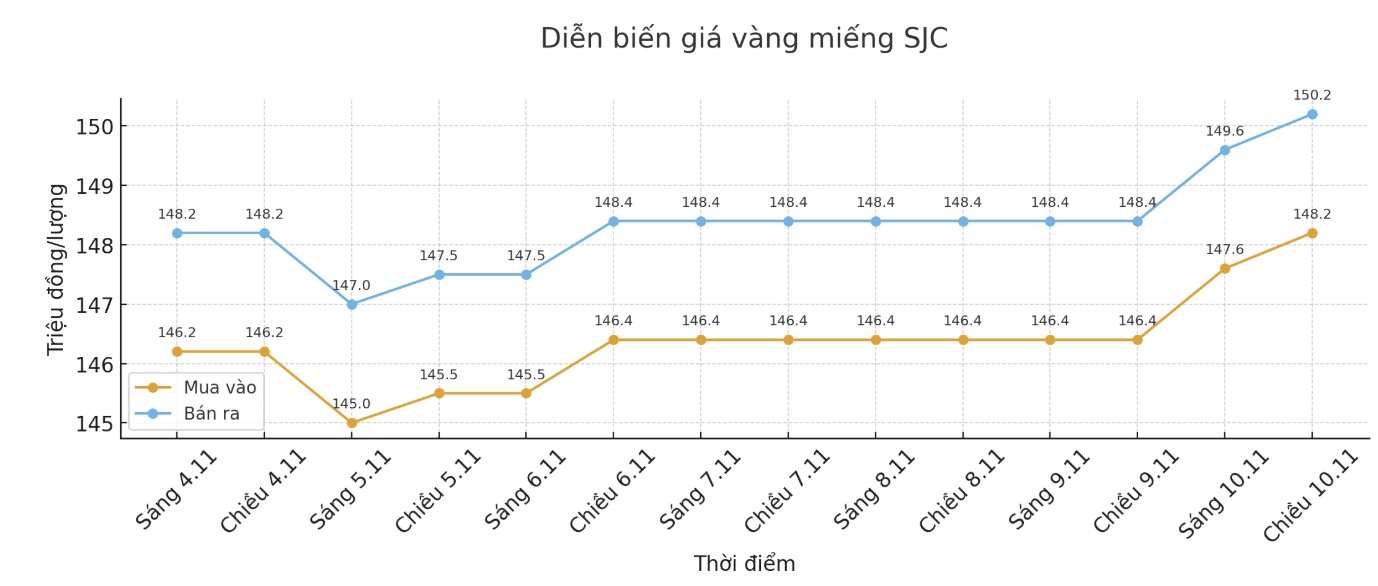

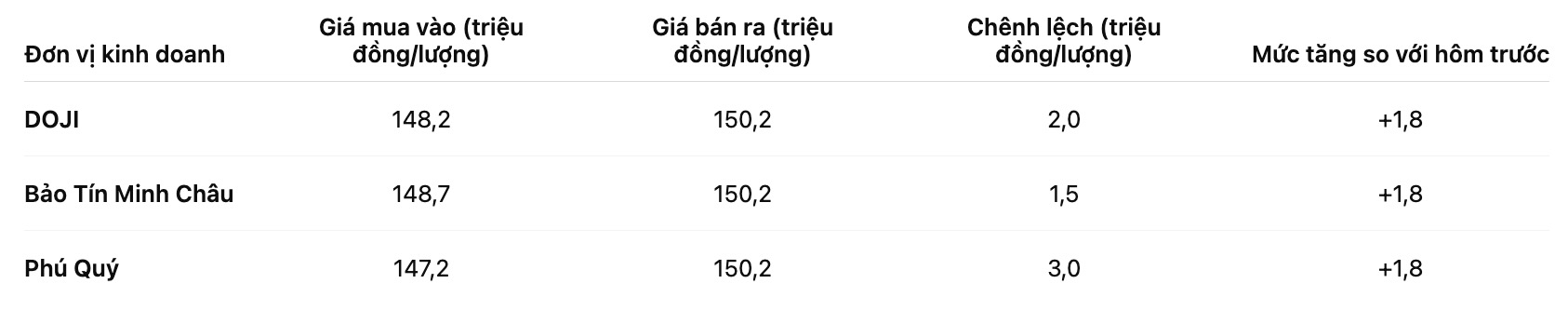

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 148.2-150.2 million VND/tael (buy in - sell out), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.7-150.2 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.2-150.2 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

