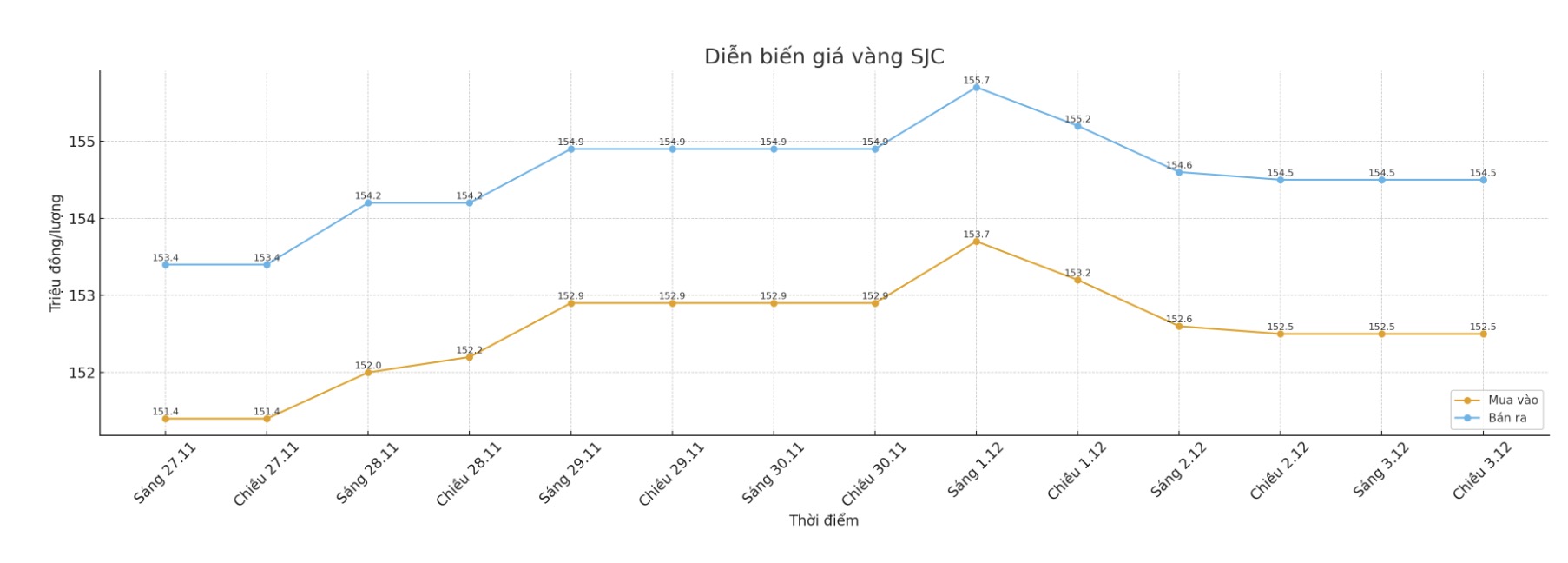

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 152.5-154.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), down 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 3 million VND/tael.

