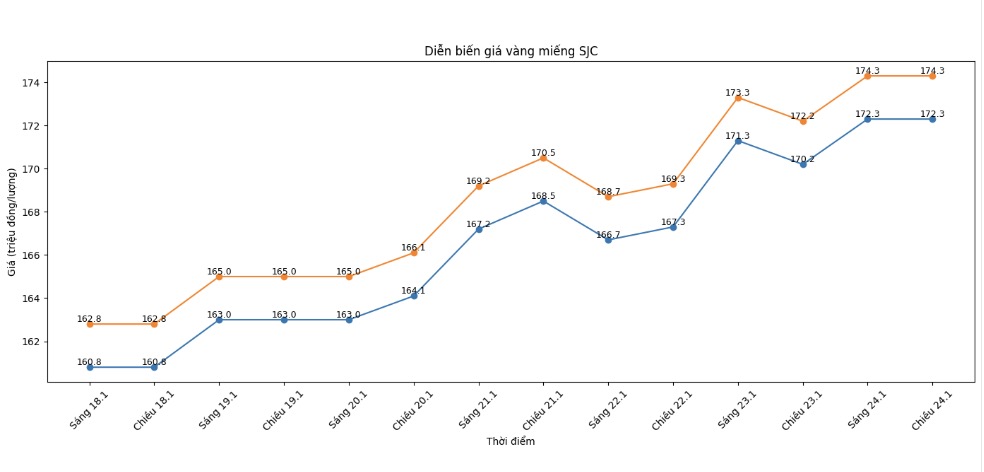

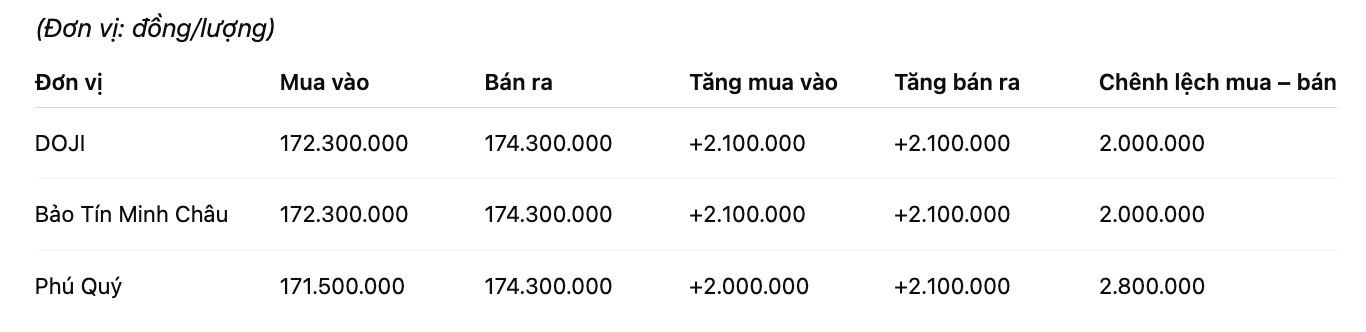

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 171.5-174.3 million VND/tael (buying - selling), an increase of 2 million VND/tael on the buying side and an increase of 2.1 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.8 million VND/tael.

