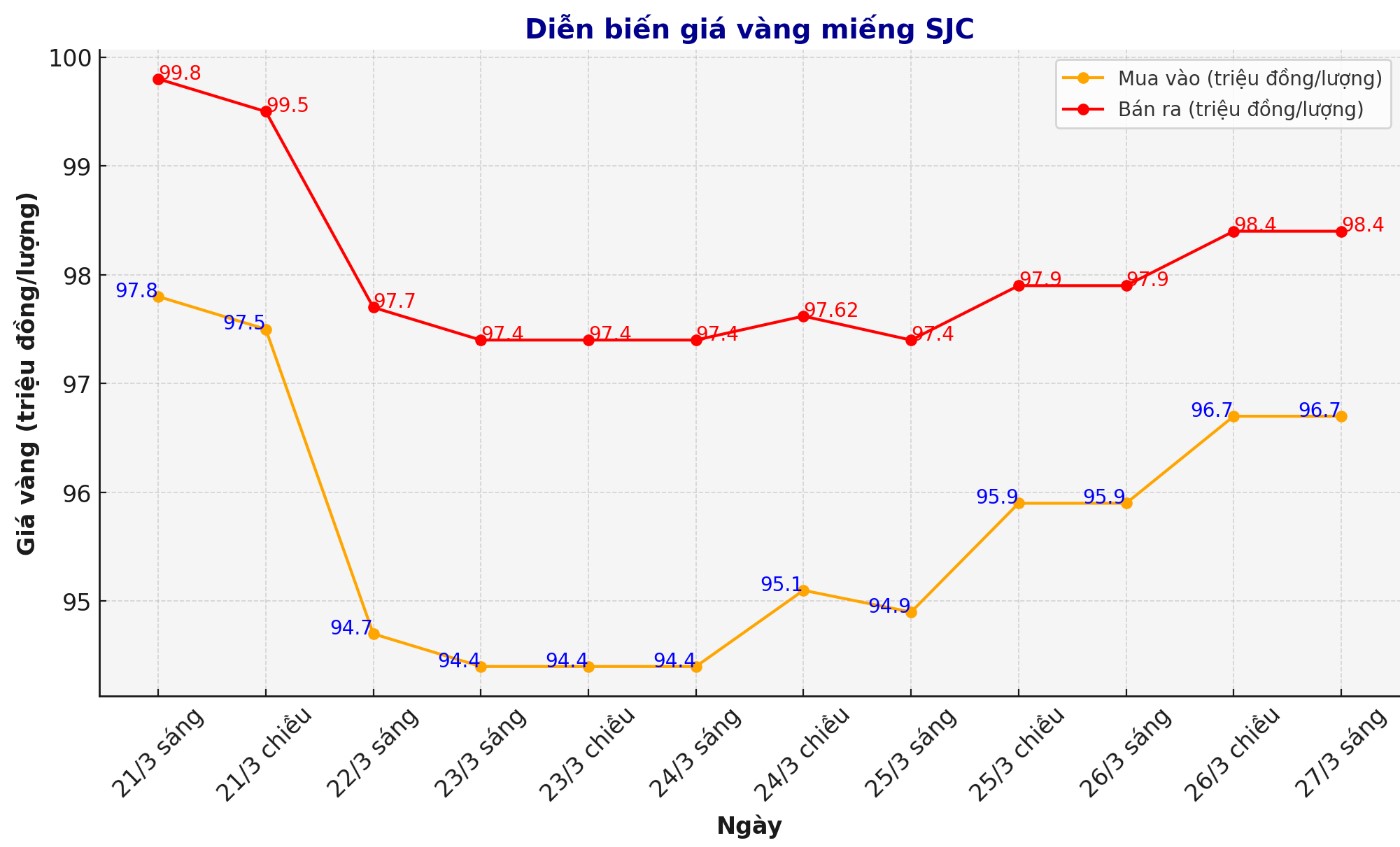

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND96.7-98.4 million/tael (buy - sell), an increase of VND800,000/tael for buying and VND500,000/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 96.7-98.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 96.8-98.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

