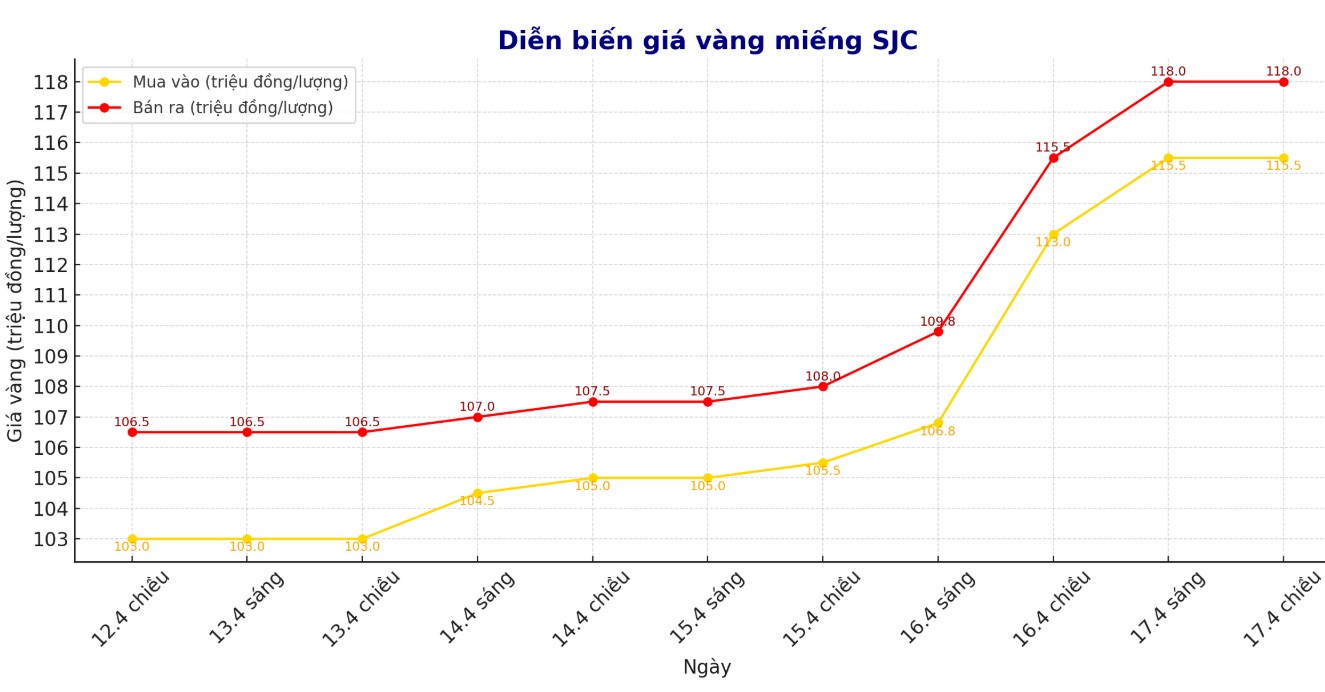

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118 million/tael (buy in - sell out); increased by VND2.5 million/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.5-118 million VND/tael (buy - sell); an increase of 2.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell); increased by 3 million VND/tael for buying and increased by 2.5 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

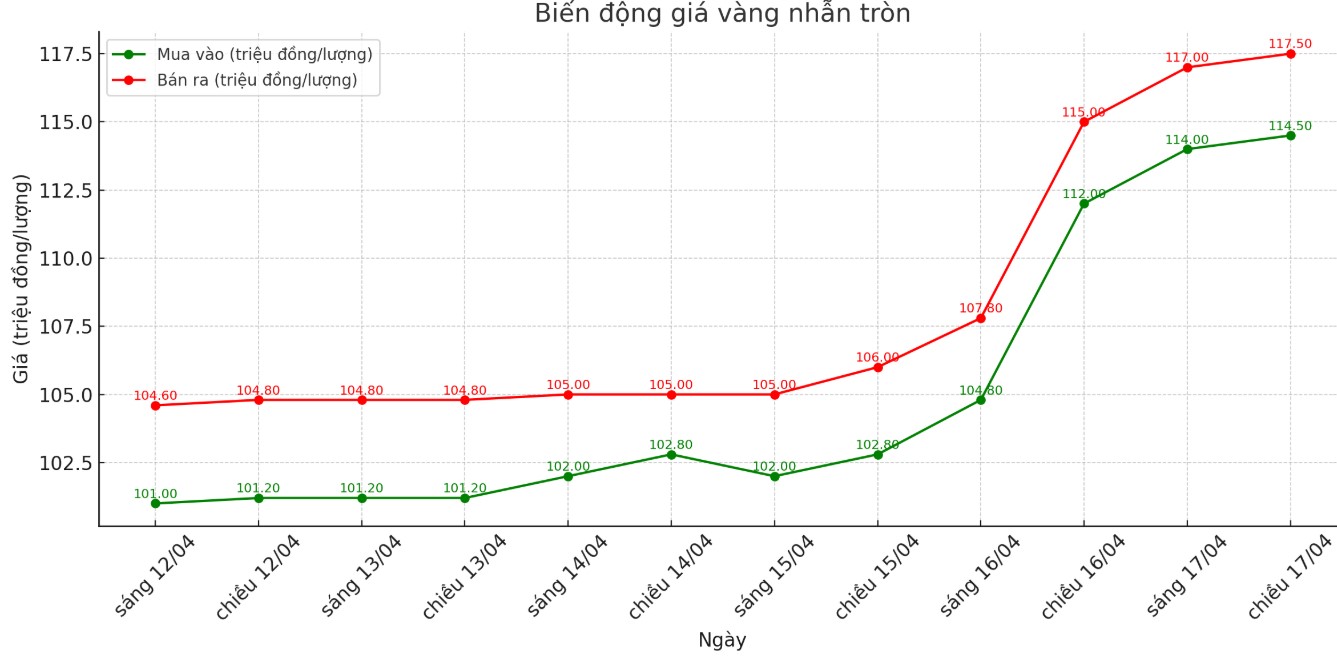

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-117.5 million/tael (buy in - sell out); increased by VND 4 million/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); an increase of 3 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