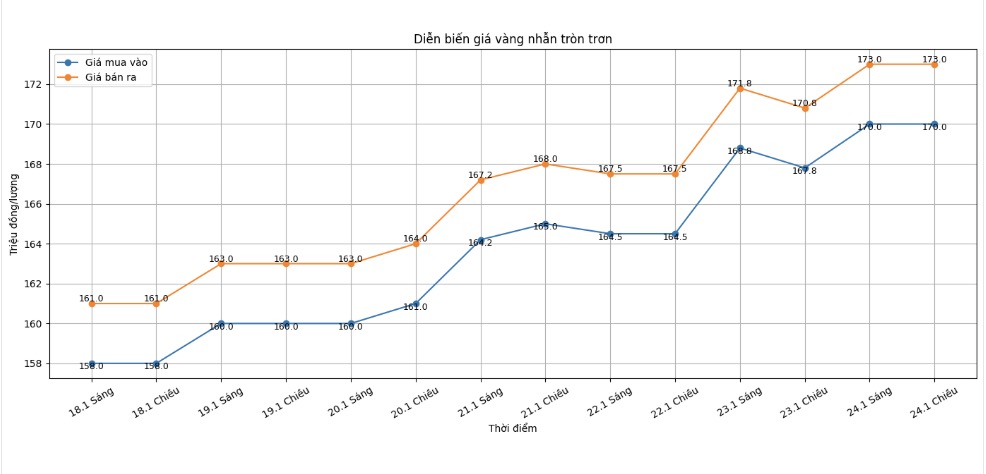

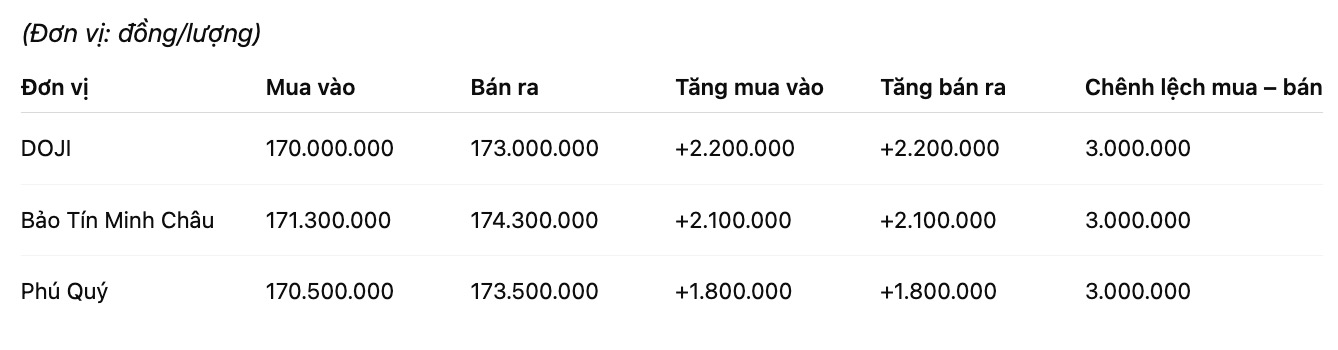

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 170-173 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 171.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 170.5-173.5 million VND/tael (buying - selling), an increase of 1.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

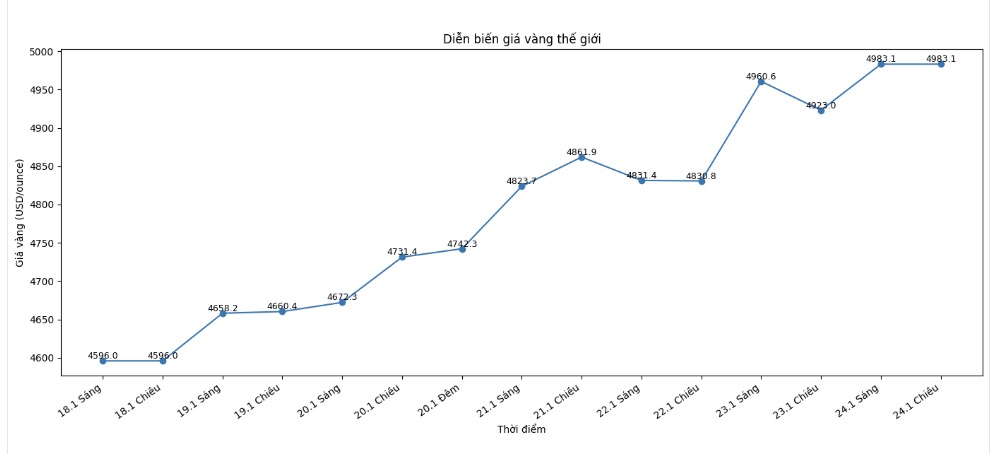

World gold price

At 5:30 am, world gold prices were listed around the threshold of 4,983.1 USD/ounce, up 33.9 USD compared to the previous day.

Gold price forecast

The strong increase in gold prices in recent sessions is attracting great attention from domestic and foreign investors. The fact that world gold prices are approaching the threshold of 5,000 USD/ounce has quickly reflected into the domestic market, pulling SJC gold bars and gold rings to new record levels. In that context, the short-term prospects of precious metals continue to be assessed in a positive direction, although the risk of technical correction cannot be ruled out.

The latest weekly gold survey results show that optimistic sentiment is clearly dominant on Wall Street. Most analysts predict world gold prices are likely to surpass the 5,000 USD/ounce mark next week, thanks to the still strong upward momentum. Conversely, the downward price forecasting group only accounts for a very small proportion, showing that the confidence of experts in the upward trend of gold has not been shaken.

From the perspective of individual investors, psychology is slightly more cautious after the recent "hot" rally. However, the majority still expect gold to continue to rise, reflecting the attractiveness of the precious metal in the role of a safe haven channel, especially when economic and geopolitical instability factors are still present.

According to Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, the current upward momentum of gold prices does not simply stem from speculation. “The persistent demand for gold purchases from central banks, along with concerns about public debt and fiscal discipline in many countries, is creating a solid foundation for the long-term upward trend of precious metals,” Mr. Hansen said. However, this expert also noted that in the short term, the market may experience corrections when investors take profits.

Sharing the same view, Mr. Chris Vecchio – Head of Futures and Foreign Exchange Strategy at Tastylive.com – said that gold is benefiting from the asset diversification trend. “As confidence in foreign currency declines, investors tend to turn to assets that are not dependent on the traditional monetary system, and gold is the top choice,” he said.

Next week, the focus of market attention will be the monetary policy meeting of the US Federal Reserve (Fed) and a series of important US economic data. Although the Fed is forecast not to adjust interest rates soon, any "hard" or more cautious signals in the policy message may cause gold prices to fluctuate sharply.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...