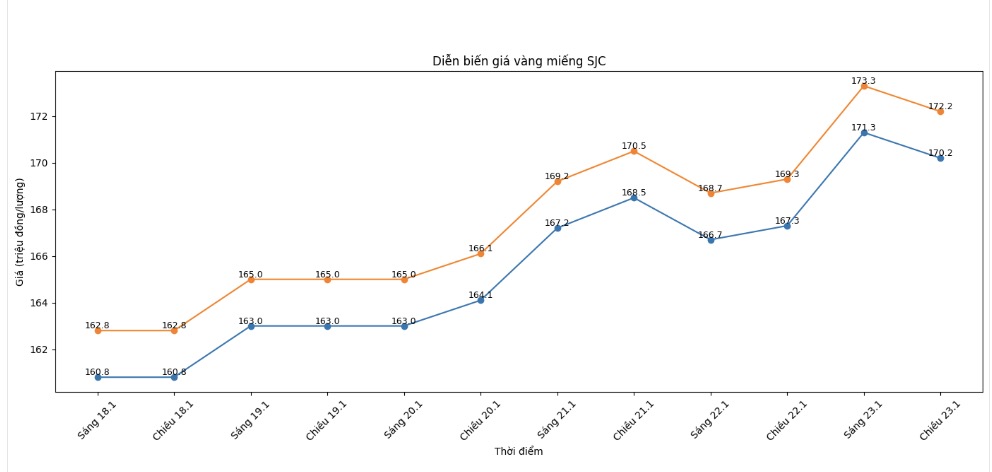

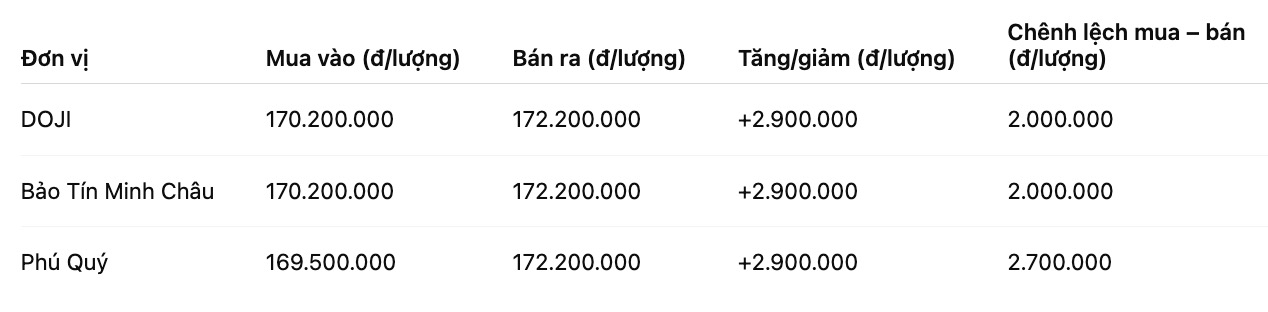

SJC gold bar price

As of 6:00 AM on January 24, SJC gold bar prices were listed by DOJI Group at the threshold of 170.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 170.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 169.5-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