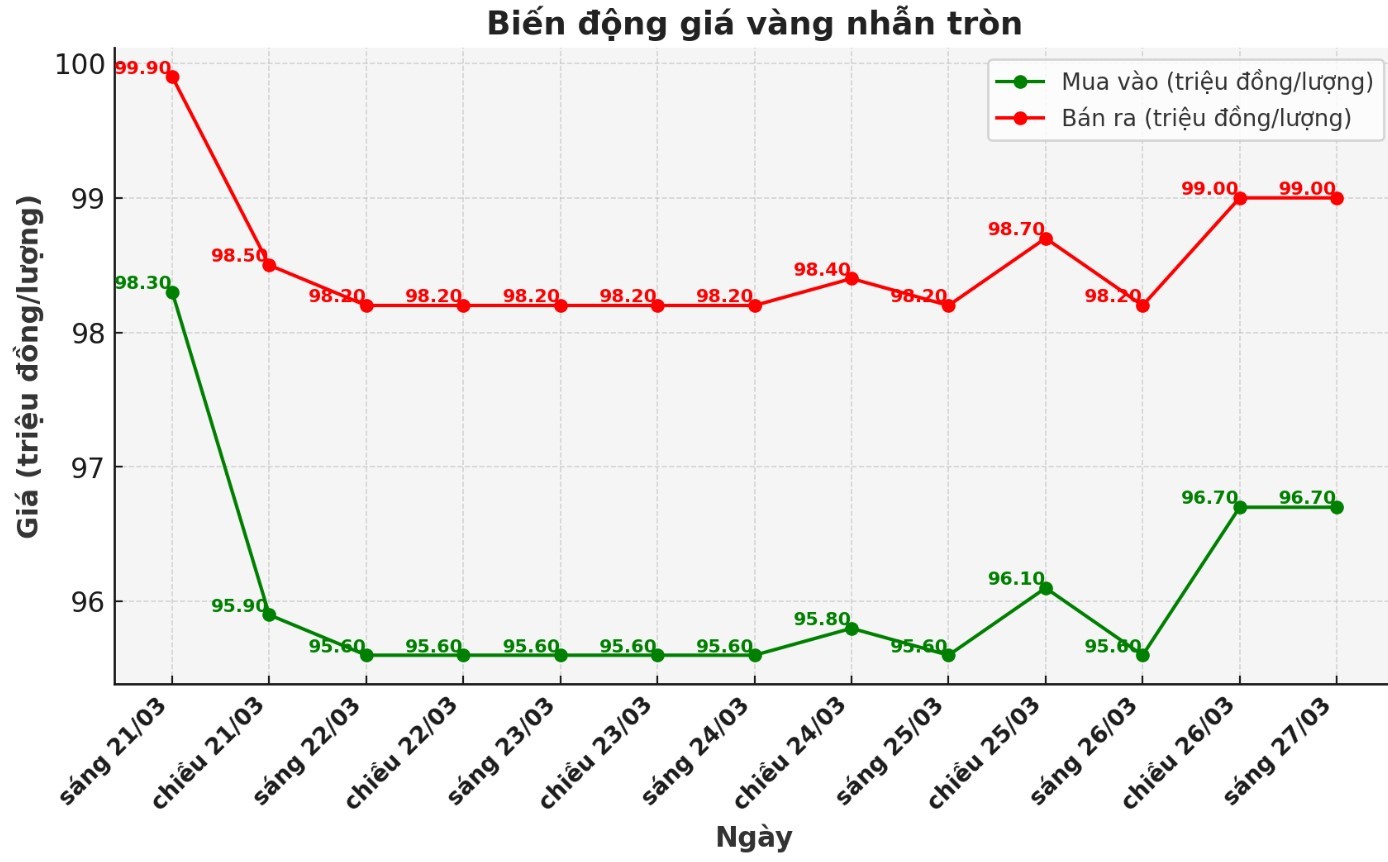

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 96.7-99 million VND/tael (buy - sell); increased by 600,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is listed at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.8-99.1 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 2.3 million VND/tael.

