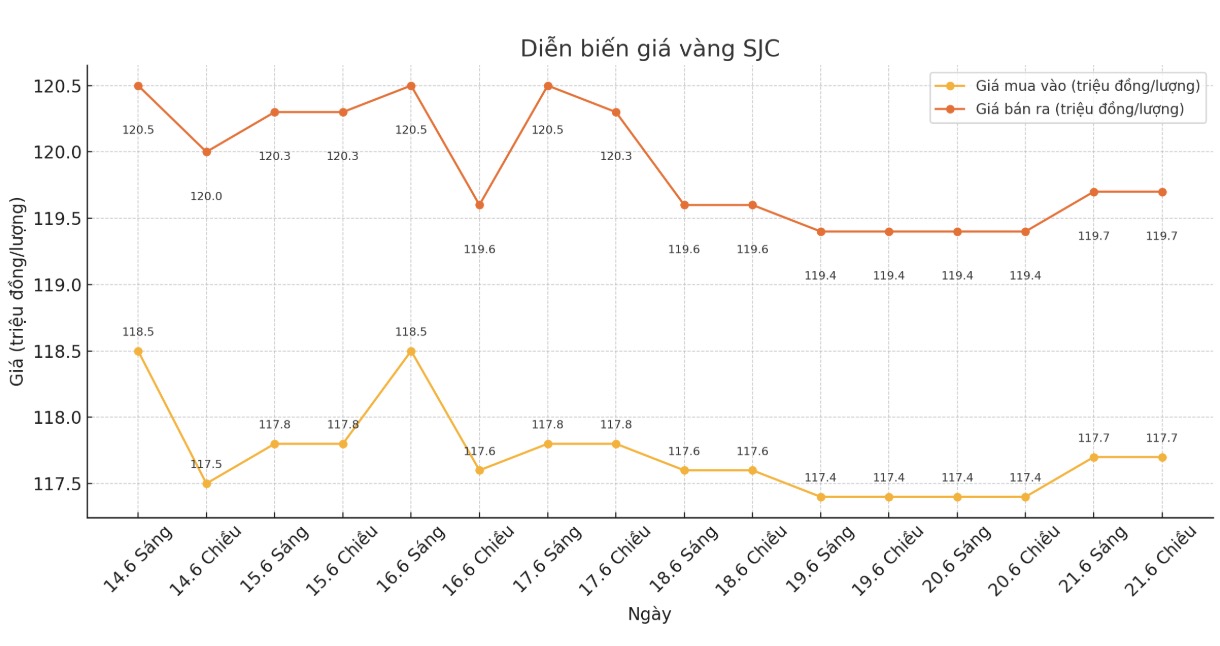

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 crore VND (1.7 million/tael (buy in - sell out); increased by VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-119 7.5 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and kept unchanged for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

