Gold prices increased slightly on Wednesday, supported by the weakening of the USD as investors awaited the policy decision and a statement from the US Federal Reserve (FED), in order to find more clues on the next action time of the central bank.

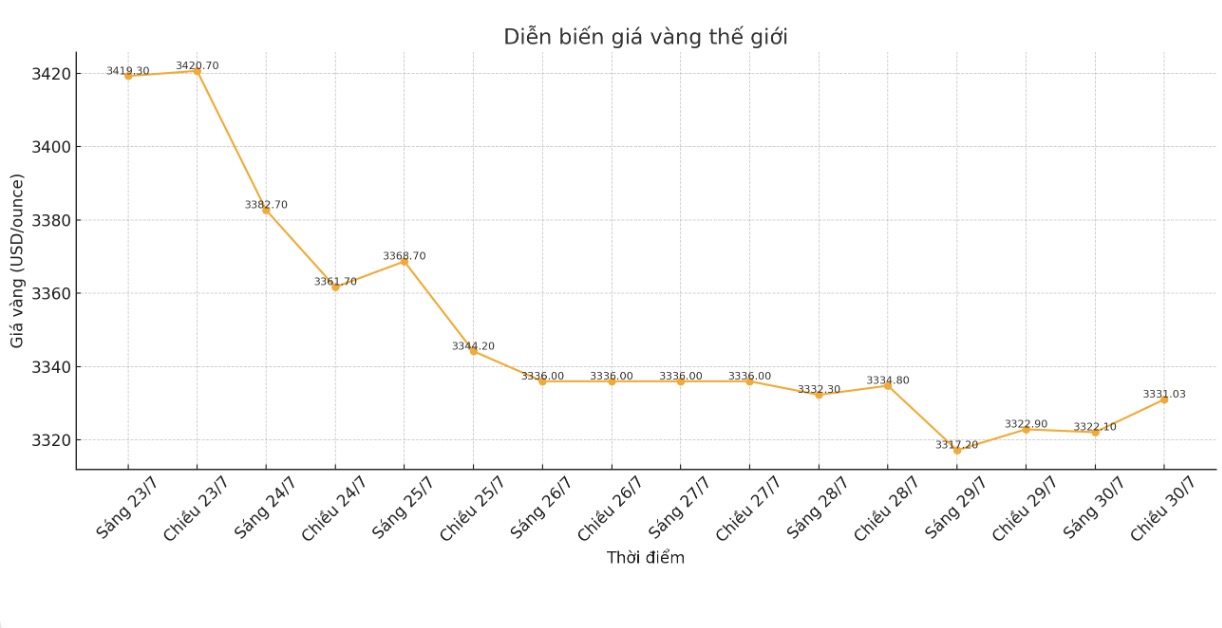

Spot gold increased by 0.2% to 3,331.03 USD/ounce at 8:38 GMT (ie 15:38 Vietnam time). US gold futures increased 0.1%, to $3,328.3/ounce.

The US dollar fell 0.1% after reaching a more than one-month high on Tuesday, making gold cheaper for holders of other currencies.

There are many factors combining which are making gold prices almost unchanged. Geopolitically, there seems to be progress in tariff negotiations, but neither side is really ready for a clear commitment, said StoneX analyst Rhona O'Connell.

The talks between China and the US will continue to be closely monitored after the two sides agreed to extend the 9-day tariff ceasefire, after two days of talks were described by both sides as constructive in Stockholm.

Trade deals reached with Japan last week and with the European Union last weekend also helped ease investor concerns and boost risk appetite in the market this week.

Meanwhile, the Fed is widely expected to keep interest rates unchanged at its meeting on Wednesday, despite repeated calls for cuts by US President Donald Trump. Investors will pay special attention to Fed Chairman Jerome Powell's statement to find more signals about the upcoming interest rate path.

The market is now expecting two cuts from now until the end of the year, but that expectation is probably too optimistic. The Fed will not yield to political pressure, but it is worth noting whether this vote will reach a consensus, OConnell added.

Gold often benefits in a low interest rate environment.

In other precious metals, spot silver fell 0.4% to $18.04/ounce, platinum fell 1% to $1,381.69/ounce, and palladium fell 0.5%, down to $1,252.40/ounce.