SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 153.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

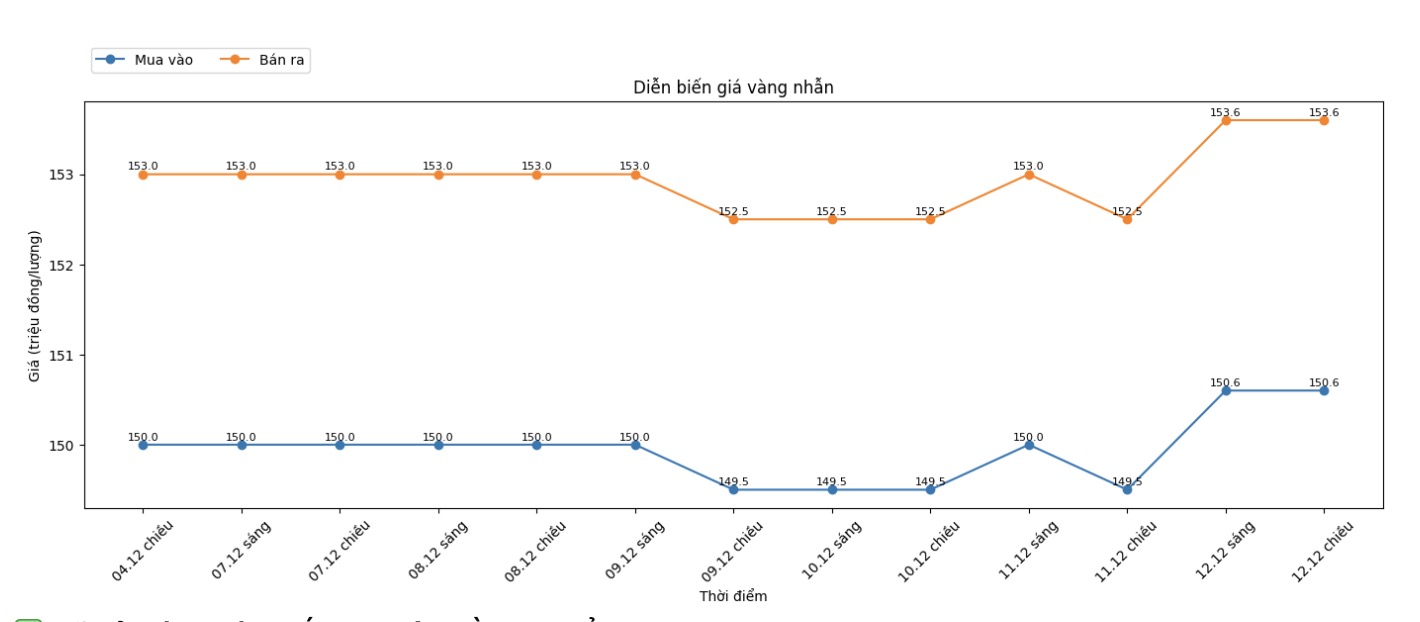

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

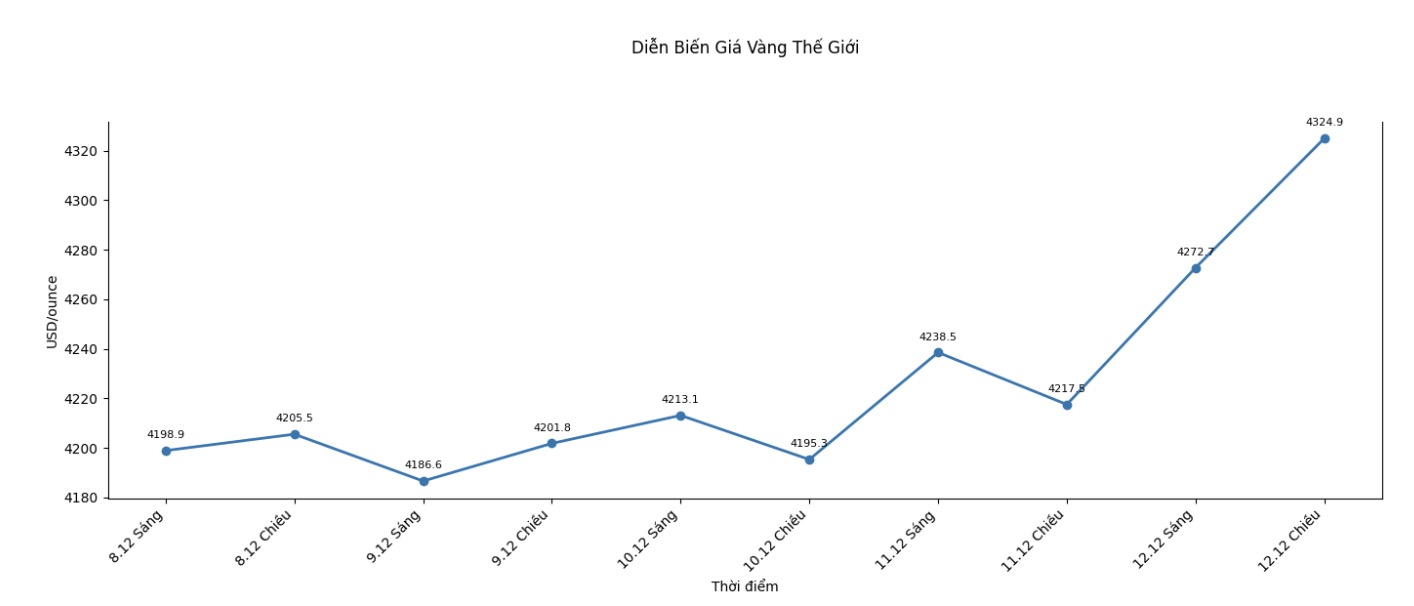

World gold price

The world gold price was listed at 7:20 a.m., at 4,337.8 USD/ounce USD/ounce, up 95.2 USD compared to a day ago.

Gold price forecast

Gold prices have broken out, seeing strong technical buying power, supported by the US Federal Reserve's unexpected loose stance, along with the weakening of the USD index.

In addition, the sharp increase in weekly jobless claims in the US, along with US-Venezuela tensions, is supporting gold prices and maintaining safe-haven demand, said Mr. Zain Vawda, an analyst at MarketPulse of OANDA.

The number of unemployment claims in the US increased the most in nearly 4 and a half years last week, reversing the sharp decline of the previous week.

The US Federal Reserve (Fed) cut interest rates by 25 basis points for the third time this year on Wednesday, but signaled caution for further cuts.

Investors are now betting on two rate cuts next year, and the US non-farm payrolls report due next week could provide further clues on the Fed's upcoming policy direction.

The global stock market mostly decreased in points in the overnight trading session. US stock indexes are expected to open down as they enter the day-to-day trading session in New York.

Technically, buyers for February gold futures are aiming for the next upside target of closing above the strong resistance zone at $4,433/ounce, which is also a record high for the contract. On the other hand, the short-term bearish target for the bears is to push prices below the important technical support zone at $4,200/ounce.

The nearest resistance zone was determined at 4,400.00 USD/ounce, followed by 4,433 USD/ounce. The support levels were at 4,300 USD/ounce and the bottom recorded in the overnight trading session was 4,295.5 USD/ounce.

In key outside markets, the USD index picked up slightly again after hitting a six-week low on Thursday. Crude oil prices fell slightly, trading around 57.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.17%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...