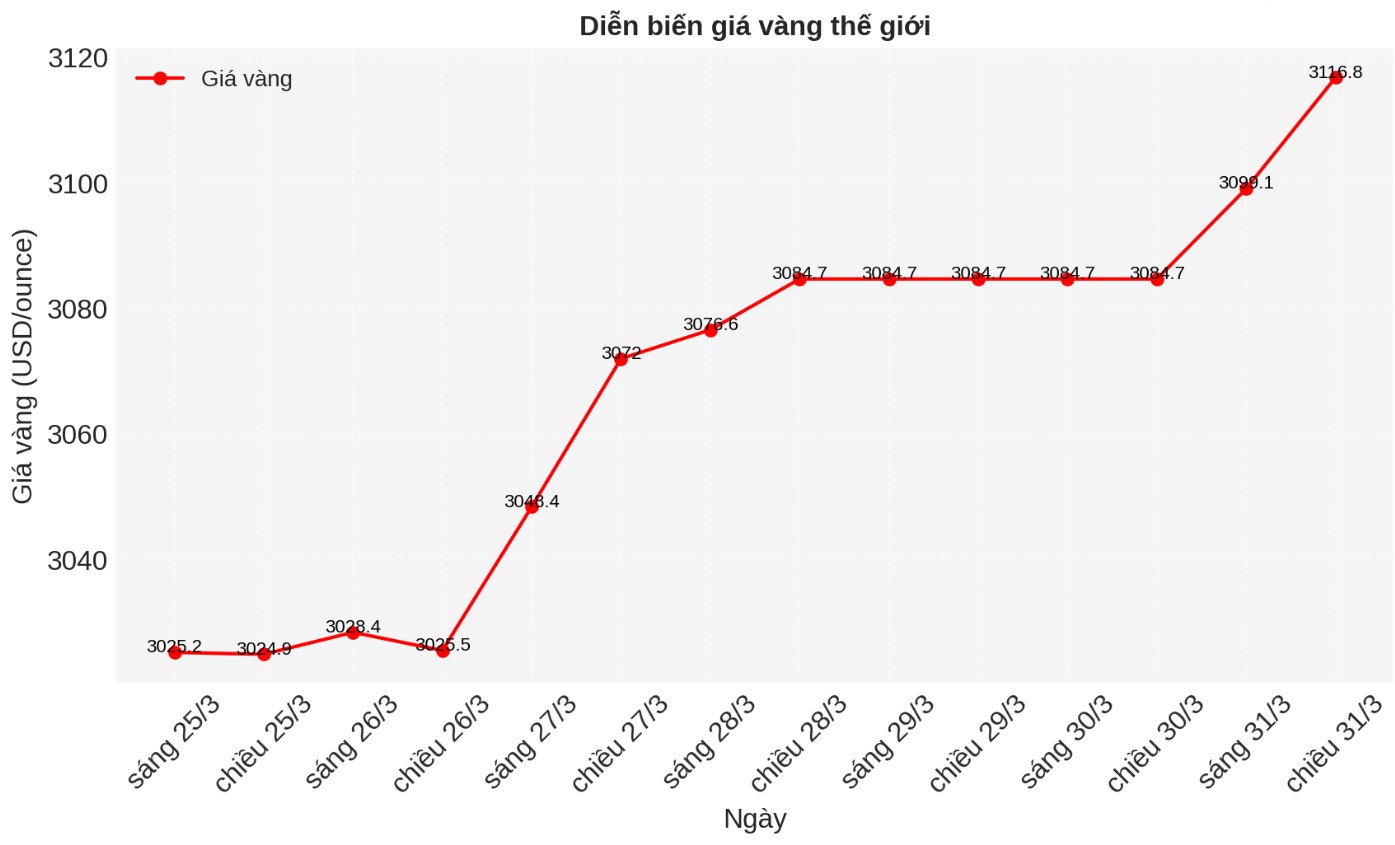

World gold price

As of 6:00 p.m., the world gold price was listed at 3,116.8 USD/ounce, up 32.1 USD/ounce.

Gold price forecast

World gold prices increased as the USD decreased. Recorded at 6:00 p.m. on March 31, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.720 points.

World gold prices surpassed $3,100/ounce due to concerns about US tariffs and increased economic instability.

According to Reuters, this increase comes from a number of reasons such as concerns about US President Donald Trump's tariffs and potential economic impacts, combined with geopolitical concerns. Many supporting factors have fueled a new wave of investment in this safe-haven asset.

Since the beginning of the year, gold prices have set many new records. The precious metal has gained more than 18% in the year, taking advantage of its reputation as a hedge against economic and geopolitical uncertainty.

Earlier this month, gold prices surpassed $3,000 an ounce for the first time, a milestone that experts said reflected growing concerns about economic uncertainty, geopolitical tensions and inflation. The increase in gold prices has caused many banks to raise their gold price forecasts for this year.

Darin Newsom - senior market analyst at Barchart.com also believes that gold prices will increase, because "very simple calculations" - as long as the geopolitical situation is tense, the trend of gold as a safe-haven asset will continue.

John Weyer - director of commercial defense at Walsh Trading commented that gold prices will increase next week as concerns about inflation and tariffs boost safe-haven demand. Weyer stressed that even if the US government reduced the tax rate on April 2, gold still has reason to stay around $3,000. However, if major tariffs are imposed, gold could surge to $3,200 - $3,300/ounce.

Marc Chandler - CEO of Bannockburn Global Forex said that it is difficult to bet on a decrease in gold prices at this time when trade tensions are escalating. Last weekend, Chandler forecasted the next target of $3,100/ounce and commented that gold is "creating its own vitality", no longer dependent on the USD index. By this morning's trading session, gold quickly broke through this threshold.

Jesse Colombo, an independent precious metals analyst, said he is watching key gold futures, such as $2,800 an ounce, $2,900 an ounce and a new support level of $3,000 an ounce. He believes that the uptrend is still strong and there are no signs of excessive excitement (mania) typically seen when the market is at its peak.

James Stanley, senior market strategist at Forex.com, sees buyers still controlling the market and there is no sign of them relinquishing control soon. Despite the potential for a profit-taking trend at the end of the quarter, $3,000/ounce is still playing a solid support role. Stanley recommends not betting on the downtrend unless there is clearer evidence.

See more news related to gold prices HERE...