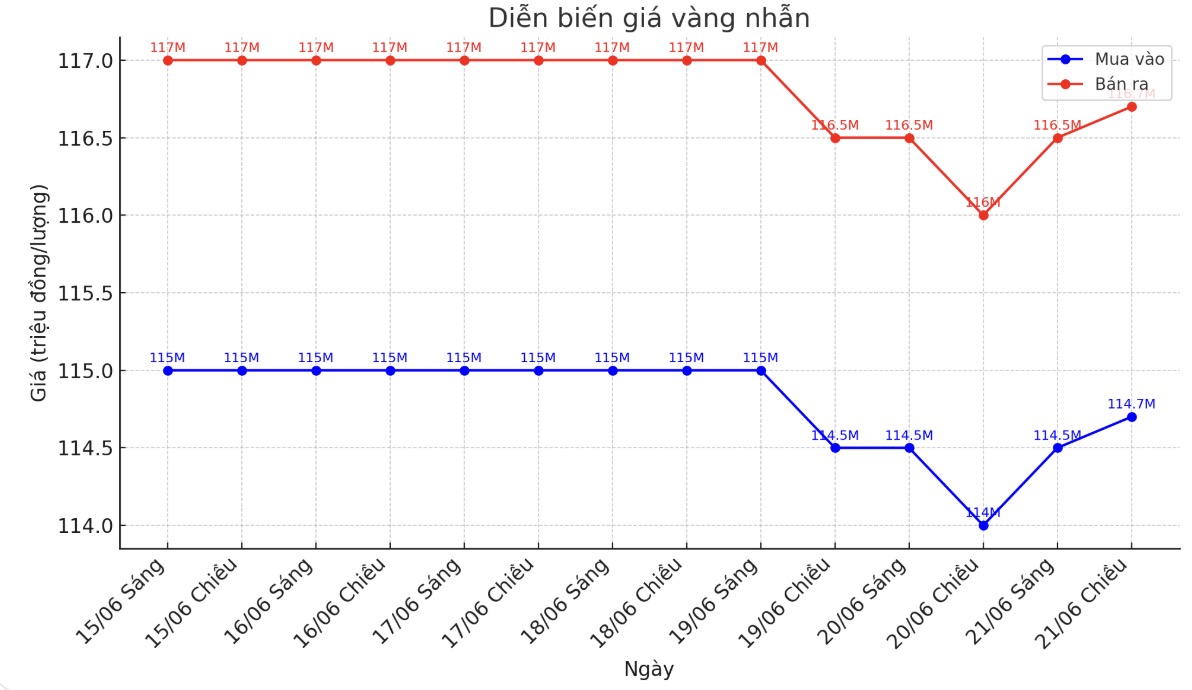

9999 gold ring price

As of 6:00 a.m., Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

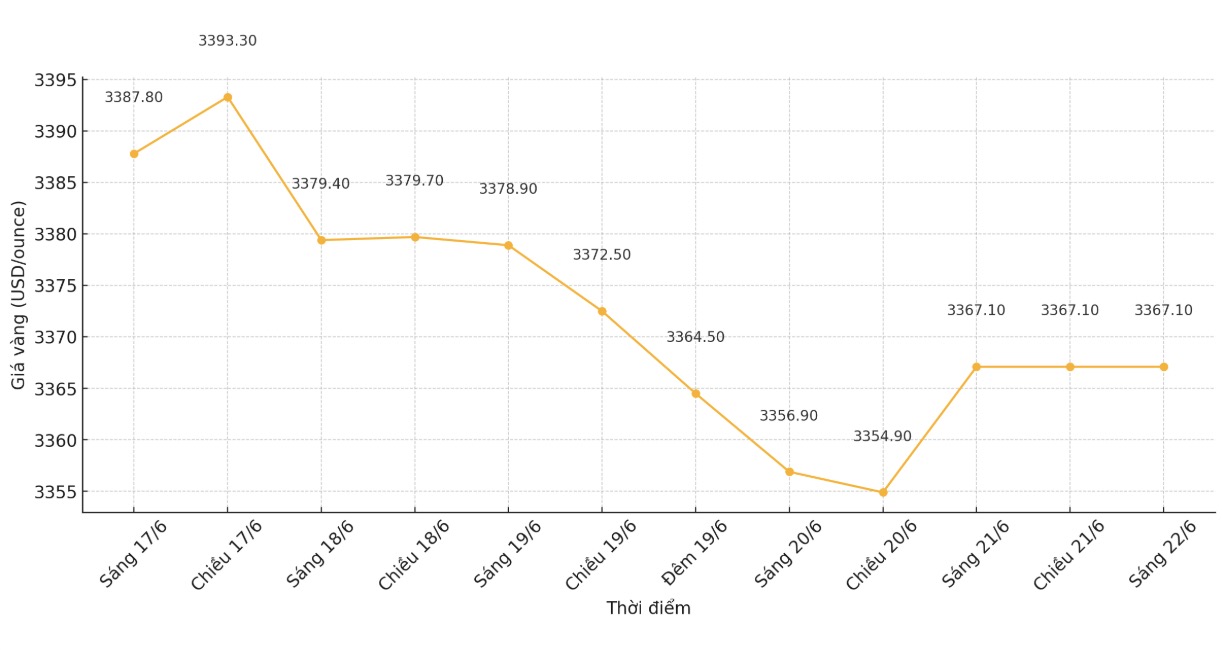

World gold price

The world gold price was listed at 6:00 a.m. at 3,367.1 USD/ounce, unchanged.

Gold price forecast

According to the gold price forecast of multinational financial services group Citigroup (commonly known as Citi), the gold price fever is at its peak, and prices may decrease by 25% by the end of 2026.

World gold prices this year have approached a historical peak, not only in USD but also adjusted according to inflation. However, according to the latest quarterly market report from Citi's global commodity analysis team, this golden period may be coming to an end.

The forecast, led by Maximilian Layton - Citi's global commodity director - said gold prices could fall to $2,500-2,700/ounce by the end of 2026. This means a decrease of about 25% compared to the current high price level.

According to Citi's analysis, the world is currently spending about 0.5% of GDP on gold, the highest rate in 50 years.

Meanwhile, Philip Streible - Chief Market Strategist at Blue Line Futures, commented: "It is true that many people are currently putting money into gold, but when it is not clear what the upcoming situation will be like, keeping an asset not subject to political risks is still a smart choice. Gold is the simplest way to balance portfolio risks. In my opinion, investors should keep a portion of their gold before the weekend to be more assured.

Christopher Vecchio - Head of futures and exchange rates at Tastylive.com said that gold is still maintaining a long-term uptrend as it continues to be considered an important monetary asset in the global market. However, he warned that current speculative activities suggest that the metal will face some challenges in the short term.

"Currently, gold has all the supporting factors but still cannot set a new peak. This should be a worrying signal for investors. Obviously, many people are buying gold and selling fake USDs, which is putting pressure on gold at the moment, Vecchio said.

Economic data to watch next week

Monday: S&P Preliminary PMI.

Tuesday: US consumer confidence; FED Chairman holds a hearing before the House Financial Services Committee.

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...