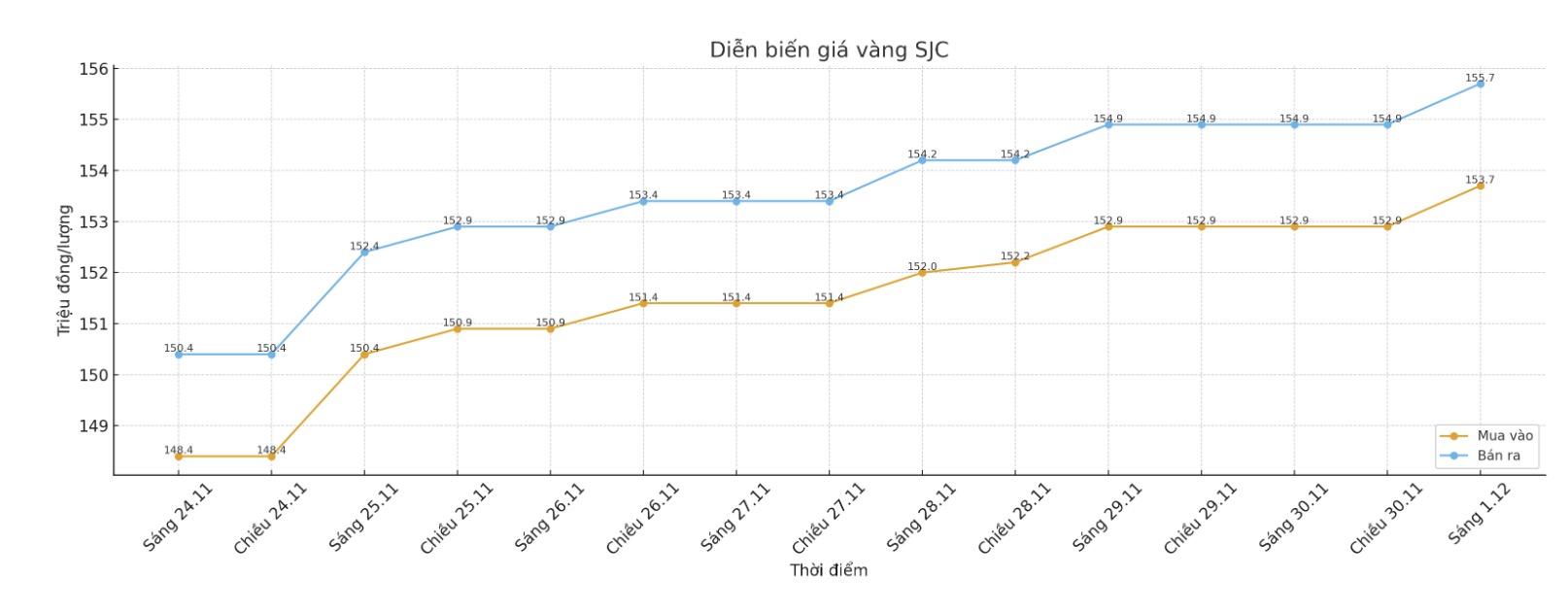

Updated SJC gold price

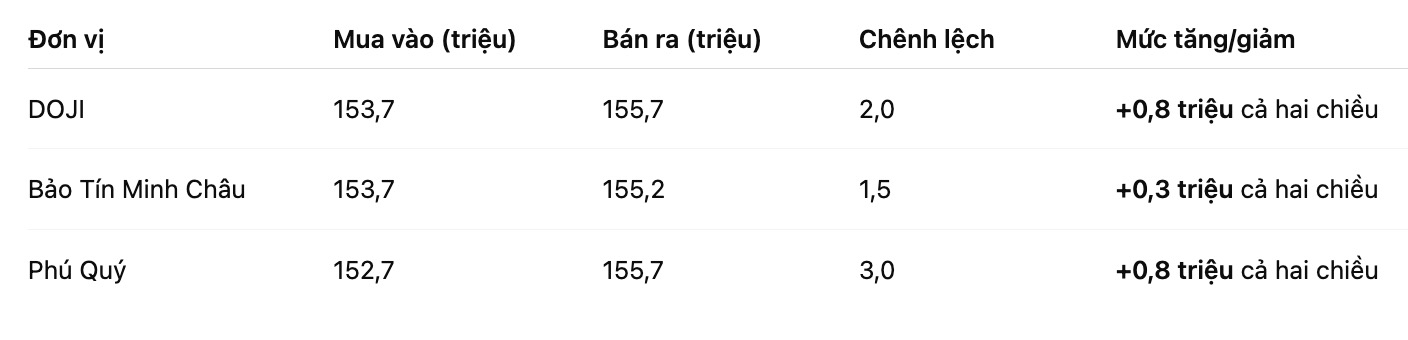

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at 153.7-155.7 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.7-155.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.7-155.7 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