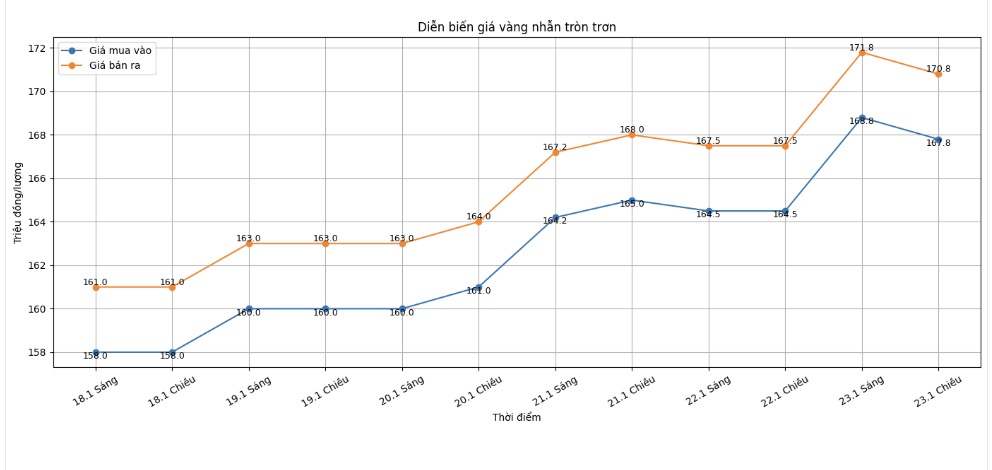

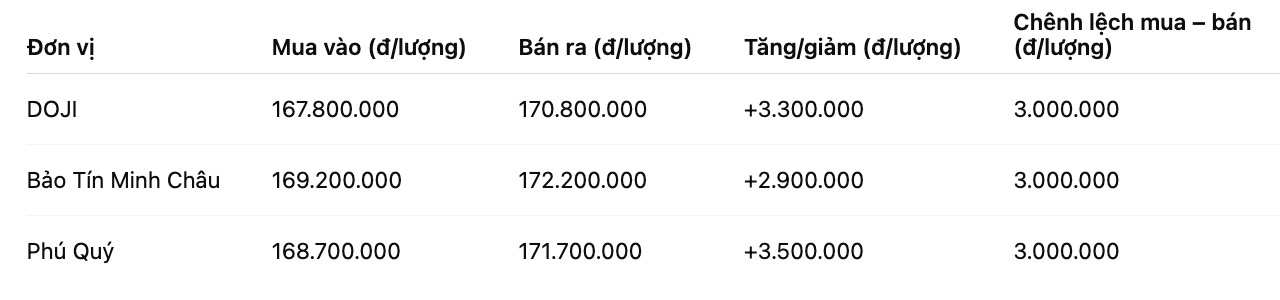

9999 gold ring price

As of 6:00 AM on January 24, DOJI Group listed the price of gold rings at 167.8-170.8 million VND/tael (buying - selling), an increase of 3.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 168.7-171.7 million VND/tael (buying - selling), an increase of 3.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

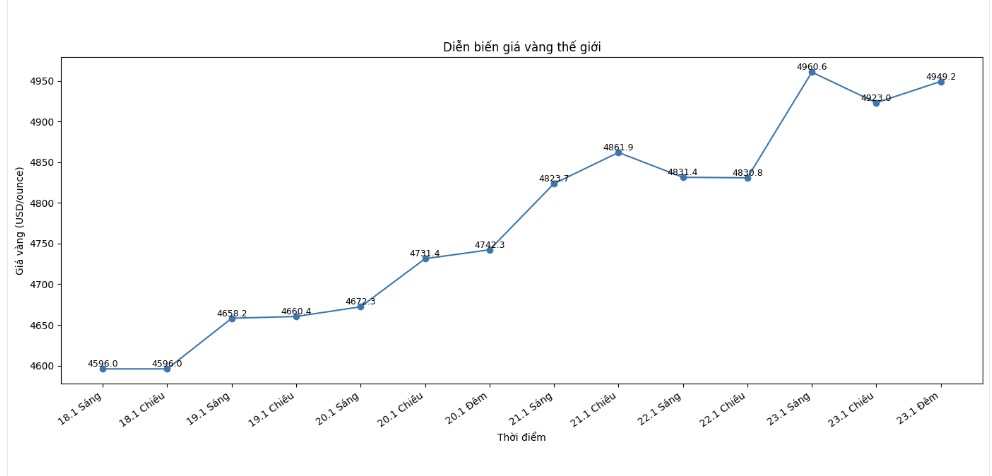

World gold price

At 10:30 PM on January 23, the world gold price was listed around the threshold of 4,949.2 USD/ounce, up 14.4 USD compared to the previous day.

Gold price forecast

World gold prices are maintaining a strong upward trend as they continuously approach the psychological threshold of 5,000 USD/ounce. This upward momentum not only reflects the increasing demand for safe havens but also shows profound changes in investors' expectations in the face of a volatile global economic and political context.

On the international market, gold is being supported by many factors at the same time. The weakening USD in the context of concerns about the growth prospects of the US economy, along with suspicions surrounding the independence of the US Federal Reserve (Fed), has driven cash flow to safe assets. In addition, geopolitical tensions in many regions continue to cause investors' risk appetite to be low.

According to analysts, the gold market currently operates in parallel on two main mechanisms: the spot market and the futures contract market. In which, gold futures contracts are attracting great attention as investors increase risk hedging activities and portfolio restructuring in the final stage of the tightening monetary policy cycle.

Commenting on this trend, Ms. Yuxuan Tang - Head of Macroeconomic Strategy for Asia at J.P. Morgan Private Bank, said that gold is entering a clear revaluation phase. “Crackdowns in the global economic order make investors see gold as a reliable tool to protect value from unpredictable risks,” Ms. Tang assessed.

From a technical perspective, many experts believe that the buying side still has a clear advantage. The fact that gold prices are maintained stable in important support zones shows that the upward trend has not been broken. If it successfully surpasses the 5,000 USD/ounce mark, gold prices may open up a new price level in the short term.

Agreeing with this view, Mr. Ahmad Assiri - a strategist at Pepperstone, said that gold supply is currently difficult to keep up with the level of global financial and political market instability. “As safe-haven demand increases sharply, traditional price resistance levels become less sustainable,” Mr. Assiri said.

With the current developments of the world market, it is likely that domestic gold prices will continue to be affected in an upward direction. However, investors are advised to closely monitor the developments of the Fed's monetary policy as well as geopolitical factors to have appropriate trading strategies, avoiding risks from strong corrections that may occur.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...