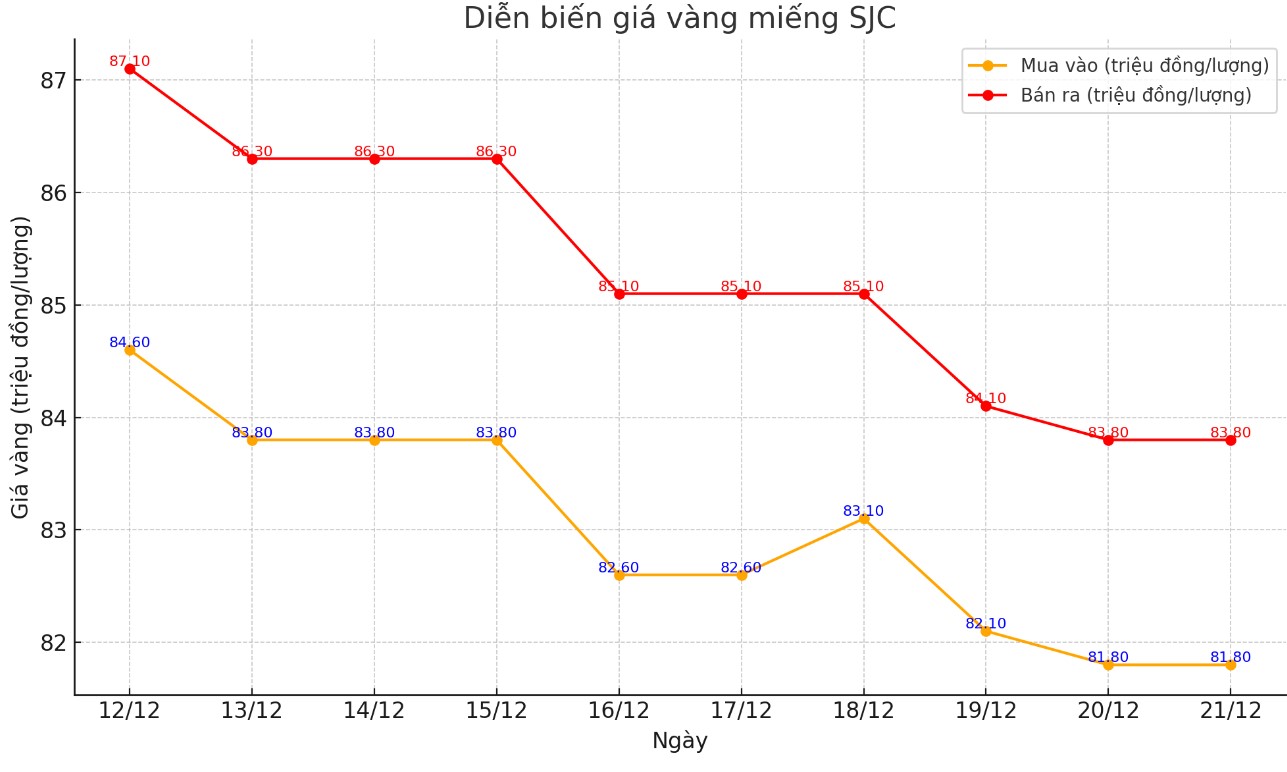

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND81.8-83.8 million/tael (buy - sell); down VND300,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 81.8-83.8 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82-83.8 million VND/tael (buy - sell); down 100,000 VND/tael for buy and down 300,000 VND/tael for sell.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.8 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