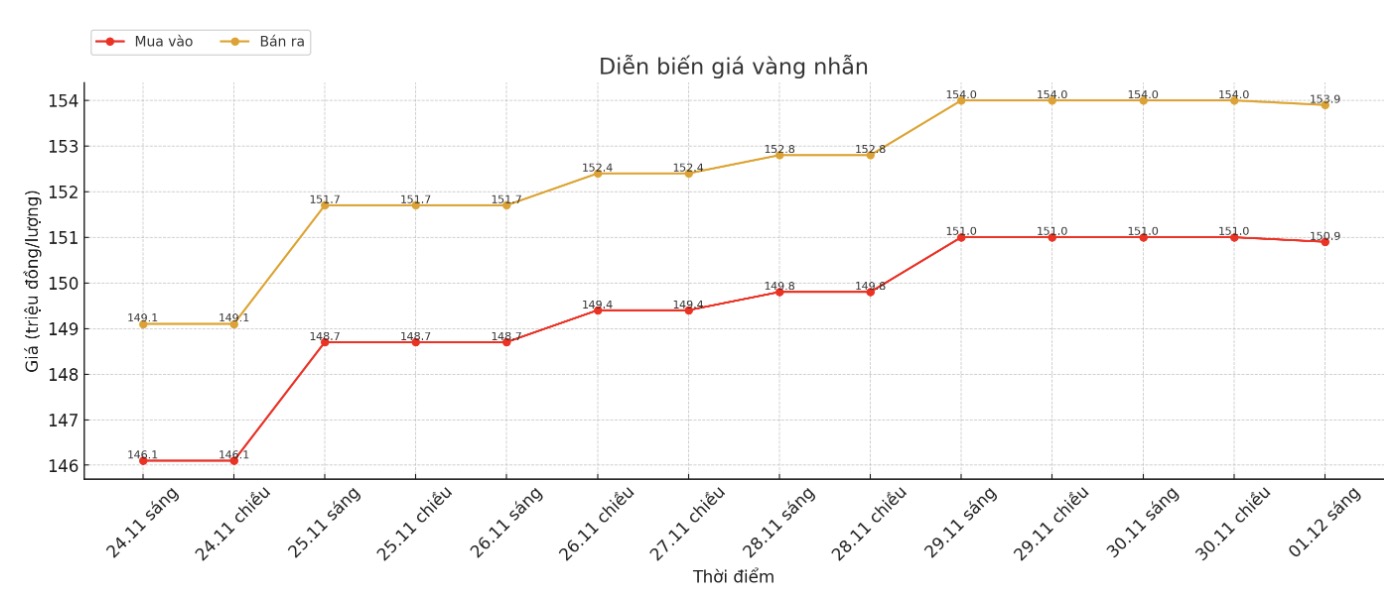

9999 round gold ring price

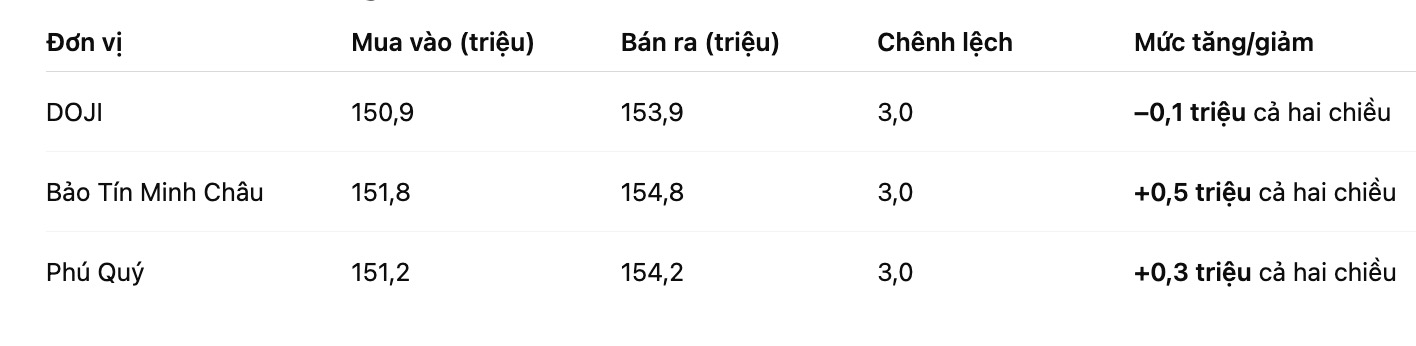

As of 9:15 a.m., DOJI Group listed the price of gold rings at 150.9-153.9 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.2-154.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