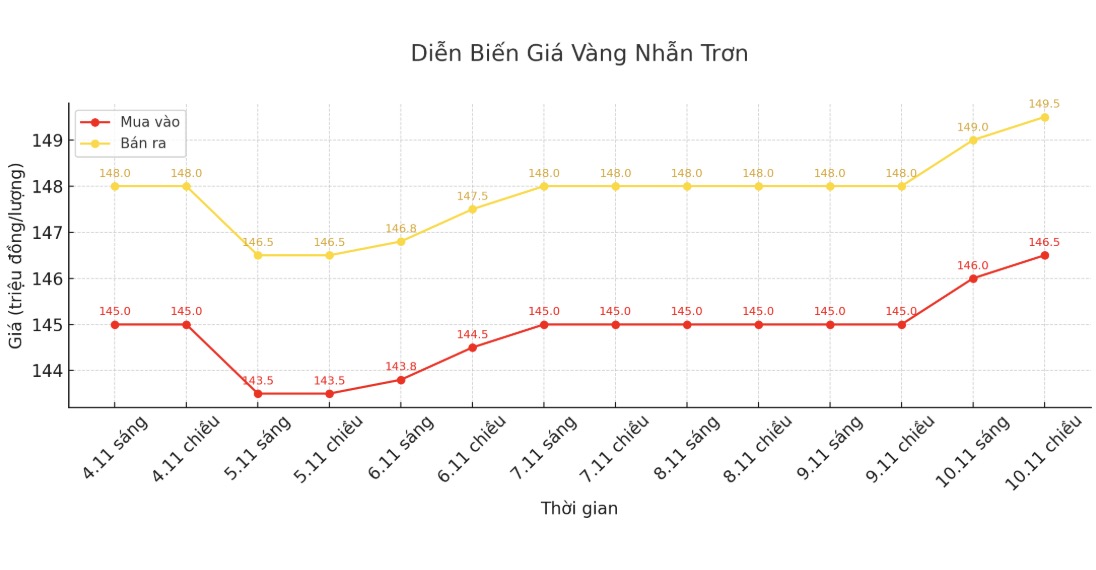

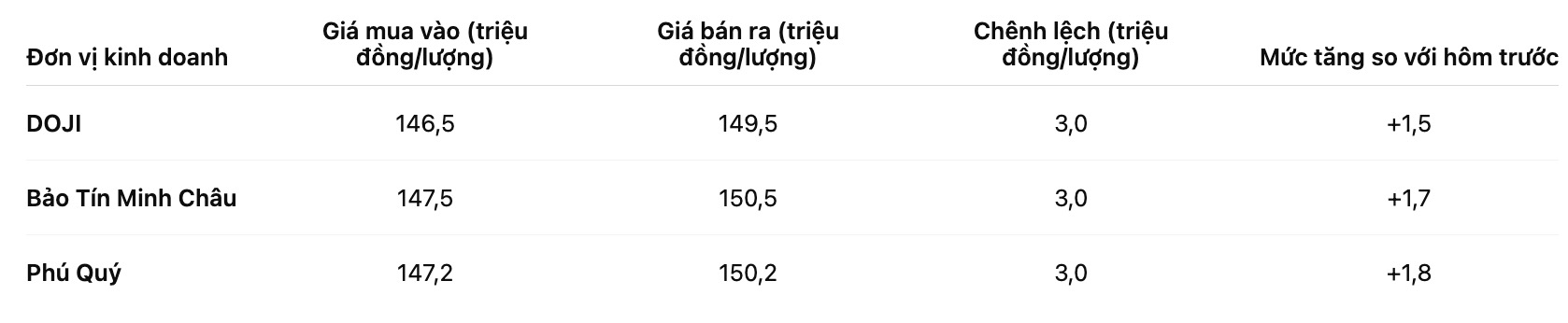

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.2-150.2 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

