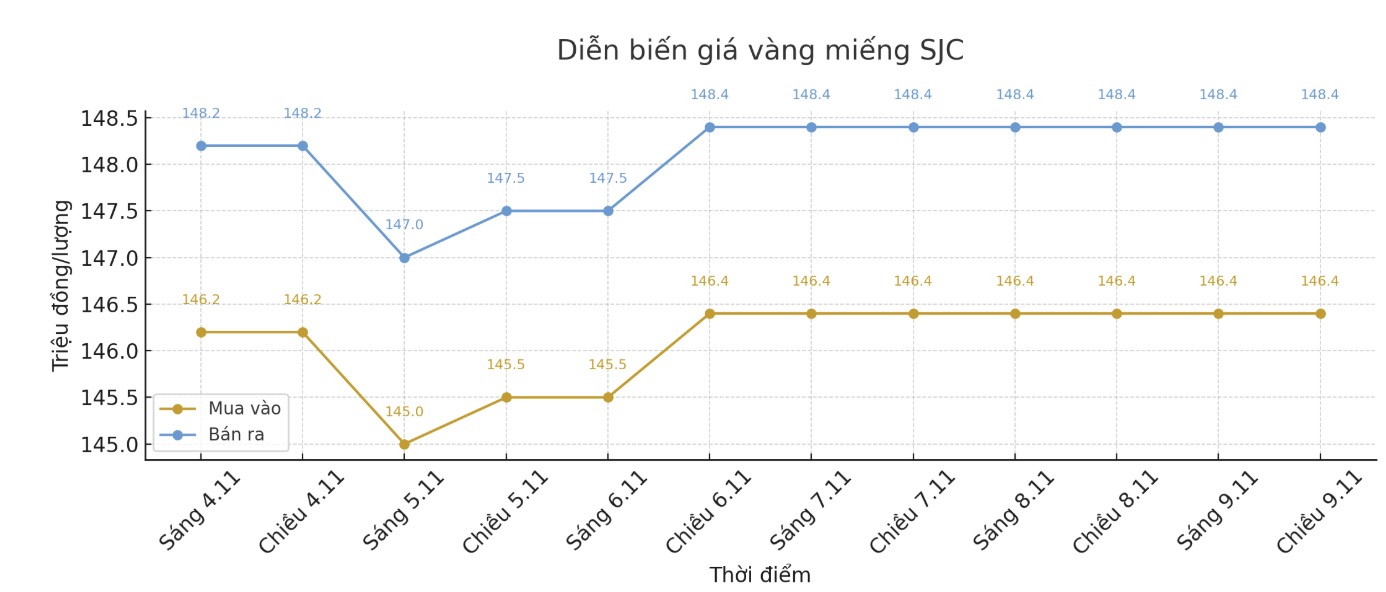

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

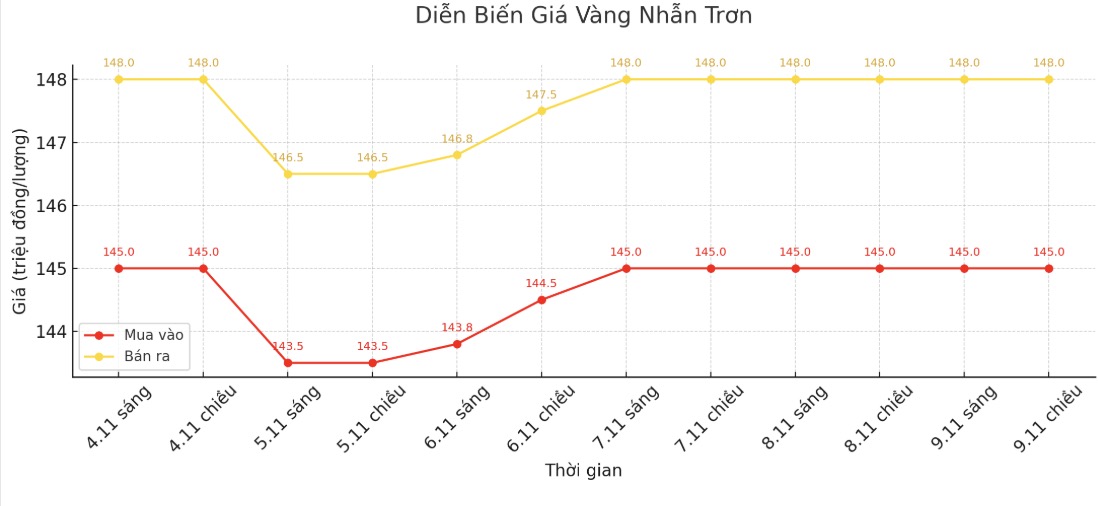

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:00 a.m., at 3,999.6 USD/ounce, up 6.5 USD compared to a day ago.