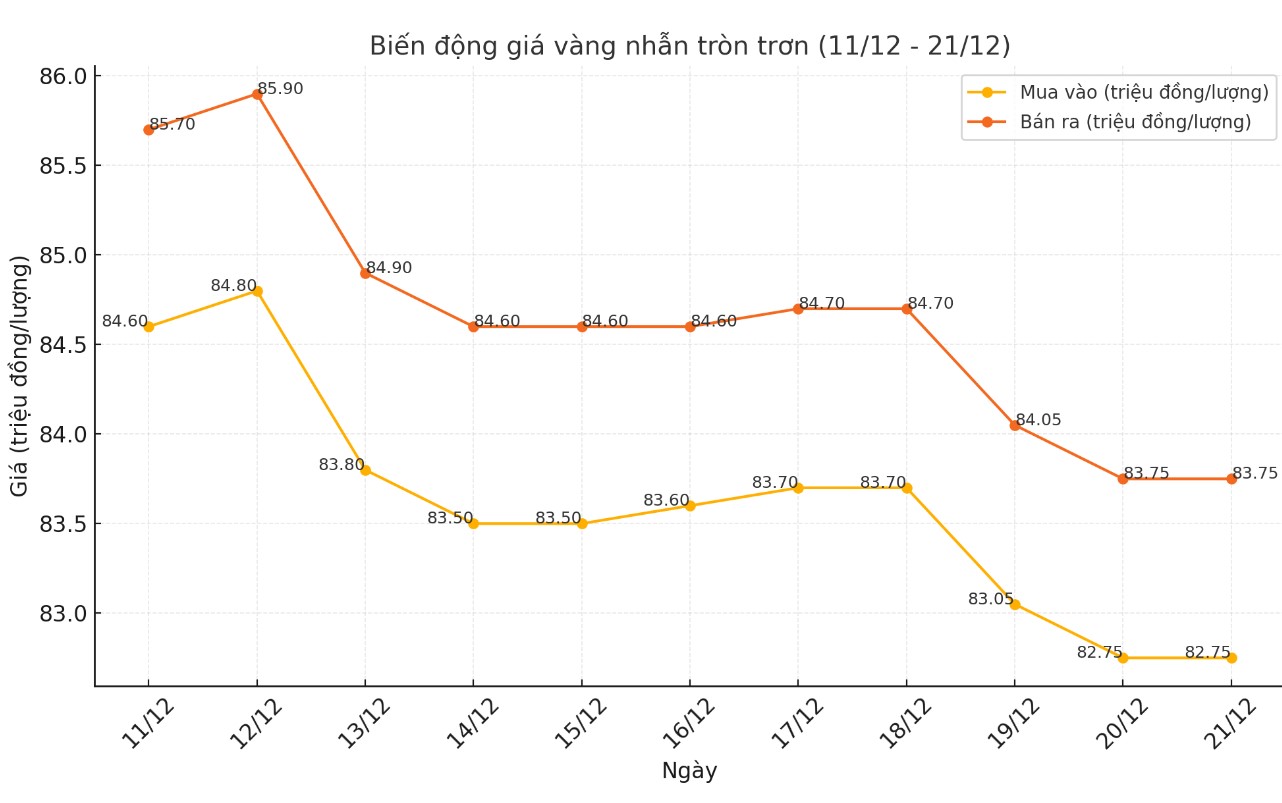

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.75-83.75 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.3-83.8 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the beginning of yesterday's trading session.

Although the price of gold rings has dropped sharply, it may rebound today as the world market is clearly improving. The price of gold rings often moves in the same direction as the world gold price.

World gold price

As of 11:45 p.m. on December 20 (Vietnam time), the world gold price listed on Kitco was at 2,625.4 USD/ounce, an increase of 31.6 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices increased sharply in the context of a sharp decline in the USD index. Recorded at 23:50 on December 20, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.150 points (down 0.64%).

Gold prices fell after a U.S. inflation report showed a slightly lower increase than expected. Short-term futures traders also covered their losses after gold hit a four-week low on Thursday.

The just-released U.S. Personal Income and Spending Report for November showed that the PCE inflation index rose 2.4% year-over-year, while the PCE core inflation rose 2.8%. These figures were slightly lower than expected, and are data that Federal Reserve officials are paying close attention to.

Stock indexes in Asia and Europe were mostly lower overnight. In the US, stock indexes were expected to open lower in New York, but rebounded slightly from multi-week lows after the PCE data was released.

Risk-off sentiment intensified over the weekend as the Republican-controlled U.S. House of Representatives rejected a temporary government funding plan backed by President-elect Donald Trump, raising the risk of a government shutdown. House Speaker Mike Johnson said Republicans would come up with another solution.

Other major markets saw WTI crude oil prices on the Nymex exchange fall slightly, trading around $69/barrel. The yield on 10-year US government bonds is currently around 4.5%, the highest level since May.

Those betting on higher February gold futures no longer have the near-term technical advantage. The bulls’ next target is to close above the key resistance level at $2,700 an ounce. The bears’ immediate target is to push prices below key support, which is the November low of $2,565 an ounce.

See more news related to gold prices HERE...