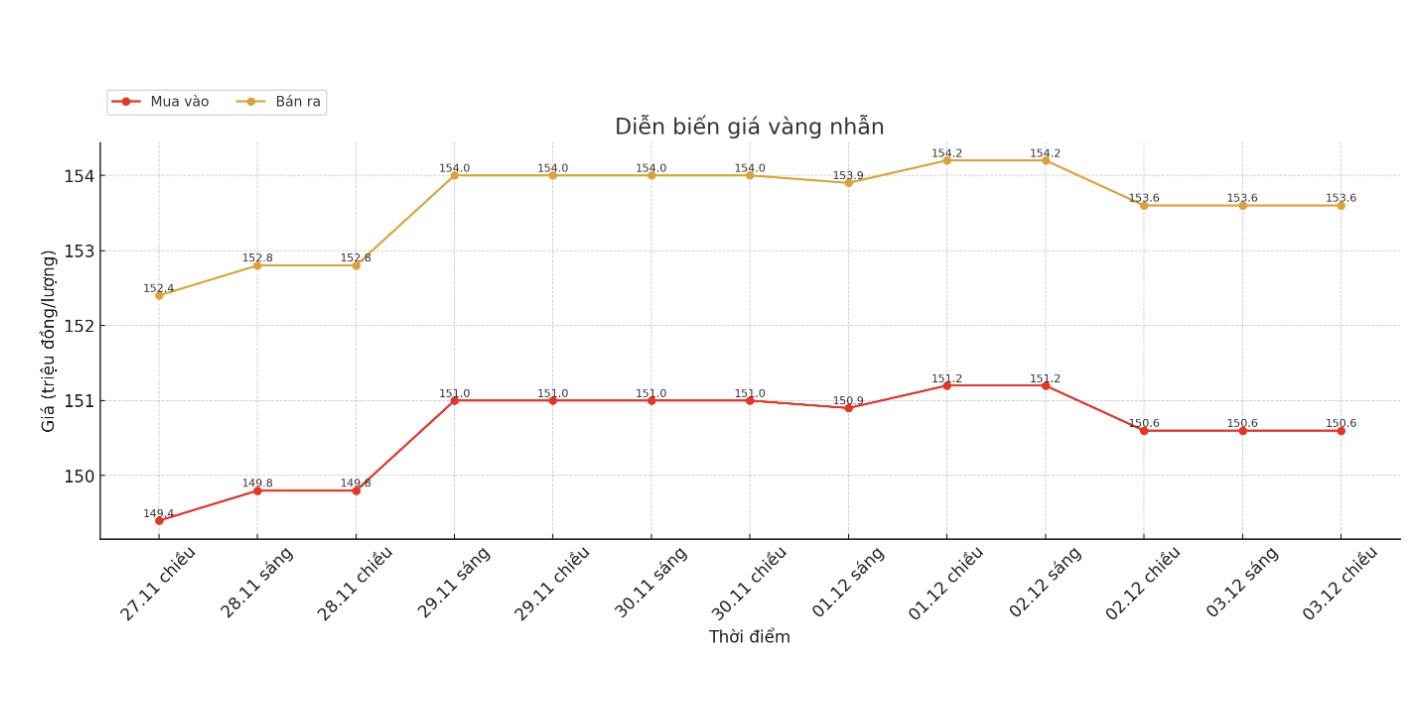

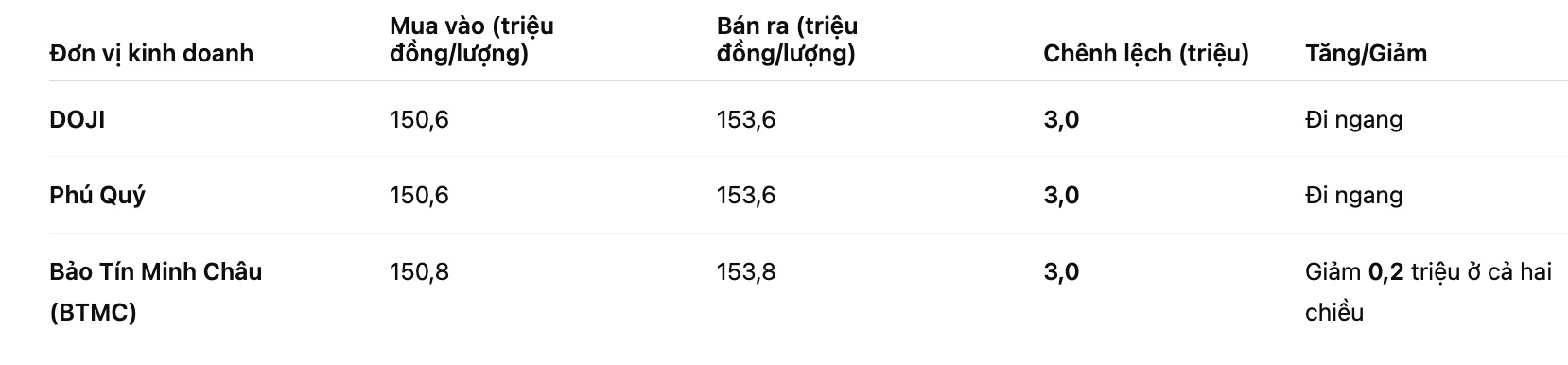

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

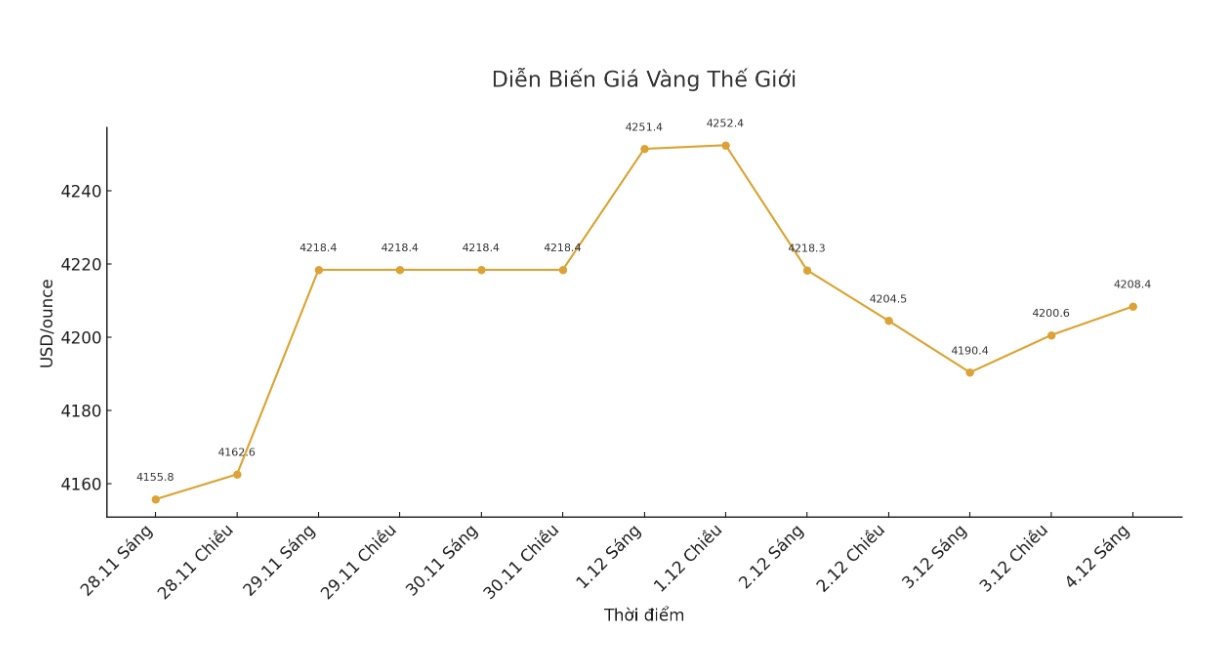

World gold price

The world gold price was listed at 8:10 a.m., at 4,208.4 USD/ounce, up 18 USD compared to a day ago.

Gold price forecast

Gold and silver prices recovered last night, with silver continuing to set a new record and approaching the $60/ounce mark. Silver maintained its gains from the overnight session, while gold expanded its gains to a modest increase after the US economic report weakened beyond forecasts.

Technical buying from speculators also supported the market in midweek, as the short-term charts of both metals showed a clear uptrend.

February gold contract increased by 30 USD, to 4,250.8 USD/ounce. March delivery silver price increased by 0.347 USD, to 59.06 USD/ounce.

The ADP's monthly employment report for November recorded a decrease of 32,000 jobs, contrary to expectations of an increase of 40,000. The data becomes more important as official government reports are still delayed. Today's ADP report is seen as a "puppet" view in US monetary policy who wants to see interest rates cut sooner.

The yield on the 10-year US government bond is around 4.08%, pausing the recent increase as investors consider the policy outlook of the US Federal Reserve (Fed).

The market is currently pricing in an 89% chance of a Fed cutting interest rates by 0.25 points at next week's FOMC meeting, and around 0.9% of the total rate easing by 2026.

Expectations that White House economic advisor Kevin Hassett will likely be nominated as the next Fed Chairman also contribute to strengthening the "dovish" sentiment in the market. Hassett is known for his view of supporting faster interest rate cuts, in line with US President Donald Trump's stance.

Technically, the next bull market target for gold in February is to close above the strong resistance level at an all-time high of $4,433/ounce. The bear's closing target is to push prices below the strong technical support level at $4,100/ounce.

The first resistance level was seen at 4,300 USD/ounce, followed by 4,350 USD/ounce. First support was $4,200 an ounce and then Tuesday's low of $4,194 an ounce.

In outside markets, the USD index fell to a three-week low. Crude oil prices increased, trading around 69.5 USD/barrel.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...