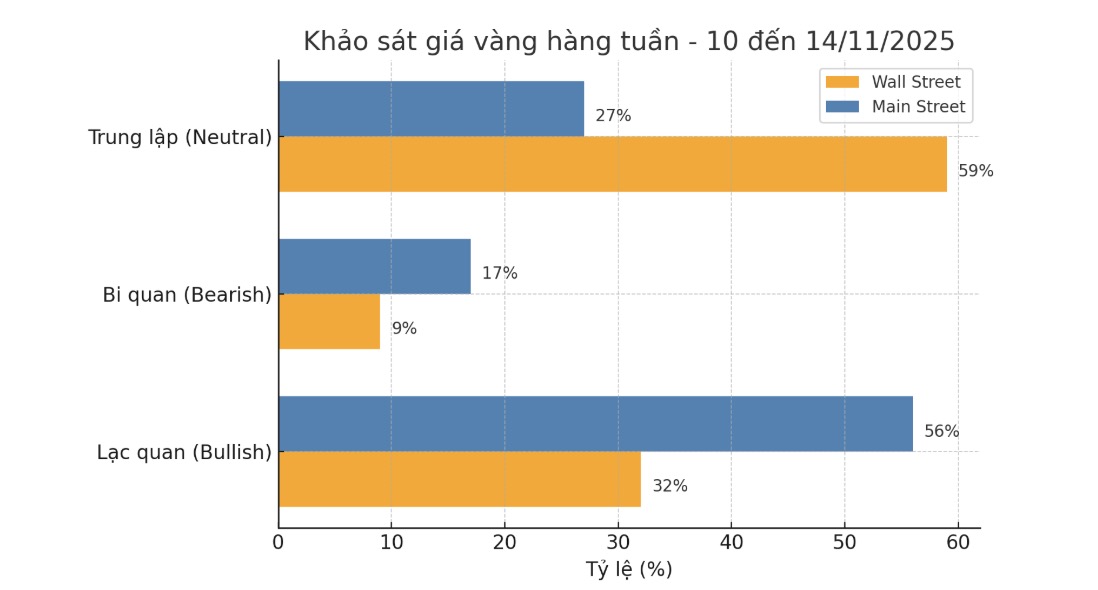

Gold price forecast

This week, 21 Wall Street experts participated in the gold price survey. Of these, 13 people (59%) are neutral on the short-term gold price trend. At the same time, 7 experts (32%) predicted that gold prices would increase during the week, while only 2 people (9%) said that prices would decrease.

For small investors, the online survey on social networks recorded 221 votes. Of these, 123 (15.7%) expect gold prices to rise for the week. In contrast, 39 people (17.6%) predict prices will decrease, while 59 people (26.7%) believe the market will move sideways in the short term.

Mr. Darin Newsom - Senior Analyst at Barchart.com - said that in the current context of instability and geopolitical fluctuations, the gold price movement is no different from "a gamble tossing coins" - unpredictable or unpredictable. However, he still maintains a positive view on this precious metal.

Can gold prices increase again? Maybe. But is that certain to happen? Absolutely not. We cant know what the US president will say, what he will do or what he will post next. Like many other markets - although not too extreme - the gold market is now affected by " winds" from a single individual with a social media account. I didn't think the market was designed to operate in this way, but that is the reality we are facing," he said.

Unfortunately for investors, the lack of US key economic data has caused the market to lack the necessary basic drivers. The US government's closure, now lasting for 38 days - the longest in history - is leaving the market at a deadlock.

Meanwhile, Mr. Aaron Hill - Head of Analysis at FP Markets - said: "I see the current period of gold moving sideways around $4,000/ounce as a typical break in the structural uptrend. Prices have fluctuated in the range of 3,950 - 4,060 USD/ounce over the past week.

This is an adjustment period after a spectacular increase of more than 48% since the beginning of the year, driven by safe-haven demand amid geopolitical tensions and central bank purchases.

The current main question - which direction is the risk leaning towards - in my opinion is still leaning towards an uptrend, with the base scenario towards the target of 4,200 USD/ounce by the end of the year. However, if prices break above $3,950 an ounce, it could signal a short-term decline to $3,900 an ounce or less.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...