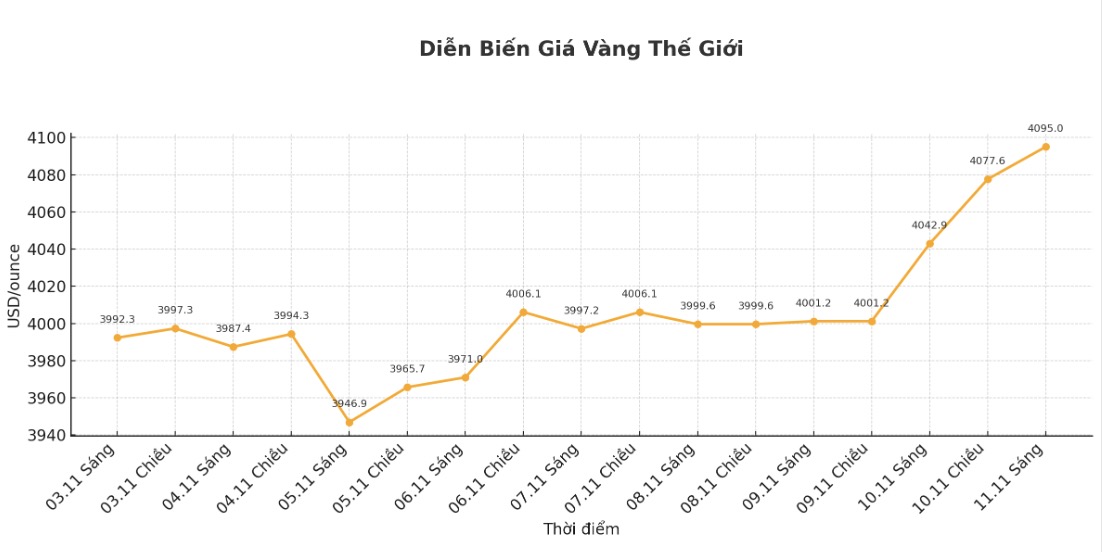

World gold price

The world gold price was listed at 0:08, at 4,095 USD/ounce, up 95.4 USD compared to a day ago.

Gold price forecast

Gold prices are boosted as weak US economic data reinforces expectations of a rate cut by the Federal Reserve (FED) next month, while a weak USD, along with a series of weak economic data, raises concerns about global growth.

The US economy lost jobs in October, mainly in the government and retail sectors, while cost cuts and the application of artificial intelligence (AI) caused the number of layoff notices to increase sharply, according to data released last week.

According to CME FedWatch tool, investors now see a 67% chance of the Federal Reserve cutting interest rates in December. Gold - un interest-bearing assets often benefit in a low interest rate environment and when economic instability increases.

There are many concerns about the US economy as weak data and the focus of the market is still the US dollar index, said Jigar Trivedi, senior analyst at Reliance Securities.

He added that demand for gold as a safe haven asset has increased, as the prolonged trade war and geopolitical tensions continue to escalate, thereby supporting the price of precious metals.

Technically, December gold contracts are being dominated by buyers. The next upside target is to close above strong resistance at $4,200/ounce. In contrast, the nearest downside target for sellers is to push prices below the solid technical support level at the October low of $3,901.30/ounce.

The first resistance level was recorded at 4,150 USD/ounce, then 4,175 USD/ounce. The first support was $4,050 an ounce and then the lowest level of the night at $4,004.2 an ounce.

Investors are also waiting for the October inflation report, due on November 13. Experts forecast the consumer price index (CPI) to increase by 0.2%, while the core CPI increased by 0.3% compared to the previous month. October retail sales, released on November 14, will also provide additional signals of US consumer health.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...