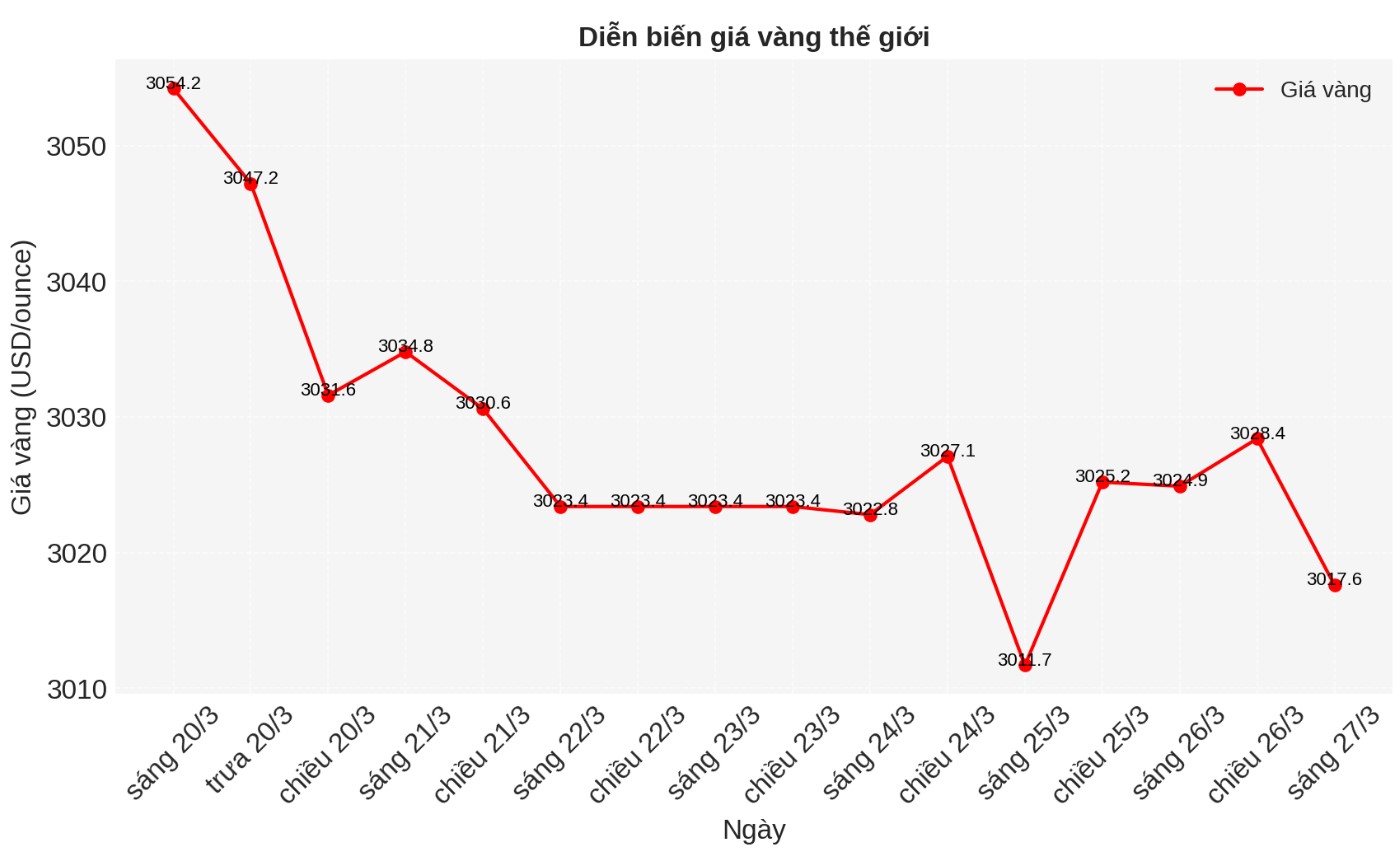

World gold price

As of 0:15 on March 27, the world gold price was listed at 3,017.6 USD/ounce, down 10 USD/ounce.

Gold price forecast

World gold prices fell amid an increase in the USD. Recorded at 0:20 on March 27, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.225 points (up 0.37%).

According to Kitco, world gold prices decreased slightly in the context of some short-term futures traders taking profits. The strengthening of the USD index and a slight increase in US Treasury yields in the middle of the week are negative factors from the market in addition to affecting buying interest in gold and silver. However, the demand for safe havens is still stable in the context of the general market being quite worried, helping to maintain the bottom price for these two precious metals.

Gold for April delivery fell $2.2 to $3,023.7 an ounce. The price of silver delivered in May increased by 0.028 USD, to 34.215 USD/ounce.

It is important that the low volatility in the gold market, at a high level, shows that prices may continue to rise steadily to new highs.

US stock indexes fell sharply in the middle of the day, but recent recoveries in US major stock indexes show that the market may have hit rock bottom.

Technically, April gold futures have a strong near-term technical advantage. The next price target for buyers is to close above strong resistance at 3,100 USD/ounce. The next downside target for the bears is to push prices below the strong technical support level of $2,900/ounce.

The first resistance level was this week's high of $3,042.4/ounce and then $3,050/ounce. The first support level was an overnight low of $3,017.8/ounce and then a weekly low of $3,007.7/ounce.

Important outside market factors today recorded Nymex crude oil prices as stable and trading at around 69.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.334%.

Economic data to watch this week

Thursday: homes waiting for transactions (number of unclosed home purchase contracts), US Q4 GDP.

Friday: US core PCE Index, US personal income and expenses.

See more news related to gold prices HERE...