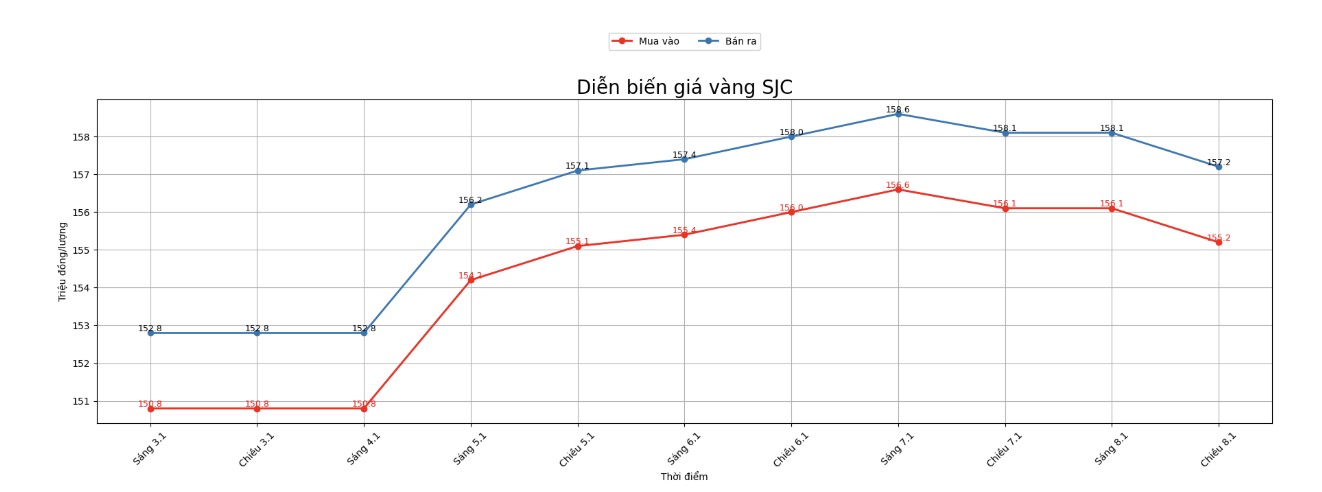

SJC gold bar price

As of 6:35 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

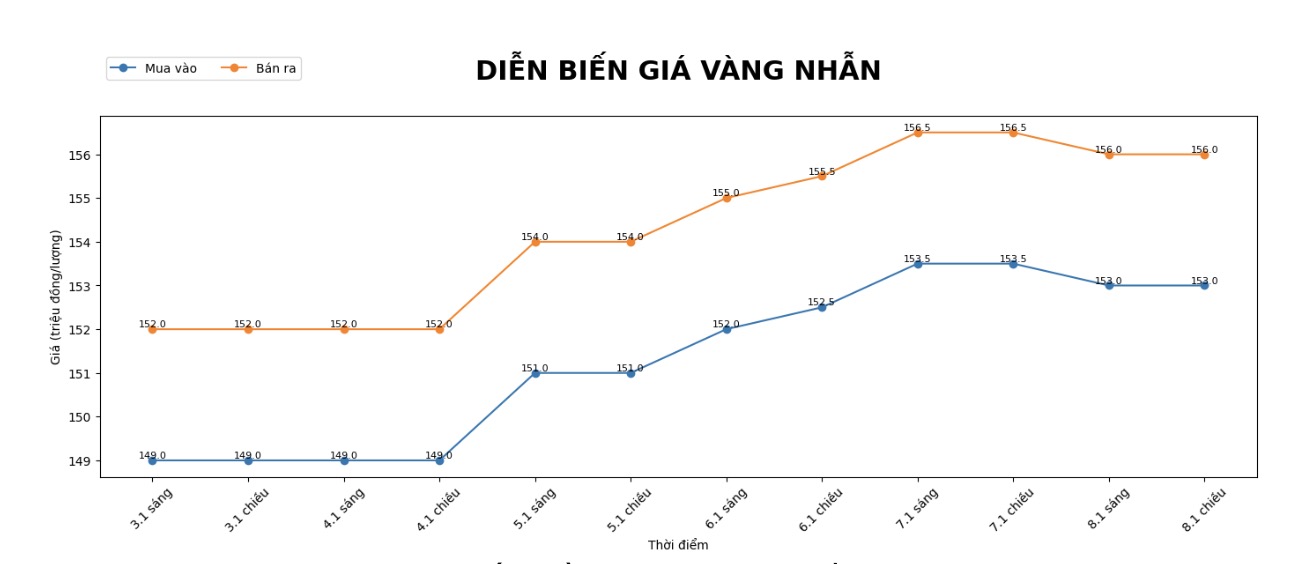

9999 gold ring price

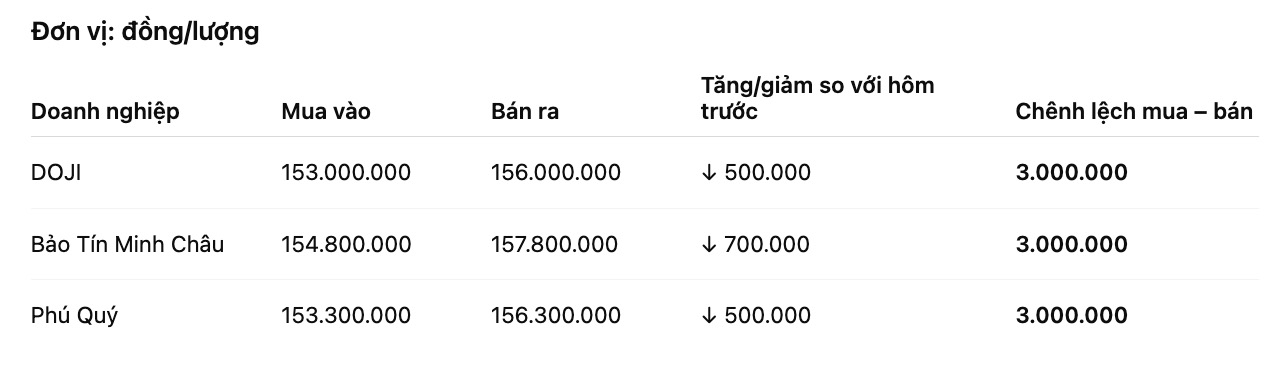

As of 6:35 PM, DOJI Group listed the price of plain gold rings at 153-156 million VND/tael (buying - selling), down 500,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.8-157.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153.3-156.3 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

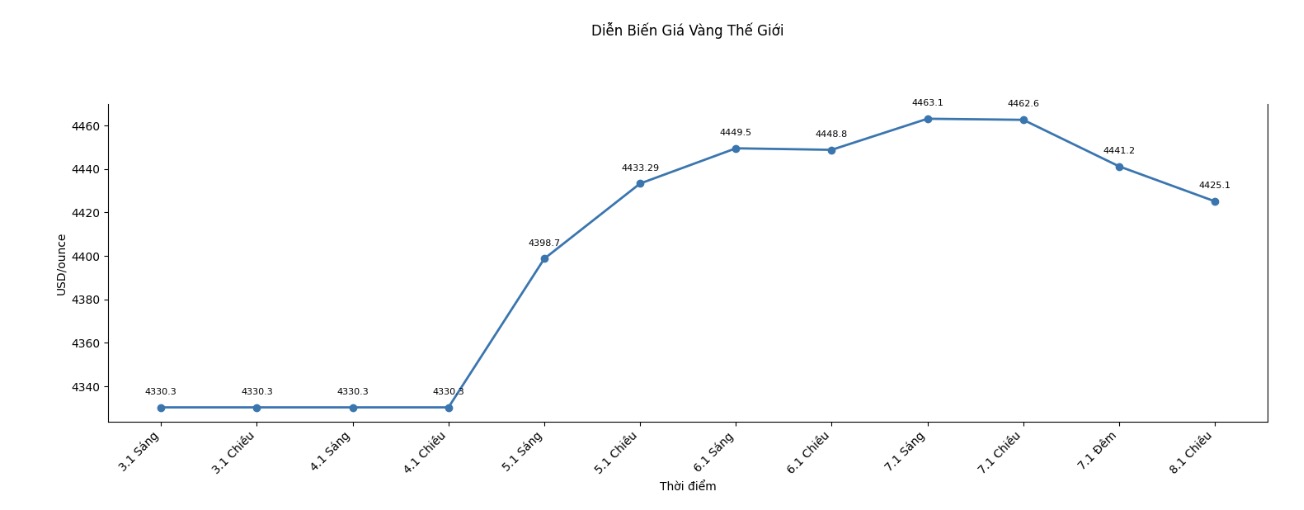

World gold price

World gold price listed at 18:38 at the threshold of 4,425.1 USD/ounce USD/ounce USD/ounce, down 37.5 USD compared to the previous day.

Gold price forecast

The downward trend of gold prices in the session on January 8 was assessed by analysts as mainly technical and short-term, in the context of the global market entering the portfolio restructuring phase at the beginning of the year.

Increased selling pressure caused world gold prices to fall deeply compared to previous sessions, leading to domestic gold prices adjusting down in both SJC gold bars and gold rings. However, many opinions believe that the current correction momentum is not enough to reverse the long-term upward trend of precious metals.

According to experts, the restructuring of the global commodity index is a strong factor dominating the market in the short term. The fact that investment funds sell off strongly increased assets to rebalance their portfolios may cause gold prices to continue to fluctuate in the next few sessions.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank said that in this rebalancing phase, the futures contract market may record sales of up to billions of USD. However, he emphasized that this is a technical pressure, not reflecting the weakening of the fundamentals.

From a macroeconomic perspective, many driving forces supporting gold prices remain intact. The USD is in a high zone, but the medium-term outlook is assessed as unsustainable as the market continues to bet on the possibility that the US Federal Reserve (Fed) will cut interest rates this year. In addition, concerns about public debt, geopolitical risks and the trend of diversifying reserve assets still promote the need to hold gold as a defensive asset.

Another noteworthy point is that the level of US investors' participation in gold is still low compared to history. According to analysis by Goldman Sachs, the proportion of gold in the US financial asset portfolio currently accounts for only a very small part, although gold prices have continuously peaked in recent times.

The large gap between the recommendation to increase gold allocation and the actual actions of investors is considered room for new cash flow to return to the precious metal market in the near future.

In the medium and long term, many financial institutions still maintain a positive view of gold. HSBC Bank forecasts that gold prices may reach the 5,000 USD/ounce mark in 2026, as geopolitical risks and global financial instability continue to increase.

Mr. Ole Hansen also said that gold is increasingly seen as an important monetary asset, playing a part role in replacing the USD in the context of fragmented global financial order.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...