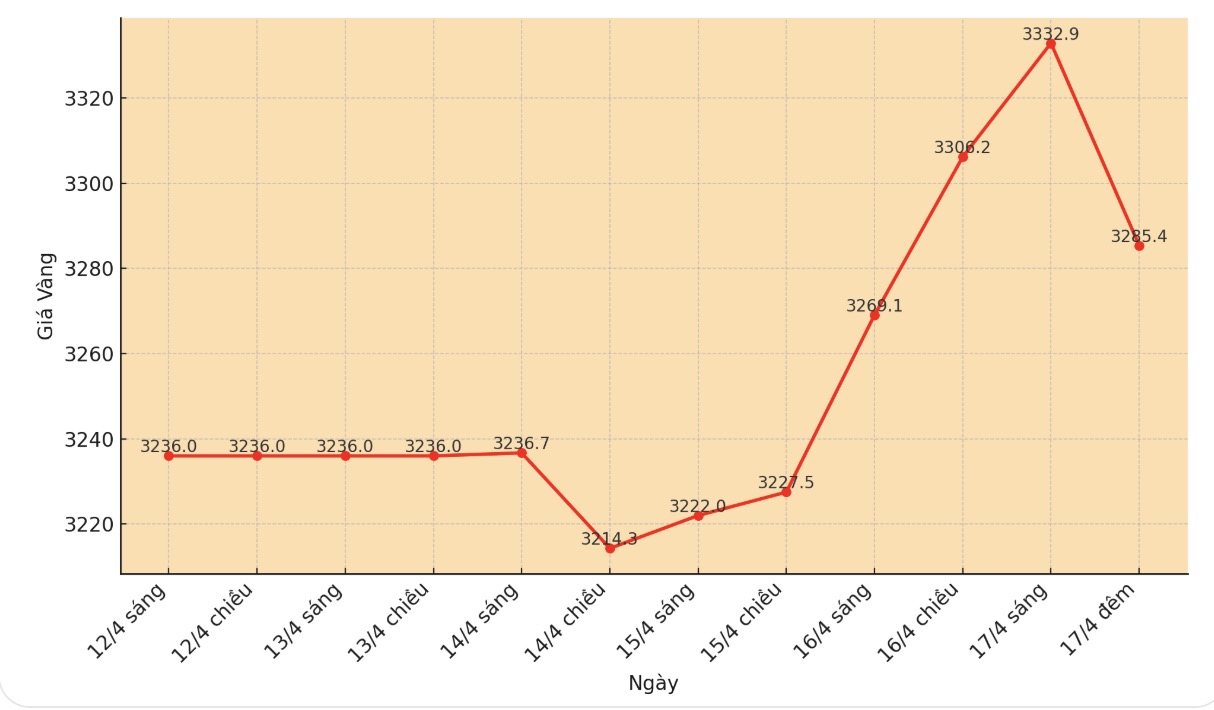

World gold price

As of 22:00 on April 17, the world gold price was listed at 3,285.4 USD/ounce, down sharply by 42.7 USD.

Gold price forecast

According to Kitco, gold prices fell on Thursday morning after hitting a new record of $3,371.9/ounce (according to the June gold futures contract on the Comex) in the night trading session. Market risk-off sentiment remains strong, continuing to boost safe-haven demand for gold.

The Asian and European stock markets fluctuated in opposite directions during the night session. Asian stocks have mostly increased, while Europe has mainly decreased. The US stock index is expected to open slightly in the trading session in New York.

Investors are still not finished discussing the speech of Federal Reserve Chairman Jerome Powell on Wednesday afternoon in Chicago. In his speech, he tended to be "happy" (ie, inclined towards tightening policies), warning that trade tariffs could increase inflation and unemployment.

He also expressed concern about the risk of "stagflation" (ie slow economic growth while inflation remains persistent). This statement caused the US stock market to turn to decrease. On social media, US President Donald Trump harshly criticized Mr. Powell, saying that his speech was a " mess" and calling for his dismissal.

The European Central Bank (ECB) also held a monetary policy meeting. As expected, the ECB continued to cut three key interest rates by 25 basis points on Thursday. Interest rates for deposits, major refinancing and frontier lending will decrease to 2.25%, 2.40%, and 2.65%, respectively.

Technically, June gold bulls are still dominating in the short term. The next target for buyers is to close above strong resistance at $3,500/ounce. Meanwhile, the target for the sellers is to pull the price below the solid technical support level of 3,200 USD/ounce.

The first resistance level was 3,371.9 USD/ounce, followed by 3,400 USD/ounce. The first support level was the bottom of overnight at $3,325.5 an ounce, followed by $3,300 an ounce.

For outside markets, the USD index is strengthening. Nymex crude oil futures increased slightly, currently trading around 63.25 USD/barrel. The yield on the 10-year US government bond is at 4.31%.

See more news related to gold prices HERE...