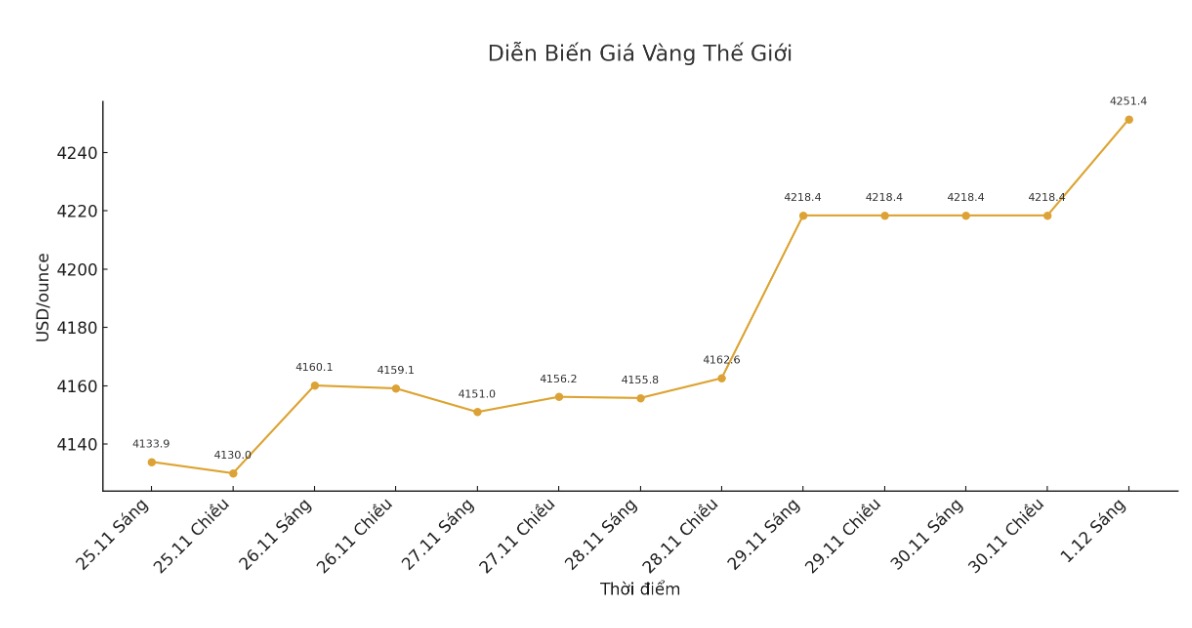

World gold price

At 9:10 a.m., the world gold price was listed around 4,251.4 USD/ounce, up 33 USD compared to a day ago.

Gold price forecast

The latest weekly gold price survey with Wall Street experts shows that the majority have returned to an optimistic view on the short-term outlook for the precious metal.

I have been optimistic for a while and there is no reason to change, said James Stanley, senior market strategist at Forex.com.

Notably, gold broke the triangular trough last week, and this model looks like a technical signal that the uptrend could continue - this is gold's third such signal since the rally began last February at the $2,000/ounce mark.

Rising prices like this are difficult to chase, as there is still a possibility that long-term investors will take advantage of the recovery period to make a profit before the end of the year. But as I have said throughout the model, the support zone is still quite attractive and the $4,150/ounce zone is such a point, Stanley added.

Sharing the same view, Rich Checkan - president and COO of Asset Strategies International, assessed. Peace is yet to be seen in Ukraine, and expectations for a third FOMC rate cut in December are rising. Both of these factors are supportive for gold.

I am optimistic about gold next week, said Colin Cieszynski, chief market strategist at SIA Wealth Management. Gold has been rising recently as expectations for the outcome of the upcoming Fed meeting have returned to the hope of a rate cut to close the year.

However, Cieszynski warned that there will be many important economic data released next week, which could increase gold price fluctuations.

Similarly, Michael Moor - founder of Moor Analytics believes that gold will continue to increase this week.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...